Stocks Sink As Fed’s Kaplan Admits “Challenges” Due To “Excess Risk-Taking”

“I’m concerned about excess risk-taking and if that excess risk-taking goes too far, whether it creates excesses and imbalances, that could ultimately create challenges,” Federal Reserve Bank of Dallas President Robert Kaplan says in an interview with Nikkei posted on its website.

“Equity market cap, divided by gross domestic product, that’s at a historically elevated level. Credit spreads, in the corporate bond markets, are at, relatively speaking, historically tight levels. There’s no question that financial assets, broadly, are at elevated valuation levels.”

Source: Bloomberg

While he is 100% correct, it’s an odd admission from a Fed President whose more typical response to any bubble-forming warnings is as follows…

All of which is comical given that the CDC director and Fauci and Biden all fearmongered the end of the world today and small caps (with a strong bias to “reopening” stocks) exploded higher today as the rest of the US Majors slipped lower…Ugly close like yesterday…

On the week, that late day weakness pushed the Dow red with Small Caps worst…

And as President Biden prepares to announce another $4 trillion in wasteful spending, why wouldn’t gold plunge to its lowest close since April 2020…

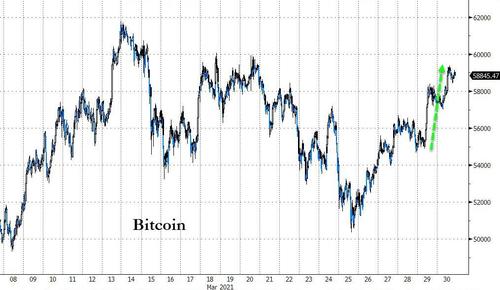

Instead, Bitcoin appeared to be the asset of choice to reflect the foolhardiness of politicians

Source: Bloomberg

Cathie Wood’s new Space ETF crash-landed…

Cyclicals outperformed Defensives today, erasing yesterday’s move entirely…

Source: Bloomberg

Equity vol continues to languish near cycle lows as rate vol explodes higher…

Source: Bloomberg

Treasuries dumped’n’pumped today with 30Y erasing yesterday afternoon’s weakness back to unch on the day. The belly of the curve remains higher in yield on the week…

Source: Bloomberg

The 10Y Yield spiked above 1.75% overnight in Asia but was bid back to unch by the close during the EU and US session

Source: Bloomberg

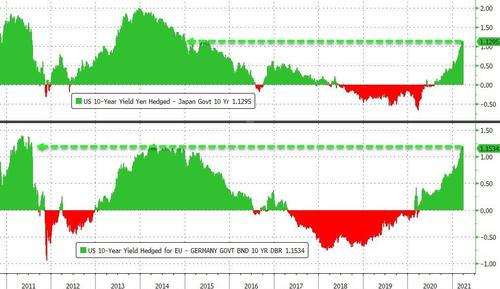

Are Japanese and European investors waiting for Q2 to pile in to USTs? And scoop up all that extra carry?

Source: Bloomberg

Real yields continued to push higher (and drag gold down with it)

Source: Bloomberg

The dollar continued its charge higher off the FOMC spike lows, taking out the early March highs to close at its highest since early November…

Source: Bloomberg

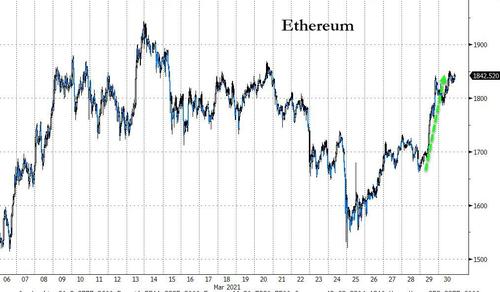

And it wasn’t just Bitcoin, Ethereum surged today also…

Source: Bloomberg

Silver puked back below $24 to its lowest since early December…

The dollar also weighed on oil prices (as well as the re-opening of the Suez Canal)

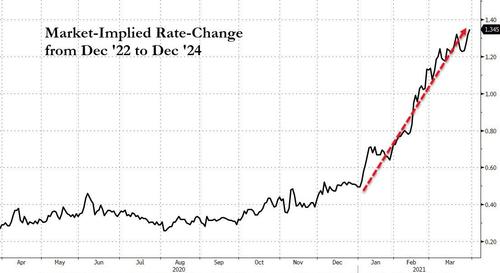

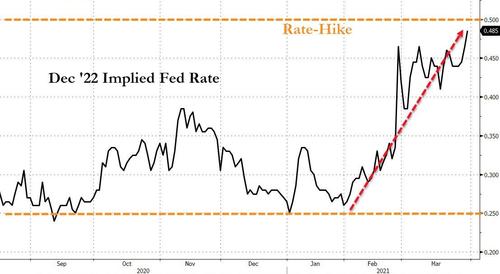

Finally, the rates market is pricing in over 5 rate-hikes between Dec ’22 and Dec ’24… that’s not at all what the equity market thinks is going on

Source: Bloomberg

And is pretty much a lock for rate-hike by the end of 2022…

Source: Bloomberg

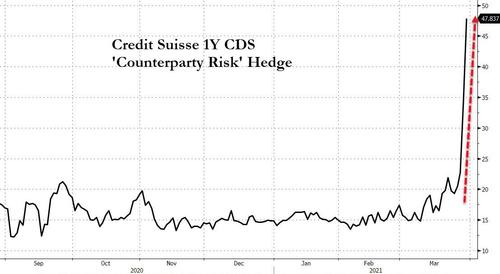

And just in case you thought the Archegos debacle was over, it appears the market is still very anxious about Credit Suisse…

Source: Bloomberg

Tyler Durden

Tue, 03/30/2021 – 16:00

via ZeroHedge News https://ift.tt/3dhur0l Tyler Durden