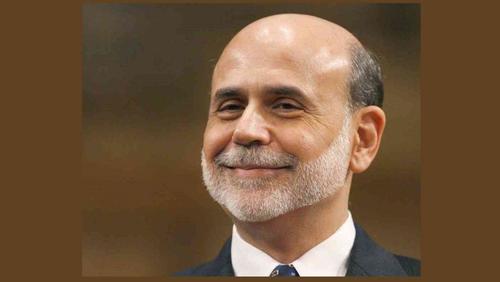

Peter Schiff: Has Ben Bernanke Ever Told The Truth?

Ben Bernanke served as the chairman of the Federal Reserve from 2006 to 2014. He famously told Congress the Fed was absolutely not monetizing the debt in 2008. He said the difference between debt monetization and the Fed’s policy was that the central bank was not providing a permanent source of financing. He said the Treasurys would only remain on the Fed’s balance sheet temporarily. He was obviously wildly mistaken or outright lying.

In this clip from his podcast, Peter Schiff wonders out loud if Bernanke has ever told the truth.

Bernanke recently did an interview and the interviewer played clips of some of the things Bernanke said back in the run-up to the 2008 financial crisis, specifically about the problems in the subprime mortgage market being transitory and of no real threat to the broader economy.

Bernanke admitted that he wasn’t speaking truthfully at the time, claiming he couldn’t speak honestly because he was part of “the administration” and he had to toe the company line. As Peter put it, this was basically an admission that he lied when he told the nation there was nothing to worry about and that subprime was contained.

He did that because he believed he was a member of the Bush administration. So much for the idea that the Fed is independent when you have a former Fed chairman admitting that he lied in order to push a narrative that the Bush administration wanted the country to believe – that everything was great and there was nothing to worry about.”

Of course, that raises a question: was Bernanke really lying then? Or is he lying now?

Is he just trying to save face because he doesn’t want to look like a complete fool, and say, ‘Well, yeah, I guess I was wrong.’? He’s now saying he wasn’t wrong. ‘I just wasn’t being honest.’”

Peter said he thinks it would be worse if Bernanke was lying back then rather than just incompetent.

Interestingly, nobody was outraged at Bernanke’s confession. Nobody seemed particularly concerned that a former Fed chair just admitted he lied to protect a political narrative.

More disturbingly, Peter said he suspects the same thing is happening today.

Either the Fed knows that we have a huge inflation problem on its hands and is lying about it, or it’s completely clueless and doesn’t realize it.”

The Federal Reserve is hanging its hat on the fact that it printed a bunch of money over the last 10 or 20 years and price inflation never reared its ugly head. Therefore, we can do this forever.

You can’t assume just because the inflationary policies of the past didn’t result in bigger spikes in consumer prices that we can turn up the heat, and we can have even more inflationary policies in the present, and that these policies won’t have any effect on consumer prices either. That is a completely ridiculous and asinine assumption to make. And I think ultimately this is going to go down as the Fed’s biggest blunder — much more so than the mistake in its bad read on subprime problems being contained. The idea that inflation was transitory is going to be an even bigger mistake and an even bigger policy failure, because by the time the Fed is forced to admit that they were wrong and inflation wasn’t transitory, they will have waited too long to do anything about it.”

Tyler Durden

Tue, 04/20/2021 – 14:05

via ZeroHedge News https://ift.tt/3el2J35 Tyler Durden