S&P, Nasdaq Plunge, Break Below Key Technical Levels

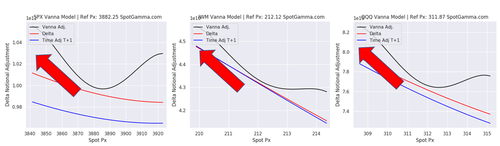

We warned this morning that ‘if’ we start to sell that selling could be quite material as implied by the trio of vanna charts below (SPX, IWM, QQQ) wherein dealer exposure gets more long as markets drop (and so they need to sell futures), with and we would anticipate a quick visit of the 3800 level in SPX.

And, after a brief attempt to ignite some momentum at the cash open, things have escalated rather quickly…

But this move has sparked breaks of some serious technical levels across the indices.

The S&P is back below its 50DMA…

The Nasdaq is back below its 100DMA…

And Small Caps are crashing far below their 50DMA…

If only there were some shorts to cover here…

Tyler Durden

Thu, 03/25/2021 – 10:59

via ZeroHedge News https://ift.tt/3tRz9Zk Tyler Durden