Beige Book Upgrades Economic Activity To “Moderate” From “Modest”

The Fed’s latest Beige Book released this afternoon, confirmed what we all knew: that U.S. economic activity has picked up strongly into the new year, and as a result the various regional Feds upgraded its description of the economic expansion to “moderate” from “modest” with consumer spending improving thanks to the trillions in Biden stimulus.

“National economic activity accelerated to a moderate pace from late February to early April,” said the Beige Book, which was based on information collected by the Fed’s 12 regional banks through April 5. “Consumer spending strengthened. Reports on tourism were more upbeat, bolstered by a pickup in demand for leisure activities and travel.”

Some more observations on overall economic activity:

- Auto sales grew, even as new-vehicle inventories remained constrained by microchip shortages.

- The picture in non-financial services generally improved, partly supported by strengthening demand for transportation, professional and business, and leisure and hospitality services.

- Despite widespread supply chain disruptions, manufacturing activity expanded further with half the Districts citing robust growth.

- Bankers in most reporting Districts saw modest to moderate increases in overall loan volumes. Sustained high demand and tight supply of single-family homes further pushed up prices, and builders noted ongoing production challenges, including rising costs.

- Reports on commercial real estate and construction varied, with activity in the hotel, office, and retail segments generally remaining weak.

- Agricultural conditions were mostly stable over the reporting period.

- Activity in the energy sector was mixed; coal production fell, while oil and gas drilling was flat to up.

- Outlooks were more optimistic than in the previous report, boosted in part by an acceleration in COVID-19 vaccinations.

Observations on Employment and Wages

-

Employment growth picked up over the reporting period, with most Districts noting modest to moderate increases in headcounts.

-

The pace of job growth varied by industry but was generally strongest in manufacturing, construction, and leisure and hospitality.

-

Hiring remained a widespread challenge, particularly for low-wage or hourly workers, restraining job growth in some cases.

-

Commercial and delivery drivers were specifically cited as in short supply, as were specialty and skilled tradespeople.

-

Some firms noted absenteeism due to COVID-19 was down.

-

Employment expectations were generally bullish.

-

Wage growth accelerated slightly overall, with more significant wage pressures in industries like manufacturing and construction where finding and retaining workers was particularly difficult.

-

Some contacts mentioned raising starting pay and offering signing bonuses to attract and retain employees.

And the all-important Prices, i.e. inflation

-

Prices accelerated slightly since the last report, with many Districts reporting moderate price increases and some saying prices rose more robustly.

-

Input costs rose across the board, but especially in the manufacturing, construction, retail, and transportation sectors—specifically, metals, lumber, food, and fuel prices.

-

Cost increases were partly attributed to ongoing supply chain disruptions, temporarily exacerbated in some cases by winter weather events.

-

There were widespread reports of increased selling prices also, but typically not on pace with rising costs.

-

Contacts generally expect continued price increases in the near term.

Here are some more details by Fed District:

Boston

Economic activity remained mixed in the First District, with strong performance at manufacturers and ongoing weakness at hospitality outlets. Labor markets were tight for skilled workers. Manufacturers faced new upward pressures on input prices. Single-family home sales increased further. Contacts in the restaurant and hotel industries expressed a more optimistic outlook.

New York

The regional economy declined modestly, with particular weakness in the service sector. The labor market has remained sluggish, though wage growth accelerated. Businesses reported further acceleration in prices, as well as increasingly widespread supply disruptions. Contacts across a wide variety of sectors expressed increased optimism about the near-term outlook.

Philadelphia

Business activity rebounded to a modest pace of growth during the current Beige Book period. COVID-19 cases waned and restrictions eased, but economic disruptions continued. On the whole, activity remained below levels attained prior to the pandemic. Employment rebounded – growing slightly – as wage growth and prices picked up to modest and moderate paces, respectively.

Cleveland

The District’s economy regained momentum, reflecting declining numbers of coronavirus infections and various fiscal support measures. That said, activity remains below prepandemic levels for most firms, and supply chain disruptions restrained output for many firms. Such disruptions also led to sizable increases in nonlabor costs. Hiring activity remained modest, although a greater share of firms reported they were raising wages.

Richmond

The regional economy continued to grow modestly. Manufacturing activity picked up, as did port and trucking transportation. Travel and tourism also rose in recent weeks. Retail sales, on the other hand, declined. The housing market remained strong and commercial real estate leasing rose modestly. Employment increased slightly while wages were little changed. Prices increased moderately in recent weeks.

Atlanta

Economic activity expanded modestly. Labor market conditions improved, and wage pressure was subdued. Some nonlabor costs rose. Retail spending was steady. Tourism and hospitality activity rose slightly. Residential real estate demand increased, and home prices rose. Commercial real estate conditions were mixed. Manufacturing activity improved. Conditions at financial institutions were stable.

Chicago

Economic activity in the Seventh District increased modestly. Manufacturing and consumer spending increased moderately; business spending and construction and real estate increased slightly; and employment was little changed. Wages and prices rose modestly. Financial conditions were little changed. Contacts expected agricultural income to be solid in 2021.

St. Louis

Reports from contacts indicate that economic conditions have been generally unchanged since our previous report. Overall, the outlook among contacts continued to improve and is generally optimistic. Contacts noted a high degree of uncertainty about the pace of recovery, which they linked to vaccine rollout and efficacy.

Minneapolis

District economic activity increased modestly. Hiring demand rose, but employment growth remained flat, likely due to labor supply constraints and workers’ hope of being rehired by previous employers. Manufacturers expected a recent uptick in business to carry forward, while construction and real estate were seeing hot-and-cold activity across the District. Conditions for minority- and women-owned businesses remained difficult.

Kansas City

Economic activity expanded slightly, with gains in most sectors. Stronger retail, restaurant, and healthcare sales drove consumer spending higher in January, but consumers pulled back in February. Activity rose in the manufacturing, professional and high-tech services, wholesale trade, residential real estate, energy, and agriculture sectors. Contacts were generally optimistic about future growth, driven in part by the COVID-19 vaccine rollout.

Dallas

The District economy expanded at a moderate pace, though output in most industries remained below normal levels. Unprecedented winter storms and widespread power outages in mid-February severely disrupted economic activity, though the impact is mostly expected to be transitory. The housing market continued to be a bright spot, and energy activity improved further. Employment rose and wages increased moderately. Outlooks were generally positive, but uncertainty persisted.

San Francisco

Economic activity in the District expanded at a modest pace as labor markets deteriorated somewhat. Wages and inflation picked up. Retail sales improved, but activity in the services sector declined moderately due to ongoing pandemic-related restrictions. Conditions in the agricultural and manufacturing sectors strengthened modestly. Residential construction and lending activity continued to be strong.

* * *

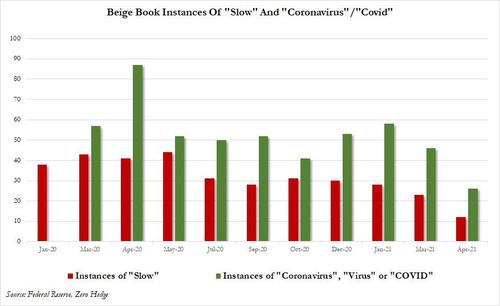

So with the economy firing on all cylinders, it’s hardly a surprise that the number of instances of the word ‘slow’ in the Beige Book dropped to just 12, almost half the 23 noted last month, while references to covid or virus also tumbled as the US is clearly ready to move on.

Tyler Durden

Wed, 04/14/2021 – 14:35

via ZeroHedge News https://ift.tt/2OOHyhn Tyler Durden