Lumber Hasn’t Had A Down Day Since March 26… And It’s Sending Home Prices Soaring Even Higher

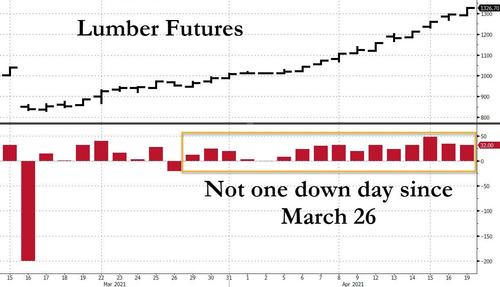

Less than a week ago, we published an article explaining that the ongoing “Supply Chain Collapse Leads To Lumber Frenzy, Soaring Home Prices.” Since then the lumber buying frenzy has gotten even more out of control, with prices surging another 12%, and as Bloomberg’s Aoyon Ashraf points out, “lumber hasn’t had a down day since March 26 and keeps hitting all-time highs with few signs of stopping.” In an amusing comparison, Ashraf also notes that while Lumber futures have climber a staggering 58% in just the past month since bottoming on March 16, “Bitcoin has fallen 3% and S&P 500 returned only 5% over this period” (of course, any comparison that is not goalseeked and stretches further beyond just a few weeks will show bitcoin trouncing lumber, but we get the idea).

Ashraf then echoes what we said last week, namely that “the reason for lumber’s meteoric rise is simple: low supply and surging demand. Slow ramp-ups at sawmills, trucking delays and worker shortages all are feeding into it.” The Bloomberg reporter than boldly suggests that going long lumber is a safer choice than bitcoin:

Meanwhile, with opaque assets such as Bitcoin, it’s quite a bit harder to explain why it moves the way it does. This makes lumber a relatively safer choice.

Well, maybe not for those who have been long bitcoin since 2015 but in any event it is true that lumber is at the forefront of reflating assets, and what makes it especially problematic is that one can’t build houses without lumber. Hence: even higher home prices.

As WIS10 News reports, leaders with the Building Industry Association of Central South Carolina and Central Carolina Realtors Association say the rising price of that material plays into the rising cost of homes, which have already soared at the highest pace since Feb 2006 (according to the Case Shiller National Home Price Index).

In Richland and Lexington Counties, Consolidate Multiple Listing Service data shows the median price of homes went from $189,900 in March 2020 to $218,000 a year later. That’s a 14.8% jump. Building association Executive Director Earl McLeod pointed to the pandemic, during which mills shut down or slowed production.

“At the same time demand for new homes increased. People were being told to stay at home, people wanted to be at home. There was a tremendous demand for new homes. That coupled with less production and high demand created a surge, so lumber prices have substantially increased,” he said.

Pointing out the painfully obvious, Realtor Association Executive Officer Taylor Oxendine said the supply and demand of homes are out of balance. Currently, there’s not enough supply. He said the price of lumber has impeded construction, which would be needed to lower the price.

“That’s made it more expensive to build homes in these new developments, meaning the supply can’t meet the demand here,” he said, adding that the costs have had to be passed onto homebuyers.

Builder John Streven said affordability is a goal for his projects, but the rising cost has forced him into tough conversations with customers.

“I don’t have any control over this. There’s nothing that I can do. All we can try and do is see how can we help defray some of that cost, mitigate against it, but there is, it’s that feeling there is no control because the control is in the hands of a few very large manufacturers,” he said.

The American Wood Council claims to represent 86% of the Structural Wood Products industry and released this statement in March on the issue:

By Chris Joseph | April 15, 2021 at 6:16 PM EDT – Updated April 16 at 10:11 PM

COLUMBIA, S.C. (WIS) – Lumber is a crucial part of many homes, and a short supply is making those homes more expensive.

The National Association of Home Builders reports the price of lumber has climbed 180% since last spring.

Association data shows 1,000 board feet went from roughly $400 in June 2020 to $1,100 in April.

Leaders with the Building Industry Association of Central South Carolina and Central Carolina Realtors Association say the rising price of that material plays into the rising cost of homes.

In Richland and Lexington Counties, Consolidate Multiple Listing Service data shows the median price of homes went from $189,900 in March 2020 to $218,000 a year later. That’s a 14.8% jump.

Building association Executive Director Earl McLeod pointed to the pandemic, during which mills shut down or slowed production.

“At the same time demand for new homes increased. People were being told to stay at home, people wanted to be at home. There was a tremendous demand for new homes. That coupled with less production and high demand created a surge, so lumber prices have substantially increased,” he said.

Realtor Association Executive Officer Taylor Oxendine said the supply and demand of homes are out of balance. Currently, there’s not enough supply.

He said the price of lumber has impeded construction, which would be needed to lower the price.

“That’s made it more expensive to build homes in these new developments, meaning the supply can’t meet the demand here,” he said.

The costs have had to be passed onto homebuyers.

Builder John Streven said affordability is a goal for his projects, but the rising cost has forced him into tough conversations with customers.

“I don’t have any control over this. There’s nothing that I can do. All we can try and do is see how can we help defray some of that cost, mitigate against it, but there is, it’s that feeling there is no control because the control is in the hands of a few very large manufacturers,” he said.

The American Wood Council claims to represent 86% of the Structural Wood Products industry and released this statement in March on the issue:

“Despite the many challenges presented by the pandemic, wood products manufacturers are responding to the high demand by producing wood products at levels not seen since before the Great Recession. Production output of wood products is the highest it’s been since 2007, according to the Federal Reserve Board.

At the beginning of the pandemic, wood product manufacturers were operating under the same uncertainty as the rest of the country. Many curtailed production in anticipation of worker shortages and reduced demand. At the same time, many wholesale and retail lumber customers significantly reduced their inventory levels. But then, the need for wood products quickly rebounded as people stayed home and tackled DIY projects, restaurants rushed to build outdoor accommodations, and many states declared home building an essential industry allowing construction to rapidly resume. New home sales are up over 19 percent year-over-year as demand for single-family homes have increased during the pandemic and mortgage rates have remained low.

The industry has quickly responded and put in extensive worker health and safety protocols to protect the 450,000 employees across the industry and prevent large scale shut-downs due to COVID exposures. Many wood products mills are back at pre-pandemic production levels or higher, with some operating seven days a week.

Additionally, many wood products companies have continued to make significant investments in improving the throughput of their existing mills and building new mills in the U.S. since the sharp rebound in demand in the second quarter of 2020. These investments will create additional supplies in 2021. However, new equipment lead times remain long in many cases, engineering and construction resources are constrained, and additional production often requires environmental permitting reviews, so near-term relief during the spring building season from new production is likely to be limited.

Constraints in supply and transportation have also continued, which are issues facing manufacturers of all kinds, and it has proven difficult to rebuild the near-zero inventories up to meet the renewed retailers’ and wholesalers’ demands. Some mills have taken temporary curtailments or reduced shifts due to localized COVID outbreaks and quarantines. All of this has been further exacerbated by constraints on log supplies resulting from recent extreme weather events, some of which also caused production downtime.

While the wood products industry is far from the only one facing supply chain challenges, we have worked hard to protect our workforce through significant health and safety measures to stay in production.”

Tyler Durden

Mon, 04/19/2021 – 18:50

via ZeroHedge News https://ift.tt/2RIGb4J Tyler Durden