Archegos Margin Call Stocks Rebound As Forced Liquidations Fade

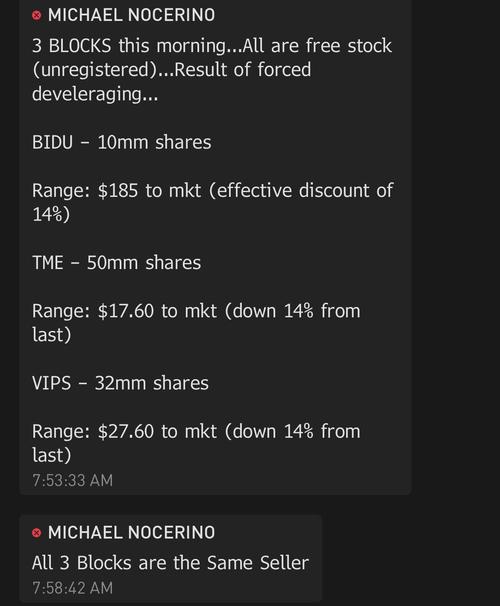

One day after a historic plunge in several media and Chinese tech stocks which was started by the following BWIC from Goldman…

… which we now know was the result of Archegos capital’s terminal margin call, which may or may not be continuing today.

So while we wait to see if we get any new BWICs from Goldman, Morgan Stanley or other Prime Brokers hit, there has been a reversal in the impacted stocks, with ViacomCBS, Discovery and a group of Chinese ADRs now trading mostly higher premarket, reversing earlier declines.

A ViacomCBS block trade that launched on Sunday has priced at $47 per share, Bloomberg reported, after shares were said to be offered at $46-$47. As a result, ViacomCBS Class B shares were back down to $47.1, after rising up 1.5% to $48.94 premarket, They plunged 27% on Friday.

Discovery shares, which also tumbled 27% Friday, rose 4.1% premarket before fading much of the gains.

Shares in most of the other stocks involved in the block trades also rose: Tencent Music Entertainment rises 5.5%, reversing an earlier drop; Baidu rises 1.5%, also reversing an earlier drop, while Vipshop +0.1%, iQiyi +0.5%, Farfetch -1.9% and GSX Techedu -1.3%.

Tyler Durden

Mon, 03/29/2021 – 08:22

via ZeroHedge News https://ift.tt/31sNAqD Tyler Durden