China Considering Huarong Bailout With $15 Billion PBOC Backstop

To everyone who said that it was only a matter of time before Beijing blinked in its latest encounter with the harsh reality of market logic… congrats, you were right.

One day after the latest report – this time from Reorg Research – that China was considering options for bad-debt asset manager Huarong that included restructuring the debt of its offshore unit and which again sent Huarong dollar bonds tumbling, Beijing has had enough of the daily rollercoaster and leaked through Bloomberg – which quoted the usual “people familiar with the matter” – that the central bank is considering a plan to “assume more than 100 billion yuan ($15 billion) of assets from China Huarong Asset Management, helping the state-owned company clean up its balance sheet and refocus on its core business of managing distressed debt.”

As Bloomberg’s PBOC source details, under the proposal that’s still being finalized and could change, a PBOC unit would assume assets from some of Huarong’s unprofitable operations. At the same time, China Huarong International Holdings Ltd., the offshore unit that issues or guarantees most of Huarong’s dollar bonds, is in the process of transferring distressed assets worth tens of billions of yuan into a separate offshore entity called China Huarong Overseas Investment Holding Co., a move which is also aimed at improving the financial health of China Huarong International, the group’s main link to overseas funding.

Naturally, if the PBOC proposal is effectuated, it would not only end the turmoil surrounding Huarong’s future – and its dollar bonds – but mark a significant show of government support for a company that has faced intense investor scrutiny after missing a deadline to report earnings at the end of March.

It would also ease much of the pressure that China’s dollar bond sector has found itself in in recent days as speculation about a looming debt restructuring sent Huarong’s dollar bonds to record lows last week, stoking market contagion and prompting some investors, as Bloomberg put it, “to reconsider assumptions about implicit government guarantees that have underpinned China’s credit market for decades.”

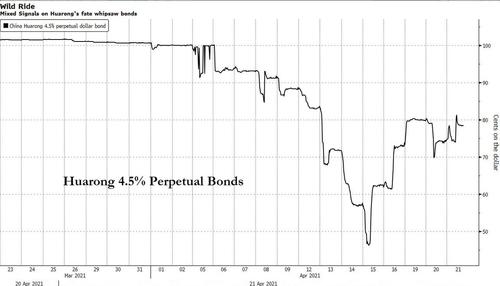

Understandably, Huarong’s bonds have swung wildly in recent days amid conflicting signals about the company’s fate. The company’s 4.5% perpetual bond gained 6.4 cents on the dollar to 79.8 cents on Wednesday, while its 3.75% dollar bond due in 2022 climbed 5 cents to 87.7 cents.

“The news suggests that the central government is examining options to provide bail-out solutions to Huarong,” said Dan Wang, an analyst at Bloomberg Intelligence in Hong Kong. “The potential involvement of the PBOC, which is experienced in handling distressed financial institutions, also gives the market more hope that the Huarong saga will be dealt with in an orderly way that is less likely to incur losses for offshore bondholders.”

In retrospect, the bailout was inevitable: with nearly 1.6 trillion yuan of liabilities including $22 billion in dollar bonds, and a vast web of connections with other financial institutions, Huarong has long been among China’s most systemically important companies outside the nation’s state-owned banks. It’s also majority-owned by China’s finance ministry, making it a closely watched barometer of the government’s willingness to backstop debt of troubled state-owned enterprises. Which is why the mere speculation that Beijing would let it default was enough to send shockwaves across China’s market.

Huarong and China’s three other main bad-debt managers have nearly $50 billion in outstanding dollar bonds, or about 8% of China’s overseas investment-grade credit market, data compiled by Bloomberg show. Huarong is the third largest Chinese financial issuer in international markets, according to S&P.

As Bloomberg further details, worries about the company’s fate have been most acute among offshore bondholders, in part because most of Huarong’s dollar debt contains a form of credit protection called a keepwell agreement that has yet to be fully tested in court. It’s unclear whether Huarong would be compelled to make good on more than $20 billion in dollar bonds if its offshore units — especially China Huarong International — were unable to repay.

The imminent PBOC bailout seeks to put an end to a saga that has enthralled China watchers since 2018, when Huarong’s then-chairman Lai Xiaomin was charged and then sentenced to death for bribery in one of the country’s biggest-ever financial scandals. Under Lai, who was executed earlier this year, Huarong moved far beyond its original mandate of helping banks dispose of bad debt. The company raised billions of dollars from offshore bondholders and expanded into everything from trust companies to securities trading and illiquid investments.

Despite Huarong’s history of mismanagement, some market observers have said the costs of allowing the company to suffer a major default probably outweigh the benefits.

“We see little for the government to gain in letting such a major crisis happen in an effort to eliminate moral hazard in SOEs,” Citigroup Inc. analysts including Eric Ollom wrote in a recent research report. “A financial crisis would likely result in a return to substantial monetary stimulus to counter any financial instability. The more likely policy outcome seems to be to remind investors of these risks but keep the fallout well contained.”

And just like that China blinked… again… confirming that for all its bluster and rhetoric about deleveraging and containing the world’s fastest growing debt bubble, Beijing will never have the balls to actually go through with such a plan.

Tyler Durden

Wed, 04/21/2021 – 13:10

via ZeroHedge News https://ift.tt/3dFFvpz Tyler Durden