Semi-Fulfilling Prophecy: Ongoing Chip Shortage Is Now Impacting Chipmaking Equipment

It seems like every day, the ongoing semiconductor chip shortage continues to get worse. For example, yesterday we wrote that Taiwan Semiconductor was now warning that the global chip shortage may extend into next year, following comments we had reported on in early April suggesting that prices would rise for the rest of 2021.

Now, the issue looks to be shifting to a shortage of chipmaking equipment, according to Nikkei. Delivery times for some chipmaking tools have grown to 12 months or more as a result of the supply crunch now spreading “so far that it is rebounding onto the chipmaking industry itself,” the report says.

At least four types of vital production equipment are in short supply, the report says. One industry insider said: “Some of these equipment makers are also suffering from chip shortages and some are struggling with labor issues due to pandemic lockdowns, like all the other tech players, and that weighs on the process of building machines,” said one of the people with direct knowledge of the situation.”

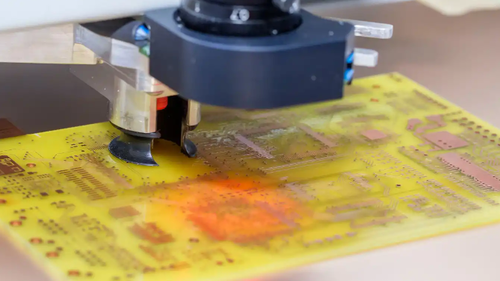

Wire bonding machines are experiencing a lead time of 10 to 12 months. They are used in the chip packaging process. Lead times for wafer dicing machines could be as long as 5 to 8 months, compared to the usual 1 to 3 months, the same people said. Mitsubishi Electric warned that lead times for laser drilling machines on printed circuit boards and chip substrates is not more than 12 months.

One executive told Nikkei: “It’s not like we don’t want to increase our capacity, [but] even if we wanted to book more machines, we couldn’t get them very quickly. People are booking 50 or even 100 of Mitsubishi’s laser processing machines at a time. We have been told by [Mitsubishi] that its capacity is fully booked because demand is so strong, and if we want to order new machines now, we will have to wait until next year for them to be available.”

Chairman David Shen of Hota Industrial Manufacturing, a key automotive parts supplier, said: “We are trying to find alternative equipment suppliers for drilling machines [for auto parts], but the precision and speed are just not as satisfactory as what we used to have.”

Chiu Shih-fang, a tech and supply chain analyst with Taiwan Institute of Economic Research, concluded: “It’s a chain reaction. … Electronics and automakers expect component makers to expand capacity to address the shortage. But when these component makers talk to their equipment and materials suppliers, they realize deliveries could be as late as the end of this year or even next year.”

“That means basically everyone is kind of stuck here. The dangerous part is that even if only one or two components are lacking, the whole system would be unable to move forward.”

Recall, earlier this month we wrote that U.S. exporters of semiconductor chipmaking tools were struggling to get licenses to sell to China. The U.S. government has been dragging its feet in approving licenses for companies to sell chipmaking equipment to Chinese semi company SMIC, we wrote.

SMIC is “the largest foundry in mainland China, is an important player in the global semiconductor supply chain, which is under pressure as pandemic lockdowns drive up demand for electronics such as laptops and phones”, according to Reuters.

Lam Research and Applied Materials are among companies trying to sell about $5 billion of parts and components to help make chips – but licensing has been a hold up. Semiconductor Manufacturing International Corp had been blacklisted by the U.S. in December over concerns it was helping China’s military, and its future under a Biden administration remains unclear.

Equipment that is used to make advanced 10 nm and smaller chips is “likely to be denied licenses”, and applications are taken on a case-by-case basis, according to the report. “Lam Research is still in the application process and has not yet received a response,” a company spokesperson said. Applied Materials’ CFO said on a recent conference call that the company is not assuming licenses would come through.

Washington trade lawyer Giovanna Cinelli said the process is “a lot of back and forth, which has elongated the period of review.”

While the review period drags out, the situation for the global semi market doesn’t look like it’s going to get better anytime soon.

Tyler Durden

Fri, 04/16/2021 – 14:53

via ZeroHedge News https://ift.tt/3doUO5V Tyler Durden