Ever Fewer People Need Ever More Money… Said Nobody, Ever (Except The Federal Reserve)

Authored by Chris Hamilton via Econimica blog,

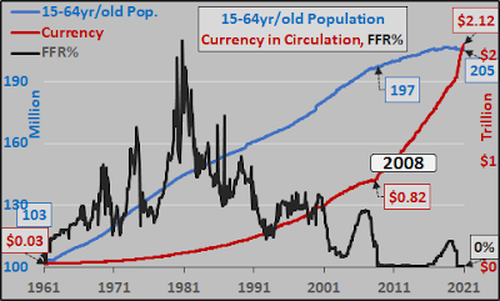

15 to 64 year old US working age population versus Federal Funds Rate & US currency in circulation. Honestly, no words are necessary.

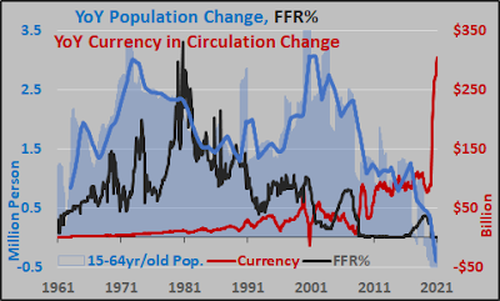

Year over year changes in 15 to 64 year old US working age population versus currency in circulation.

Ever fewer people need ever more “money”…BRRR.

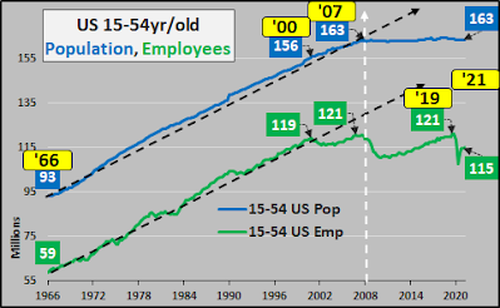

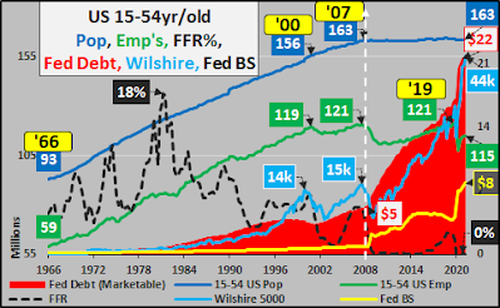

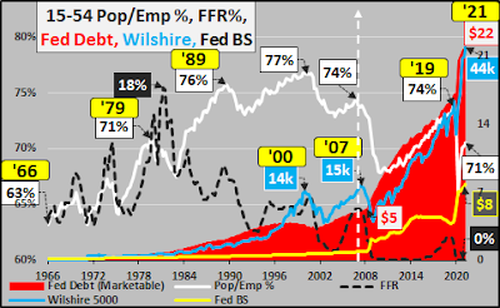

Just for fun, observing America through it’s 15 to 54 year old population (blue line) and those employed among them (green line).

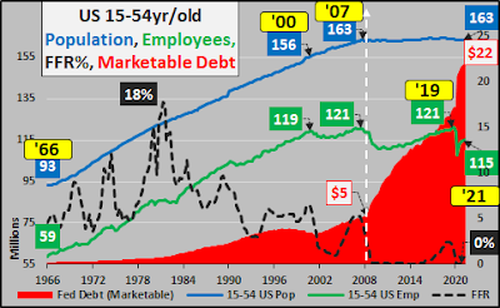

Now adding in the Federal Funds rate and the impact of “free money” on US federal marketable debt.

Add in the Fed’s balance sheet (yellow line) plus the Wilshire 5000 (blue line…all publicly traded US equity).

Lastly, the 15 to 54 year old raw employment/population ratio. Asset owners rejoice, the Fed has a long way to go to fulfill it’s “full employment” mandate…assets will soar until full employment is achieved.

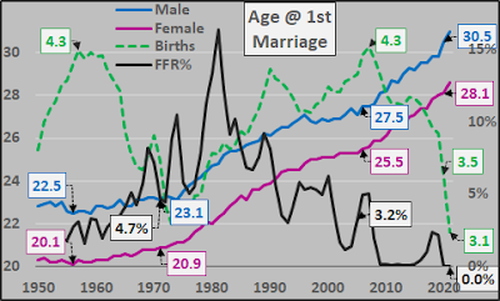

And what is the impact on America’s young adults…soaring age at first marriage…collapsing births.

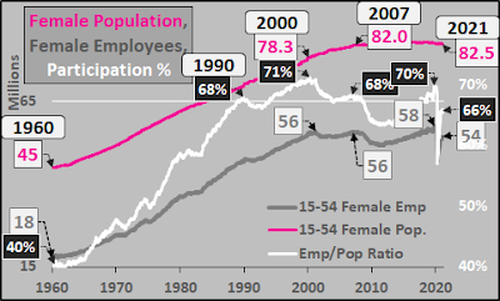

Out of necessity of paying the soaring costs of living…females fully brought into the labor market and seemingly unable to step away for the luxury of having a family.

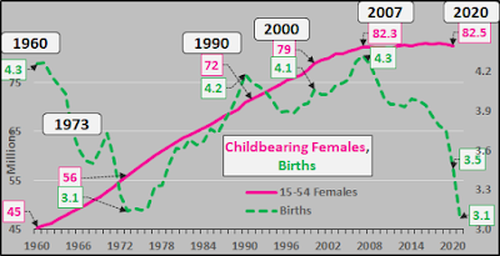

Widest possible view on childbearing females…and births.

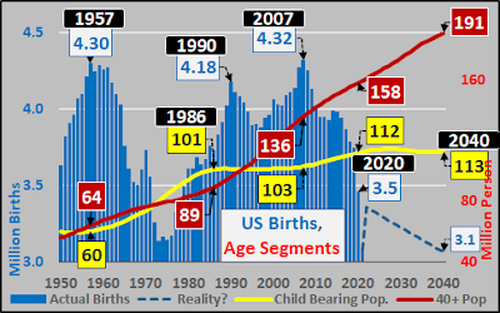

And here is America by 15 to 40 year olds (yellow line), 40+ year olds (red line), and annual births (blue columns) plus my best estimate through 2040 (blue dashed line).

Soaring debt, asset prices, fueled by ZIRP are enriching asset holders (America’s past) at the expense of young adults (America’s future). Whether this is policy error or intentional is open for debate…but no debate about the destruction of the future of the US to safeguard it’s past.

Tyler Durden

Sun, 04/18/2021 – 09:20

via ZeroHedge News https://ift.tt/3anZeYy Tyler Durden