The Post-Target Paradigm: Analyzing China Just Got Harder

By Damien Ma of Macro Polo

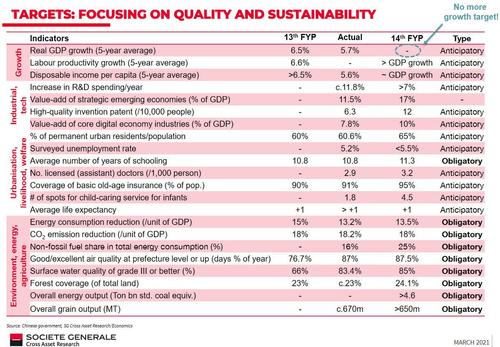

The just released 14th Five-Year Plan (FYP) and 2035 long-range vision is some 75,000 words long. But it is short on concrete targets. For the first time in 35 years, the biggest news that came out of the 14th FYP was what was missing: the GDP target.

It wasn’t just the GDP target either. Almost all socioeconomic indicators in the FYP became relatively modest “soft targets”—meaning there’s no political mandate to meet them. Even though Beijing will likely still determine general economic targets based on annual conditions, the reality is that the Xi Jinping era has ushered in the post-target era.

That might seem unexpected, but we have been making the case for the downgrading of targets. The irony, though, is that this uncharted target-less terrain can be more vexing than the prevailing target-rich environment.

Indeed, despite regular criticism lodged at China’s obsession with targets, their sudden demotion and even absence can be discombobulating. This is particularly so for the humble analyst who has long relied on them as an anchor by which to assess China’s goals and ambitions.

But worry not. Rather than wandering aimlessly down Beijing hutongs in search of targets, we think it is now more important and productive to look at systemic and qualitative changes to gauge China’s progress. For the next five years at least, targets will simply be peripheral, while reshaping institutions and incentives will likely take center stage.

From Targets to the “Two Is”

To understand this shift, it is important to first grasp how Beijing arrived at this point. Targets of all stripes have long held an exalted place in Chinese policymaking. The GDP target, in particular, was a direct and simple key performance indicator (KPI) for local officials. But over the decades, the singular fixation on this KPI massively distorted incentives across local economies.

For one, intrepid and competitive officials found creative ways to “meet” the target, chief among them manipulating local economic statistics. By MacroPolo’s counting, in the past five years, seven provinces have been caught overstating their GDP by 10 percent or more.

It also mattered less whether that growth was virtuous or unsustainable, so long as it hit the KPI. For instance, debt-fueled investments and discounting environmental costs were tolerated because the headline target was met or exceeded. Even when Beijing’s objectives shifted to prioritize the environment or deleveraging, the grip of targets was so strong that local officials simply found loopholes or continued fabricating data to meet a new set of targets. Overreliance on targets, then, diverted local officials’ focus on meeting real objectives.

Perhaps the most pernicious effect of the target was embedding short-termism in local government behavior. Much like how a publicly listed corporation often forfeits long-term objectives in order to meet quarterly revenue targets and shareholder expectations, local governments behaved in much the same way. They consistently tried to meet short-term growth at the expense of addressing longer–term weaknesses.

But Xi has made it rather clear that he doesn’t intend to run China like a corporation, instead preoccupying his first two terms with imposing longer-term thinking—for example by consistently touting the “two centenary goals.”

Deemphasizing targets can be interpreted as essentially a “whole-of-economy” effort to dislodge short-termism, paving the way toward a new paradigm that focuses more on the “two Is”: incentives and institutions.

In fact, Xi admitted as much in a public speech on science and technology. He highlighted the need to overcome institutional barriers to innovation rather than simply increasing spending on research and development (R&D) to produce the desired results.

With China’s ballyhooed turn toward more technology independence, it would make sense for Beijing to pour money into R&D. Yet surprisingly, the R&D spending growth target of 8% in the 14th FYP is actually two percentage points lower than the real growth of R&D expenditure (10% after inflation) during the past five years.

It isn’t for the lack of money. China’s total spending of $23 billion on basic research is less than the annual budget of the US National Institutes of Health. With an annual fiscal budget of more than $3 trillion, Beijing can easily double or triple the spending on basic research. Yet it has opted not to do so.

This newfound modesty, not just for R&D but also in other areas like energy and urbanization, further reinforces the shift away from targets and reflects the priority of fixing institutions, untangling distortions, and taming vested interests before throwing money at problems.

In many ways, the current set of targets no longer serves China’s economy today and where it wants to be by 2035. To the extent that some targets still exist, they will mainly function as a floor. It is a recognition that targets won’t solve structural issues that are institutional in nature and difficult to measure.

As the new post-target paradigm takes root, analyzing China will need to adapt accordingly.

It will certainly be more demanding, but also more intellectually interesting to evolve existing mental models of the Chinese political economy.

Tyler Durden

Fri, 03/26/2021 – 20:20

via ZeroHedge News https://ift.tt/3lTIIUZ Tyler Durden