Old-School IPOs Trounce SPACs As Blank Check Craze Fizzles

It’s been a very bad month for SPACs: last week we pointed out that the SPAC Bubble may have popped as the “Flood Of New SPAC IPOs Hit A Brick Wall.” In the article, we said that the flood of recent SPACs which through the end of March was a non-stop torrent…

… had come and gone, spelling trouble for the broader market for initial public offerings with just three SPACs listing last week,, following just a pair of IPOs by SPACs last week which was a collapse from the more than 20 deals a week during most of the year.

There was much more pain to come for SPACs, however, and as we reported earlier this week, out of the blue the SEC lobbed an accounting bomb at the SPAC frenzy, when it began privately telling accountants that warrants, which are issued to early investors in the deals, might not be considered equity instruments. As Bloomberg explained, the proposed changes could result in warrants being considered a liability for accounting purposes, a shift which would spell a massive nuisance for accountants and lawyers, who are hired to ensured SPACs are in compliance with the agency.

Simply put, as Bloomberg concluded, “the communications mean that filings for new SPACs may not go forward until the warrants issue is addressed.”

So, in a dramatic reversal as Bloomberg’s ECM team reported, special-purpose acquisition companies may have become the hottest must-have for business tycoons, celebrities and even athletes, but old-school initial public offerings have quietly outperformed them this year.

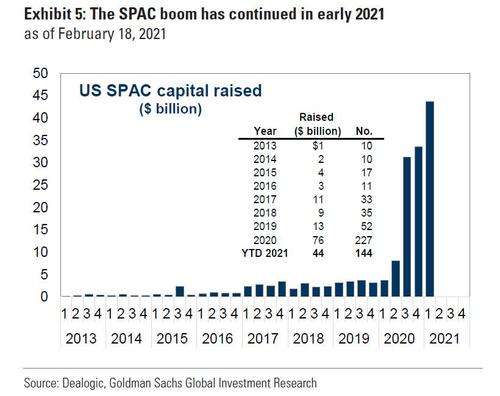

More than 330 blank-check firms have listed in 2021, mostly in the U.S., making up just over a third of global IPO activity, data compiled by Bloomberg show. They join the 300 SPACs already floated last year, sparking concern among investors about their potential to find suitable acquisition targets and increased competition for the most attractive assets in the market.

One place where there is a profound difference is in the early returns: this year’s SPACs are trading up about 1.2% on average on an offer-to-date basis, whereas regular IPOs have gained 36%. The strong performance for traditional listings, Bloomberg said, “signals there is brisk appetite for new companies coming to market, while investor sentiment toward SPACs is cooling.” This is precisely what we said last week.

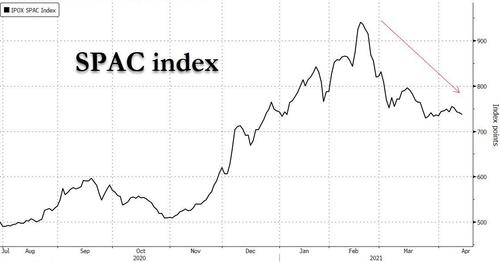

Early this year retail traders helped fuel a strong rally in SPAC stocks amid reports of several potential deals. Since reaching a peak in late February, the U.S. IPOX SPAC index, which tracks U.S. blank-check stocks, has tumbled 21%.

“The billions of dollars that have flown into SPACs over the past year means there’s much more competition for attractive takeover targets, which diminishes the prospects of lofty returns for blank-check firms,” said Stephane Monier, chief investment officer at Lombard Odier & Cie.

According to Bloomberg, this could be good news for Europe, where blank-check listings are only beginning to trickle in. On Tuesday, Berlin-based venture capital firm 468 Capital announced a SPAC in Frankfurt, set to become only the seventh such deal in the region over the past 12 months. At the same time, Europe enjoyed its biggest-ever first quarter for proceeds from regular IPOs this year.

It is too soon to truly assess SPAC performance, though there is some damping of investor euphoria, said Shaunak Mazumder, a global equities fund manager at Legal & General Investment Management. These shares are only expected to pick up after announcing a deal, he said.

Still, even the SPACs that have agreed to buy a target recently have elicited a disappointing market reaction, signaling waning investor interest. After announcing the $40 billion purchase of Singapore-based Grab Holdings Inc. on Tuesday, shares of Altimeter Growth Corp. rallied 10%, but remain 15% below a January high.

Meanwhile, 2021’s regular IPOs have provided some stellar returns for investors. Kuaishou Technology, this year’s largest deal globally, has surged 125% since listing in Hong Kong in February. In the U.S., online courses provider Coursera Inc. is up 56% and dating app developer Bumble Inc. trades 38% higher, while bootmaker Dr. Martens has jumped 28% since its London debut.

And now, as we noted above, the SEC is also cracking down on how accounting rules apply to the warrants issued along with shares in blank-check offerings, new filings in their biggest market New York will be further disrupted.

Tyler Durden

Sat, 04/17/2021 – 09:45

via ZeroHedge News https://ift.tt/3trHKSL Tyler Durden