COIN Bounces Back As Cathie Wood ‘Bought The Dip’, Dumped Some Tesla

There was at least one dip-buyer in yesterday’s disappointing post-open plunge in Coinbase (COIN).

Cathie Wood’s Ark funds bought $246 million worth of Coinbase shares on the cryptocurrency exchange’s Nasdaq debut on Wednesday and sold some Tesla shares.

Those headlines sparked a panic-bid this morning in pre-market trading, but sellers have immediately reappeared…

COIN remains well below its opening price however. Notably, one of Wood’s funds sold a $4.4 million stake in New York Stock Exchange owner Intercontinental Exchange. Ark also sold Tesla shares worth about $178 million, though the stock is still by far their biggest bet by weightage on three of their major funds.

“What’s interesting is their unwinding of some Tesla shares after their ludicrous call on Tesla,” said Karim Moussalem, head of cash equity sales at Cantor Fitzgerald Europe in London.

“Selling some shares after that is a bit odd.”

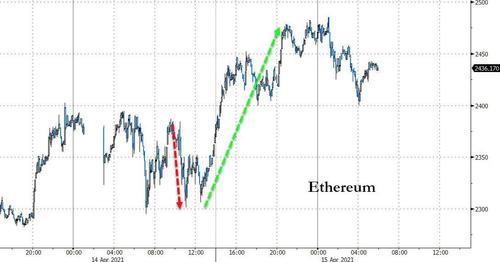

Meanwhile, in cryptocurrency-land, Ether reversed the losses during the COIN listing, pushing top a new high near $2500…

Source: Bloomberg

“Coinbase listing is a key milestone that arguably has created a lot of interest and hype, so it will be interesting to see how the entire cryptocurrency industry evolves over the coming months,” said Steen Jakobsen, chief investment officer at Saxo Bank.

Tyler Durden

Thu, 04/15/2021 – 09:03

via ZeroHedge News https://ift.tt/3g7s9UC Tyler Durden