Previewing Today’s Closely Watched 7Y Auction

Today the Treasury will auction $62BN in 7-year notes at 1pm. It will be a closely watched auction because one month ago the same 7Y February auction was “catastrophic” and sparked a rout in bonds which then quickly morphed into a marketwide dump hitting tech, momentum and growth stocks the hardest.

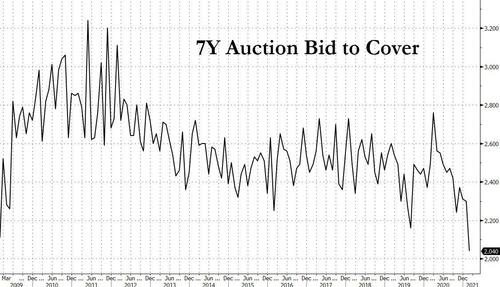

As a reminder, last month’s 7Y tailed 4.4bps, the largest tail on record with dismal end-user demand declining to 60.2%, 20.2%-pts below the previous auction and the lowest level since September 2014, while the bid-to-cover ratio declined to 2.04, the lowest since the Treasury reintroduced the 7-year in early 2009

At the investor class level, the investment manager share declined 14.3%-pts to 49.1%, the lowest level since May 2020, and the foreign share of demand declined to 8.1%, the lowest level on record.

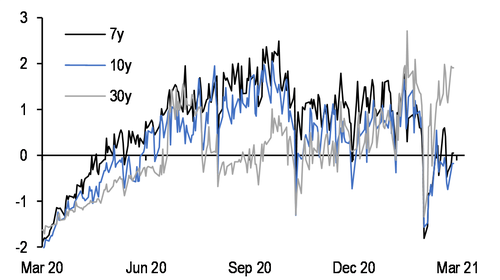

To be sure, it wasn’t just fear of inflation that was the culprit last month: technicals played a prominent role in last month’s weak results, as intermediate yields rose as much as 25bp on the day of the auction, and Treasury market depth declined significantly to levels not seen since the early spring of 2020

In fact, the deterioration in depth was particularly severe around the auction as volumes surged and the most rapid sequence of the sell-off took place.

Some more thoughts from JPM:

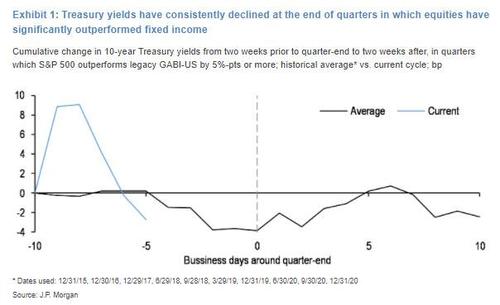

Looking ahead, though intermediate and long-end yields have declined 5-15bp from their recent highs last week, once we get through the 7-year auction, we think portfolio rebalancing could also drive yields lower. Equities have once again significantly outperformed fixed income: the S&P 500 has risen 3.5% QTD while the GABI-US (our aggregate fixed income index) has declined 3.4%. This sort of performance differential has typically led to rebalancing around quarter-end, and our colleagues estimate this could total $200bn rebalancing out of equities. Empirically, we have observed these sort of rebalancing flows have been supportive of lower Treasury yields: Exhibit 1 shows the cumulative change in 10-year yields around quarter-ends in which equities have outperformed the GABI-US by more than 5%-pts. Ten-year yields tend to decline by an average of 4bp in the weeks leading up to quarter-end and then reverse higher as the calendar turns to the new quarter, and this has occurred in 7 of 10 instances. Thus, cyclicals indicate risks are skewed toward a decline in yields in the coming days.

Market depth has recovered in the intermediate sectors, retracing back in line with average levels over the past year, but remains lower than prior to the 7-year auction, and depth remains relatively depressed in intermediates compared to the long end. Additionally, even though seven-year yields are 7bp higher since the last auction, yields have declined 10bp this week alone. The 7-year sector appears modestly cheap versus the wings after adjusting for the level of rates and the shape of the curve. The WI 7-year roll opened at +1.75bp, in line with our fair value estimate, and is still trading, underperforming the erosion of carry. Lastly, though end-user demand at intermediate auctions have generally remained above historical averages—last month’s auction notwithstanding, dealers have had to absorb significantly more duration supply, which has likely driven more variable auction results recently. That said, the quarter-end rebalancing flows mentioned above could be supportive on the margin.

Overall, despite relatively cheap valuations, given the recent decline in yields, and technicals that have not yet fully recovered, JPM thinks today’s auction will require above-average end-user demand to be digested smoothly, which following the two most recent auctions this week where we saw a solid 2Y and 5Y auction, this shouldn’t prove to be too difficult.

Tyler Durden

Thu, 03/25/2021 – 12:40

via ZeroHedge News https://ift.tt/3lSjSo8 Tyler Durden