“All The Good News Are Priced In”: BofA Lists 5 Reasons Why The S&P Will Drop To 3,800

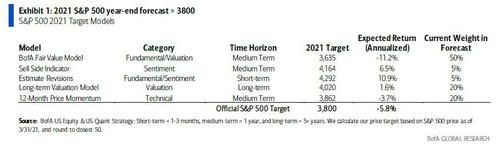

Bank of America chief quant, Savita Subramanian, starts off her latest strategy note titled appropriately enough “Five Reasons To Curb Your Enthusiasm” with a question: why despite the recent upgrade of US GDP from BofA economists and why despite positive guidance from companies – which led BofA to also raise its 2021 EPS estimate – did the bank not change its year-end S&P price target of 3800, nearly 400 points below where the index is trading today?

Here is Subramanian:

Amid increasingly euphoric sentiment, lofty valuations, and peak stimulus, we continue to believe the market has overly priced in the good news. We remain bullish the economy but not the S&P 500. Our technical model, 12-month Price Momentum, has recently turned bearish amid extreme returns over the past year. We thus incorporate higher likelihood of 12m returns mean-reverting to “normal” levels by taking the weight down in our other models and raising the weight of our 12m price momentum model to 20% from 0%.

With that big picture view in mind, Subramanian then proceeds to list 5 reasons why – as the note is titled – investors should curb their enthusiasm but first makes some big picture observations, pointing out that while the correlation between returns and quarterly/annual earnings growth is low, at just 12%/22% – a host of other factors matter as well. Subramanian notes that while over the past month, only one of our five target models has grown more bullish on stocks (which is also based on earnings), the bank’s 2021-22 EPS forecasts of $185 and $205 imply 2900-3200 on the S&P 500 based on the average forward P/E of 15.5x vs 20x-22x currently implied by today’s price level which is in the top ~90th %tile. Furthermore, and as we noted a few months ago, companies that beat on earnings in Q4 underperformed in the subsequent days to a level not seen since just before the dot com bubble burst, “suggesting the market was pricing in blowout earnings” and with record inflows into stocks in 1Q, such optimism has only accelerated. Translation: stocks are priced to absolute perfection and reality will most likely disappoint.

This brings us to the five reasons why according to Savita “blowout earnings =/= blowout market“, and the prudent step here is to take some chips off the table, a conclusion even Goldman would agree with as the bank over the weekend reiterated that its own S&P year-end target of 4,100 isn’t likely to change.

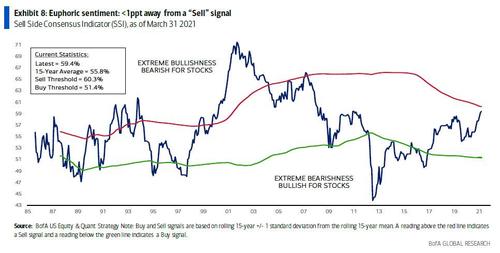

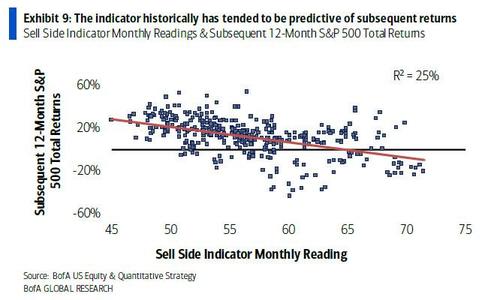

1. Sell Side Indicator < 1ppt away from euphoria: BofA’s contrarian measure of Wall Street’s bullishness is <1ppt away from a “sell” signal.

As we noted last week, the last cycle when it was this close to a “sell” (May 07), the S&P dropped 7% over the next 12mths. As shown in the chart below, the indicator historically has tended to be a good predictor of subsequent returns.

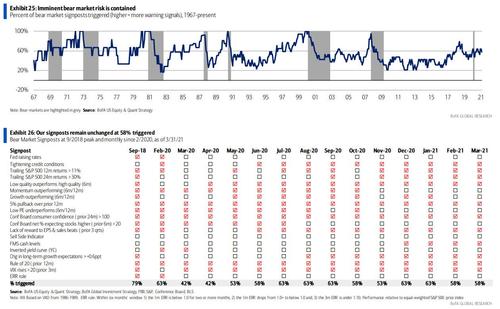

Still, Subramanian hedges that she is not calling for a full-fledged bear market as just 58% of the bank’s “Bear Market Signposts” have been triggered vs. 80%+ ahead of prior bear markets…

And in amusing twist, the BofA strategist says that in another measure of Wall Street bullishness: “we’re tied for last place among strategists’ forecast for the S&P 500.”

2. S&P 500 valuation indicates paltry (2% p.a.) returns over the next decade: As BofA notes, valuation is almost all that matters over the long-term (~80% explanatory power as shown in chart below).

With the increase in valuations in April, BofA calculates that this framework yields 10-yr price returns of just 2%/year (versus 5% in Nov., and 10% 10 years ago).

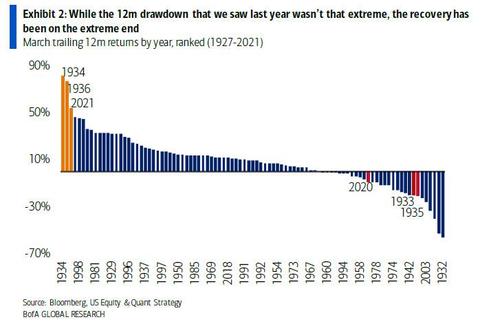

3. Outsized (2+ std dev) returns precede losses 75% of the time: The S&P 500 posted 12 month returns of +54% through March, marking the best 12m since 1936, the third highest on record, and 2.3 std. dev. above average.

This, needless to say, is abnormal: as Subramanian notesm two+ standard deviation moves have only happened four other times since 1928, with losses occurring over the next 12 months in three of the four cases (avg. next 12m ret. of -4%).

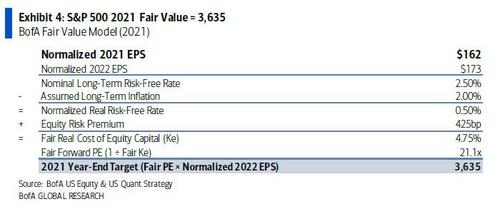

4. Fair Value model spits out S&P 500 3635: This is based on BofA’s 2022 cyclically-adjusted earnings forecast of $173 and its equity risk premium (ERP) forecast of 425bp by year-end (vs. 398bp today) as 2H shifts to concerns about peak earnings and peak stimulus.

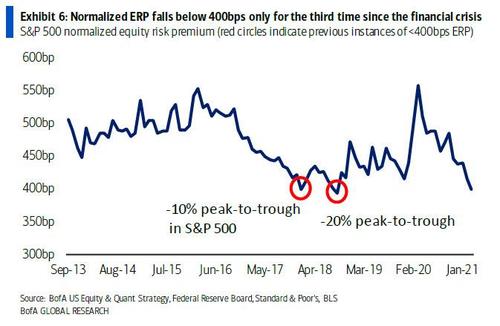

5. The Equity Risk Premium dropped below 400bps – a contrarian negative signal: This is only the third time since the global financial crisis that the ERP dropped below 400bps, according to BofA. Two prior instances were Jan 2018 (399bps) and Sep 2018 (394bps), after which the S&P 500 posted -10% and -20% peak-to-trough declines, respectively.

* * *

So what – if anything – should one buy according to BofA? According to Subramanian, pick “small over large, cyclicals over defensives, capex over consumption, stocks over bonds.” Given Subramanian’s positive outlook on economic and profits growth, plus the potential for a big recovery in capex, she prefers “areas tethered to GDP and capex.”

Tyler Durden

Wed, 04/14/2021 – 14:50

via ZeroHedge News https://ift.tt/32sm5y5 Tyler Durden