“Stunning Divergence”: Latest Bank Data Reveals Something Is Terminally Broken In The Financial System

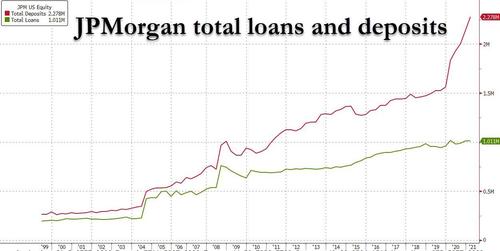

There was a remarkable disclosure in the latest JPMorgan earnings report: the largest US bank – an entity that historically has best been known for making loans to the broader population – reported that in Q1 its total deposits rose by a whopping 24% Y/Y and up 6% from Q4, to $2.278 trillion, while the total amount of loans issued by the bank was virtually flat sequentially at $1.011 trillion, and down 4% from a year ago.

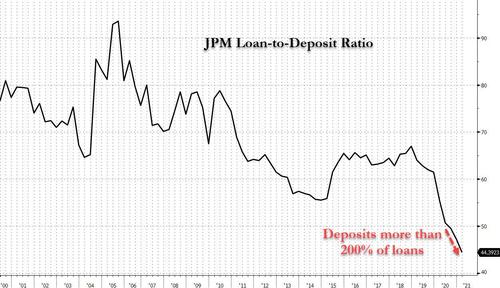

In other words, for the first time in its history, JPM had 100% more deposits than loans, or inversely, the ratio of loans to deposits dropped below 50% for the third quarter in a row after plunging in the aftermath of the covid pandemic:

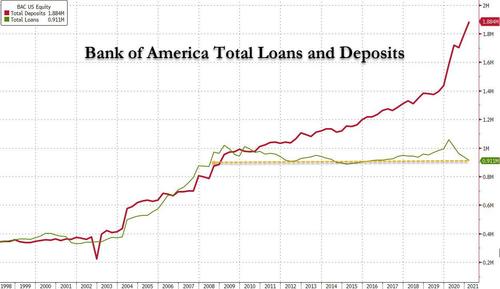

An even more stunning divergence between total deposits and loans, emerges at Bank of America where deposits similarly hit a new all time high of $1.88 trillion, even as the bank’s loans have continued to shrink at an alarming, deleveraging (and deflationary) pace and are now at $911 billion, below their level during the great financial crisis: in other words, there has been 12 years with zero loan growth at Bank of America!

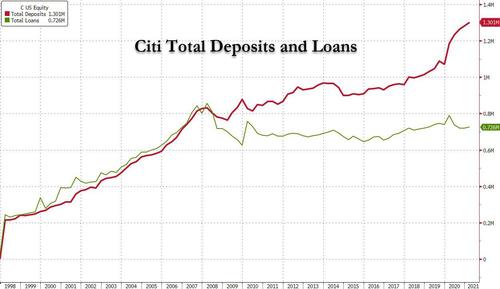

It’s not any better at either Citigroup…

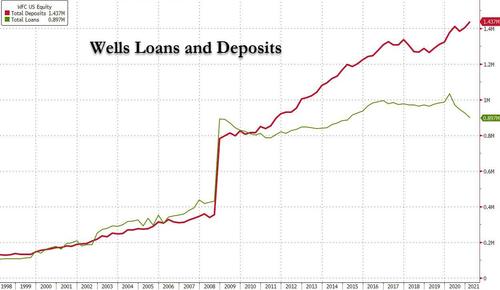

… or even Wells Fargo (which while having been limited by the Fed in how much loans it can issue, apparently has had no limit on how many deposits it can collect):

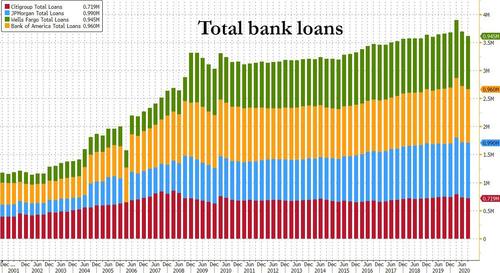

Summarizing the above data, we get the following picture breaking down total loans by Big-4 bank:

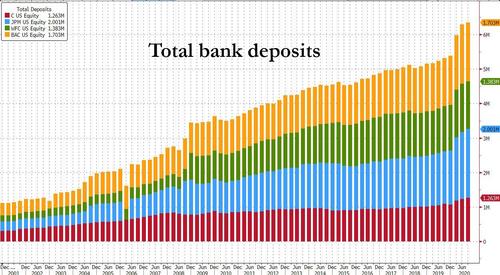

And total deposits.

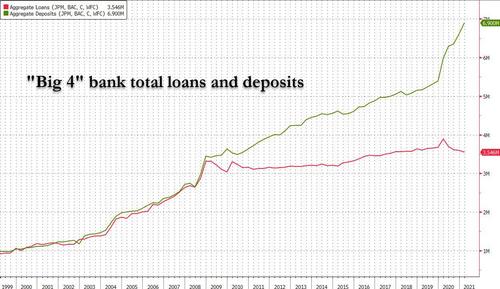

Finally, aggregating the data across the big 4 banks shows something striking: there has been no loan growth since the global financial crisis, while total deposits have doubled!

There are two major implications one should draw from the collapsing loan-to-deposit ratio. The first, more superficial one is that this ratio is a closely watched metric that measures how much lending a bank is doing when compared to its capacity to lend.

The second, and far more profound implication, is arguably the most fundamental question in modern fractional reserve banking: what comes first, loans or deposits, in other words do private, commercial banks create the money in circulation (by first lending it out) or is the central bank responsible for money creation?

One thing that is now beyond debate: there are now far more deposits than there are loans in the US banking system.

This is a problem because most conventional monetarists will argue that loans always come first, and only then do banks receive deposits.

It gets worse: as everyone now knows, we live in an MMT world where the Fed and Treasury have merged and where one basically monetizes what the other has to sell. And since the rainbows and unicorns world of MMT says that there is nothing to worry about from such debt monetization, even respected economists have been swept into this absolute idiocy and are urging the US to issue as much debt as it possibly can (with the Biden administration glad to oblige).

There is just one problem: as of this moment, the core tenet of MMT is no longer applicable. As a reminder, according to MMT loans create deposits not the other way around, and this socialist crackpot theory further claims that Reserve balances have nothing to do with this – they are part of the banking system that ensure financial stability. Don’t believe us? Watch the following clip from one of the priests of MMT, Warrn Mosler who explains how “loans create deposits.”

Only… clearly that’s no longer the case, and the empirical data shown above makes patently obvious that the core, anchor theory of MMT on which all its other laughable theories are built is false, with huge consequences for a world that has thrown its future into a world prescribed by said crackpot theory.

The recent loan and deposit data also means that the conventional process of deposit creation via loans is terminally broken.

Indeed, that’s precisely the case with the missing link being – drumroll – the Fed, as we explained all the way back, in 2014. Here is the punchline of what we said then, when we did a similar analysis observing what was already a record amount of excess deposits over loans:

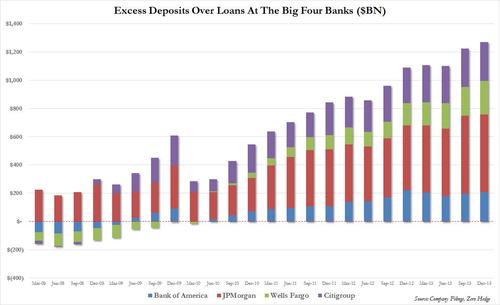

… how does the record mismatch between deposits and loans look like? Well, for the Big 4 US banks, JPM, Wells, BofA and Citi it looks as follows.

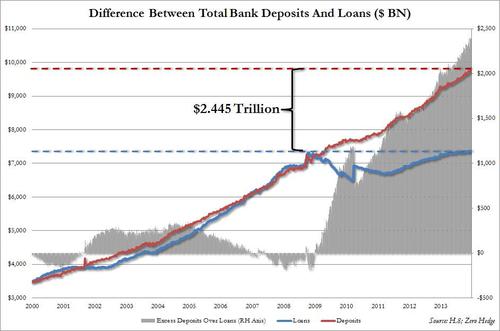

What the above chart simply shows is the breakdown in the Excess Deposit over Loan series, which is shown in the chart below, which tracks the historical change in commercial bank loans and deposits. What is immediately obvious is that while loans and deposits moved hand in hand for most of history, starting with the collapse of Lehman loan creation has been virtually non-existent (total loans are now at levels seen at the time of Lehman’s collapse) while deposits have risen to just about $10 trillion. It is here that the Fed’s excess reserves have gone – the delta between the two is almost precisely the total amount of reserves injected by the Fed since the Lehman crisis.

So what does all of this mean? In a nutshell, with the Fed now tapering QE and deposit formation slowing, banks will have no choice but to issue loans to offset the lack of outside money injection by the Fed. In other words, while bank “deposits” have already experienced the benefit of “future inflation”, and have manifested it in the stock market, it is now the turn of the matching asset to catch up. Which also means that while “deposit” growth (i.e., parked reserves) in the future will slow to a trickle, banks will have no choice but to flood the country with $2.5 trillion in loans, or a third of the currently outstanding loans, just to catch up to the head start provided by the Fed!

It is this loan creation that will jump start inside money and the flow through to the economy, resulting in the long-overdue growth. It is also this loan creation that means banks will no longer speculate as prop traders with the excess liquidity but go back to their roots as lenders. Most importantly, once banks launch this wholesale lending effort, it is then and only then that the true pernicious inflation from what the Fed has done in the past 5 years will finally rear its ugly head.

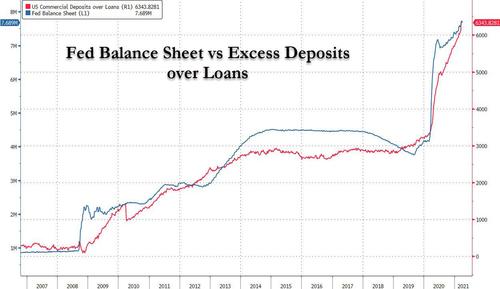

It will also come as no surprise to anyone, that updating the chart we first showed in 2014 correctly explains today’s reality, something which MMT is completely incapable of doing: as shown below the excess deposits over loans is entirely driven by the trillions in reserves pumped by the Fed!

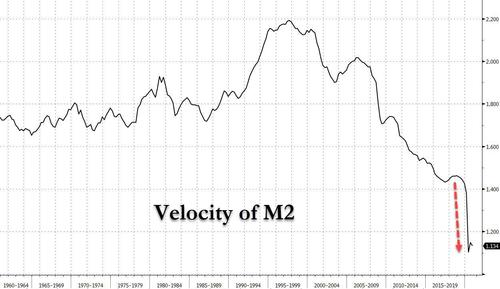

The above also explains why even as the Fed has pumped trillions in reserves into banks, which by transformation have ended up as deposits on bank balance sheets, the velocity of M2 money has plunged to an all time low (and will soon drop below the fractional reserve system singularity of 1.0x), as loan demand is nowhere near enough to offset the Fed’s forced deposit creation which incidentally ends up not in the economy but in capital markets, resulting in broad deflation offset by asset price hyperinflation.

One final reason why this data is absolutely critical: in a world where the dominant daily argument is whether the US is facing deflation or inflation, and where many have become convinced that we are facing a surge in higher prices, continued loan destruction is about the most deflationary thing possible. But don’t take our word for it – here is an excerpt from the latest “Flows and Liquidity” report from JPMorgan strategist Nick Panigirtzoglou titled “The challenge from weak bank lending” in which he confirms all of the above observations, and writes that “a common feature of this week’s US bank earnings reports has been the weakness in loan growth. Indeed, weekly data from the Fed’s H8 release shows that the pace of US bank lending remains in negative territory, exhibiting persistent weakness since last summer”

This persistent weakness, Panigirtzoglou writes, “followed a temporary spike in bank lending during Q2 2020, immediately after the virus crisis erupted, and is reminiscent of the US bank lending trajectory after the Lehman crisis. After a temporary spike immediately after the Lehman crisis, driven by companies and consumers tapping bank credit lines, the pace of US bank lending had remained largely in negative territory up until the middle of 2011. Although it entered positive territory after 2011, the pace of US bank lending had stayed significantly below pre -Lehman crisis levels, an important feature of the secular stagnation thesis.”

The JPM quant then concedes that it remains to be seen “whether the protracted post Lehman period weakness in bank lending would be repeated in the current post virus cycle” although what is likely to be the case “is that the future trajectory for bank lending would be important in determining both the inflation and liquidity picture over the longer term.”

And the JPM punchline:

“A repeat of the post Lehman period protracted weakness in bank lending would cast doubt to the idea of a sustained inflation impulse over the coming years. It would also act as a drag for money supply and liquidity creation going forward, reducing a key driver of asset prices.”

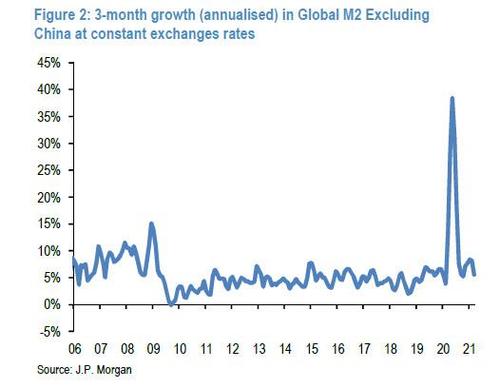

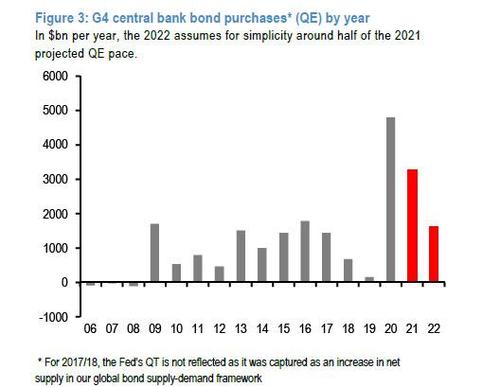

Indeed, the next chart shows that money creation has been already normalizing from the torrid pace of the first half of 2020.

Looking ahead, central bank tapering in 2022 – or whenever it arrives…

.. would likely induce further slowing in money creation over the coming years according to JPM, unless bank lending improves avoiding the protracted weakness of the post Lehman period.

JPMorgan’s ominous concludes, “whether the protracted post Lehman period weakness in bank lending is repeated in the current post virus cycle will be critical in determining both the inflation and liquidity picture over the longer term. So far the trajectory for bank lending shows more similarities than differences to the post Lehman crisis period.”

Tyler Durden

Sun, 04/18/2021 – 12:28

via ZeroHedge News https://ift.tt/32mUTAy Tyler Durden