Companies Are Freaking Out About Soaring Costs, And Are Rushing To Pass Them On To Consumers

One doesn’t have to go too far – a trip to the local gas station, grocery store, or restaurant should suffice – to observe how soaring commodity prices and other costs are bleeding through to the consumer. And it’s only going to get worse: Procter & Gamble, Kimberly-Clark and Coca-Cola have publicly discussed lifting prices, citing rising commodity costs and manufacturing expenses. P&G and Kimberly-Clark’s higher price tags for everyday items like toilet paper and tampons are the first in about two years, as the trade war unfolded, further adding pressure on raw materials.

Cost pressures are certainly appearing in company earnings commentaries: while it is still early on in earnings season (less than 10% of S&P 500 companies have reported), Morgan Stanley notes that cost pressures have emerged as a prominent topic of discussion. This development is corroborated by a number of macro data points which suggest that a range of expenses are on the rise.

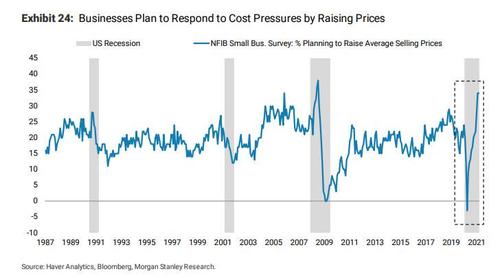

Such surging cost pressures have been best captured by the record prices prints in PMI survey data. The NFIB Small Business Optimism Survey also indicates that companies intend to raise prices in response to these cost pressures. With a strong, demand-led growth environment, Morgan Stanley’s Micheal Wilson writes that many companies will ultimately look to pass along price, but on a more near-term basis the strategist is watching how stocks trade as cost pressures impact results relative to expectations.

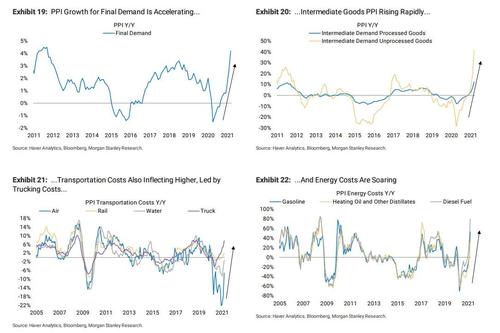

The charts below that PPI growth is accelerating both for final demand and intermediate demand goods. This acceleration is particularly acute for unprocessed goods, which tends to be a volatile series, but is an important indication of early stage supply chain cost pressure. Additionally, transportation costs (particularly trucking costs) and energy costs are also on the rise.

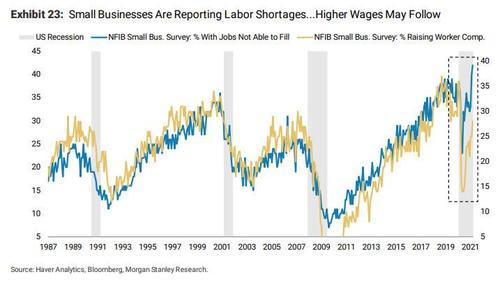

Beyond input and raw material cost pressures, we recently showed that companies – especially small and medium businesses – are having a difficult time filling jobs. The NFIB Small Business Survey: Percent with Jobs Not Able to Fill Index is at historical highs, indicating labor shortages – a trend being driven by expanded unemployment benefits and fiscal stimulus directed at consumers. This labor shortage series (blue line) tends to trend closely with the NFIB Survey’s sub series on higher worker compensation. Interestingly, a divergence has formed over the past year between these two indicators. As such, Wilson would not be surprised if the higher worker compensation series caught up to the labor shortage series as corporates are forced to raise wages in order to bring workers back.

The next chart reveals that companies intend to respond to higher costs by raising prices even further. It shows the Percent Planning to Raise Prices series from the NFIB Small Business Optimism Index. This indicator has surged higher and is now near historical highs!

Given the broad range of accelerating cost pressures, it is not surprising that corporates have been discussing rising expenses in recent weeks (see a select list of corporate commentary on this subject below). Expect a continuation of this trend through 1Q earnings season and well beyond.

Below is a list of companies focusing on surging costs:

- ULTA: Yes, we have wage pressure, just like all of retail has wage pressure, there’s a lot of things going on both out in the store portfolio, but also in our distribution centers as well. We feel like we’re in good shape on the DC side, the supply chain…

- FAST: Financial impact from increasing supply chain pressure and product cost inflation was modest in 1Q21, but challenges are rising. Our supply chain capabilities and the flexibility of our local businesses are limiting service issues,and we plan to take pricing actions in 2Q21.

- WDFC: Though the lower crude oil prices have been a net positive to gross margin in recent quarters, if the cost of crude remains at its current levels, we will most likely see pressure on gross margin in the future. We believe there will be increased pressure on gross margin in the second half of 2021, driven by the recent increase in the cost of oil as well as additional costs associated with the disruptions within our supply chain.

- SMG: Even with some of the cost pressures and an increase investments we’ve been talking about on our Q1 earnings call, this higher level of growth also means we’ll see EPS at a higher level as well.

- CAG: We will also leverage our capabilities beyond just pricing to offset margin pressure, including overall mix management, cost savings measures, such as our ongoing supply chain realized productivity programs,and the optimization of our fixed cost leverage. In short, we will continue to closely evaluate the impact of inflation on our business and are confident in our ability to utilize our entire tool kit to manage through this environment.

- RPM: Segment adjusted EBIT decreased 41.6% to $14.1 million from $24.2 million during last year’s third quarter.Lower sales volumes and pricing pressures resulted in earnings deleveraging, which was offset in part by discretionary cost cuts and MAP to Growth savings.

- LW: So in summary, in the third quarter, we delivered solid top line results as demand continued to gradually recover, but incremental costs related to pandemic related disruptions pressured earnings. We expect that the increasing availability of COVID vaccines and the easing of government imposed social restrictions will allow restaurant traffic to gradually improve as the year progresses. And we remain optimistic that overall frozen potato demand will approach pre-pandemic levels on a run rate basis by the end of calendar 2021.

- MU: some of this procurement of capacity does put some cost pressure in terms of our second half outlook as well and so, of course, for FQ3that’s baked into our guidance.

- LULU: Our Q1 guidance reflects pressure from airfreight costs due to port congestion and capacity constraints.

- MKC: We’re now projecting our 2021 adjusted gross profit margin to be comparable to 2020 due to increasing inflationary pressure mainly due to transportation costs, but our inflation expectation for the full year remains a low-single digit increase.

- KO: “Last quarter, we said that despite a rising commodity environment, we expected a relatively benign impact in 2021, given our hedged positions. While this continues to be the case, we’re closely monitoring upward pressure in some inputs such as high fructose corn syrup, PET, metals, and other packaging materials as they impact us as well as our bottling partners.”

Finally, yesterday morning consumer products giant Procter & Gamble said that this fall it will will start charging more for household staples from diapers to tampons, the latest and biggest consumer-products company to announce price hikes. The maker of Gillette razors and Tide detergent cited rising costs for raw materials, such as resin and pulp, and higher expenses to transport goods, the WSJ reported.

The announcement, which came as P&G disclosed its quarterly financial results, follows a similar move last month by rival Kimberly-Clark, maker of Huggies diapers and Scott paper products, which said its percentage increases would be in the mid- to high-single digits and take effect in late June. They will apply to the company’s baby- and child-care, adult-care and Scott bathroom tissue businesses.

P&G said organic sales grew 4% in the quarter ended March 31: rhe results marked P&G’s slowest overall organic sales increase since 2018, following a year in which the Covid-19 pandemic created high demand for products such as cleaning supplies, paper towels and toilet paper.

“It’s a different situation, as everywhere in the world countries are in very different places as far as coming out of the pandemic,” operating chief Jon Moeller said in an interview. “There is very strong consumption across the board.”

The last time big consumer-products companies raised prices significantly because of materials costs was 2018, when surging pulp prices drove up the cost of diapers, toilet paper and other products. Those prices were not reduced subsequently even after pulp prices dropped.

Several food makers have raised prices as well. Hormel Foods Corp. said in February that it raised prices on its turkey products, such as Jennie-O ground turkey, in response to higher grain costs. J.M. Smucker said it recently raised prices for its Jif peanut butter and that it might do the same with pet snacks because of higher shipping costs and other inflationary pressure.

In short, the inflation that the Fed is convinced is supply-driven and thus – transitory – is in fact, shifting to the demand side, as consumer are just buying more. And prices hikes by the likes of P&G suggest that inflation is here to stay for a long time for one simple reason: once companies raise prices they never lower them again.

Tyler Durden

Wed, 04/21/2021 – 15:36

via ZeroHedge News https://ift.tt/3gB4koa Tyler Durden