Investor Positioning Is Now At Record Highs

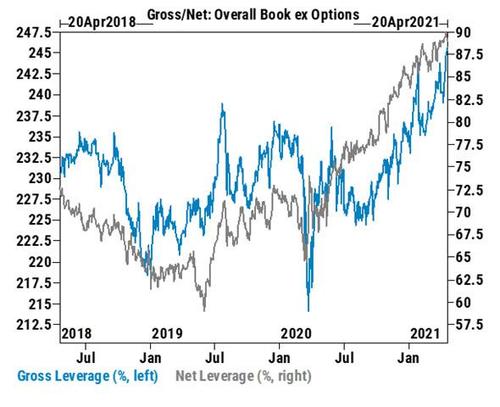

Earlier today we showed that hedge fund leverage – both gross and net – has hit record highs according to Goldman’s Prime Brokerage.

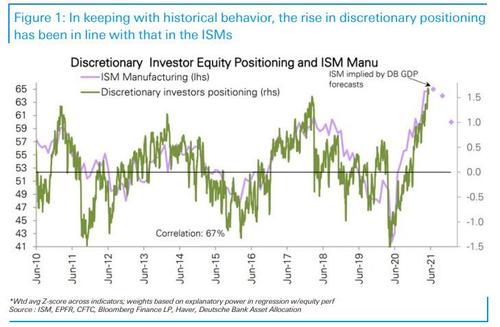

It’s not just hedge funds. As Deutsche Bank’s Jim Reid writes in his “Chart of the day” note from this morning, with European equity markets seeing their worst day of the year yesterday and the US market suffering saw noticeable declines across the board “it’s worth being aware that US discretionary equity positioning is now at a record high according to our Equity strategists.”

In other words, besides hedge funds going all in – and with record leverage to boot – both institutional, retail and HNW investors have also never been more bullish!

As Reid observes next, given the historical correlation to the ISM this is not a big surprise since this itself is at 37-year highs. And as DB’s quants logically suggest, “further positioning increases are likely only if growth accelerates further. In the short term, growth signals are still likely to be strong and will support the market but they do expect growth (ISMs) to peak over the next 3 months.“

This is in line with Deutsche’s recent warning, which we discussed one week ago, according to which the German bank expects a sharp correction over the next 2-3 months.

“So perhaps”, Reid muses, investors should expect another spurt higher in discretionary positioning, “but for this to be relatively short-lived and to be pared back following a peak in the ISMs.”

Tyler Durden

Wed, 04/21/2021 – 18:00

via ZeroHedge News https://ift.tt/3syZk64 Tyler Durden