Russia-Ukraine Tension: The Current Stand Off And Potential Impact

By Michael Every, Ryan Fitzmaurice, and Dennis Voznesenski of Rabobank (pdf link)

Attention: Russia-Ukraine Tension: The current stand off and its potential impact

Summary

-

The long-standing conflict between Russia and Ukraine has flared up again, with huge Russian military deployments at the border. Russia has also closed the Kerch Strait into the Sea of Azov until October to foreign military and foreign-state vessels.

-

The cost and logistics of massing this force means Russia must make an imminent choice between sabre-rattling to achieve a political target or a genuine military offensive

-

Russian President Putin’s speech to the Russian general assembly, and hence the nation, on Wednesday 21 April could consequently be one of extreme gravity

-

The sabre-rattling scenario would see Russia underline Ukrainian membership of NATO is a non-starter and that Ukrainian territories annexed to it will remain Russian

-

The war scenario ranges from limited Russian strikes to Russia annexing eastern Ukraine up to the Dnieper river and the Black Sea coast to Transnistria

-

Importantly, the US is unlikely to fight Russia, while the EU has no ability to. However, both may arm Ukraine to varying degrees

-

The US has already imposed fresh sanctions on Russia and any military move would see these escalated. However, so far they have had no impact on Moscow, and the most painful sanctions mean pain for the West too, and even risk fragmenting the global financial system

-

The impact on energy markets could be profound, depending on if there is fighting, the ultimate settlement, and in particular what happens to the Nord Stream 2 gas pipeline

-

The impact on commodity markets would also be significant given Ukraine and Russia’s role in the global agri production. Ironically, this underlines the extent to which global food producers have the realpolitik upper hand at present

-

Overall, this crisis has potentially huge implications for the ‘liberal world order’ and US-China tensions in particular, where even a benign scenario has long-run tail risks

2014 redux – or worse?

2021 has seen a rapid build-up of tensions between Ukraine and Russia, the latest episode in a conflict going back to 2014, and which has already seen Russia annex the Crimea region from Ukraine.

Both sides blame the other for this escalation, and the need for distraction by President Putin is obvious given anti-regime protests in 2021: but what is clear is that Russia has amassed a huge force on the Ukrainian border of over 100,000 men, a flotilla of amphibious ships, tanks, artillery, armoured personnel carriers, and hundreds of aircraft. This is now the largest mobilisation of the Russian military in the region since the Cold War, and perhaps since World War Two.

There are also reports that Russian allies Belorussia and Transnistria are seeing mobilization of forces, while Belorussian president Lukashenko –also subject to recent anti-regime protests– has claimed an assassination plot against him, heightening tensions further.

The US has already placed more sanctions on Russia (covered ahead), and both it and the EU have pledged support for Ukraine – albeit not military. President Biden has also called for de-escalation and requested a US-Russian summit in a third country, omitting Ukraine. This is already a Russian victory: but Moscow has not yet agreed.

In short, war is by no means certain, and there would be no element of surprise. Yet the logistics for an invasion appear in place. President Putin’s speech to the nation on April 21 could prove to be an historic one.

What next: “benign” scenario

Assuming President Putin is rational and looking at the risk-return of a potential conflict with Ukraine, the safe assumption may be that he would prefer not to go to war.

Wars are expensive: and while they can provide a political fillip, as they did to his popularity in 2014, this only happens if Russia wins easily. Russia clearly outmatches Ukraine militarily on all fronts, most especially in terms of critical air superiority, but Ukraine of today is still far better armed and prepared than it was back in 2014, and hence the potential risks of a protracted and/or painful conflict should be clear. On this basis we assume that President Putin is primarily interested in achieving a few political goals:

-

Testing the new US administration, which was always to be expected – and notably so far there has been no military response from either the US or the EU;

-

Making clear to the US and EU that Russia’s sphere of influence precludes Ukraine’s entry into NATO; and, potentially

-

An insistence that the Nord Stream 2 gas pipeline be completed, which Germany already wishes to, but which the US opposes – a pre-existing wedge Russia may try to drive between the two

On this basis, we could expect a de-escalation from President Putin’s address on Wednesday; agreement to a US-Russia summit, providing a global PR victory; a roll-back of Russian forces; and a de facto hiatus in Ukrainian and NATO entry. Even if existing US sanctions were not rolled back, this so far means little pain for Moscow.

In this case, however, there would still be important geopolitical and geostrategic implications. Above all, the US would have demonstrated that even despite: a planned troop drawdown from Afghanistan and Saudi Arabia; returning to the Iran nuclear deal regardless of Tehran’s current and previous breaches of its commitments; and retaining troops in Germany, the US appears to have no mind for a fight against Russia – while the EU has no mind and no arms to do so.

The signal sent to what the US dubs “revisionist powers” is the opposite of the wisdom of Vegetius: si vis bellum, para pacem. The long-term consequences could be terrible.

There is also the possibility that Wednesday could see President Putin absorb the disputed rebel portions of Ukraine in Donbas into Russia – and perhaps even a deeper political union with Belarus at the same time. The former would be seen as unacceptable by the West, and would arguably lead to a push for further sanctions – but presumably not military action.

What next: “war” scenario

But what if it is war? Perhaps not much if this means a series of small skirmishes. However, it seems illogical to move a large army into place if the only intention is to seize a few kilometres of land – particularly given Russia will know that even this strategically negligible action would carry the risk of large economic and geopolitical consequences, such as accelerating Ukraine’s entry into NATO.

Indeed, military thinkers posit that were Russia to commit to the military option, effectively burning its bridges with the West, it would need to attain a significant prize for doing so. Geostrategically, Russian nationalists and some military strategists suggest this could include annexing eastern Ukraine up to the Dnieper River; and all of the Black Sea coast through to Transnistria – in short the Novorossiya (New Russia) plan below.

Figure 1: The Russian-nationalist maximalist position

Such an invasion would bifurcate Ukraine and boost Russia’s strategic depth. Russia would have a ‘natural border’ at the Dnieper while Ukraine’s capital, Kiev, would be vulnerable; Russia could take control of the Motor Sich plant in Zaporizhzhia, which produces military engines for Russia’s military helicopters, yet which will no longer sell to it. Russia would take command of the Black Sea, land-locking Ukraine. Indeed, a rump Ukraine in NATO would be an expensive proposition for the West to defend, being effectively a finger of land surrounded by Russia and allies on three sides. This would unilaterally redraw the map of Europe by force, involve mass population transfers – and would have enormous geopolitical and market implications.

The EU would have to make painful choices. It could walk away from Nord Stream 2 and acquire more military muscle, or plead with the US for support: in short, a new Iron Curtain. Or it could acquiesce to Russian influence on its borders – and within its economy if it refuses to abandon Nord Stream 2.

The US would have to decide what steps it could take next following on from the sanctions that are already in place and given its reluctance to fight.

Sanctions

On March 2, the US imposed sanctions on seven Russian officials over the poisoning of opposition leader Navalny. It also expanded existing sanctions imposed in 2018 to include a policy of denial for exports of defence goods.

The US imposed further sanctions on April 15 in response to the SolarWinds hacking, the (disproven) Russian bounty on US soldiers allegation, and “attempts to interfere in the 2020 election”. The White House also issued an executive order barring US financial institutions from purchasing RUB-denominated bonds from June 2021. This shows the Biden administration continuing the Trump tactic of using the US financial system as a weapon.

Yet these sanctions are more sabre-rattling than attack: US entities are still able to buy and hold RUB bonds in the secondary market; and none of President Putin’s inner circle, or their USD assets, were targeted.

A Russian invasion of Ukraine would mean significantly tougher sanctions from the US and EU, with the US acting much faster due to its unitary executive power in this respect. However, history shows that when this is done, there is also pain to the West and the global economy.

In April 2018, the US sanctioned Russian aluminium producer Rusal to retaliate for its role in what the US Treasury stated as “worldwide malign activity.” This action saw a severe supply squeeze in aluminium, and a near-50% price spike that was only reversed when the US rolled back the Rusal sanctions in response.

Given the current surge in input prices across most commodities, any action against Russian energy, mineral, or food exports, would have a similar impact. Moreover, any potential sanctions on Rusal could also complicate the move to decarbonise the Western economy, as Rusal is currently the largest supplier of “green” aluminium, which is produced with renewable energy sources compared to the mostly coal-fired Chinese production.

There have even been suggestions that as a nuclear option, the US might consider pushing Russia out of the global SWIFT network for inter-bank transfers. This step was last taken against Iran – which is ironically about to be rolled back, if rumours are to be believed, to allow the US to focus more on the Indo-Pacific (i.e., China).

The failure of the toughest US sanctions to break Iranian resistance should be a warning that constant usage of such measures can actually undermine their impact. Indeed, with Russia being such a large exporter of key commodities, it seems hard to imagine that the US could act against it via SWIFT without sanctioning all those who buy from it too, especially China.

Moreover, in the event this kind of policy were seen, Russia might shift to selling in cryptocurrency, or even the new digital CNY (despite PBOC protestations to the contrary).

Neither seem practical near-term. However, they underline the extent to which the limits of US military power, already exposed in its unwillingness to fight a war over Ukraine, are also potentially starting to extend into the financial sphere – perhaps akin to the British experience of Suez in 1956 at the extreme.

Unless, that is, the US and EU target President Putin and Russian oligarchs: in which case bridges (and villas) would be burned; the more targeted a sanction, the more targeted its response in kind; Russia would perhaps irrevocably break away from the Western orbit, marking an even larger geostrategic challenge for the US; and, awkwardly, the Western public may start to question why sanctions with real teeth are not being used against Myanmar, or China, or Saudi Arabia.

Hence, if Russia were to invade or formally annex parts of Ukraine, the US and EU would only have financial weapons to respond that:

-

Wouldn’t have an impact; or

-

Would hurt themselves too; or

-

Would require a massive escalation that could rapidly make this a systemic issue; or

-

Require a true Iron Curtain between East and West, even for elite oligarchs.

Where some might find this reassuring (“so nothing can happen then!”), the opposite is true: arguably only an escalation to a painful or systemic level could send a powerful enough message that the liberal world order is prepared to act to prevent the use of war redrawing borders in the modern world – and yet we may well fail to see this happen.

A lot of energy

With Russia a critical global energy exporter, and Ukraine a conduit point en route to the EU, a war between the two would obviously push up energy prices – and so would the West sanctioning Russian energy supplies, were this to occur.

However, we do not expect to see a sharp reduction in global oil supplies but rather a re-routing of current import and export flows. Even so, any potential oil ban would come at a particularly troubling time given recent shipping attacks in the Middle East —ironically linked to regional perceptions of a likely US pull back from sanctions on Iran— as well as the global supply chains risks currently at play. As such, we see this scenario resulting in an elevated geopolitical risk-premium and higher transit costs for oil, and so higher energy prices overall.

Europe would likely feel the brunt of any action as they are much more dependent on Russian oil compared to the US. In fact, Russia is Europe’s biggest crude-oil supplier, with a nearly 30% market share of European imports. Russia has been able to maintain its dominant oil export position to Europe in large part due to the Druzhba pipeline, which stretches from the oil fields of Western Siberia all the way to Germany with various arteries along the way. This pipeline provides Russia with a lower cost of transport and, as such, a competitive advantage versus waterborne imports.

We see a similar outcome developing with natural-gas prices should the West sanction Russian energy supplies of these. As many are aware, natural gas exports are already a highly contested issue between Russia and the US, and specifically with respect to the Nord Stream 2 pipeline that is currently near completion. The massive 55bn cubic meter per year project is set to run from Western Russia to Germany via an underwater pipeline below the Baltic Sea. The US has aggressively pushed back on the development of this project, urging Europe to reduce its dependency on Russian natural gas rather than increase it.

As already alluded to, it would not surprise us to see further US pressure on Europe to cancel the completion efforts of the Nord Stream 2 pipeline, which would leave the Germany economy’s future energy needs unaddressed.

If the pipeline is ultimately halted, then Europe would be forced to import more waterborne LNG supplies, to the benefit of the US, which is a major supplier of the fuel, but at a much higher cost to the EU.

A lot of food

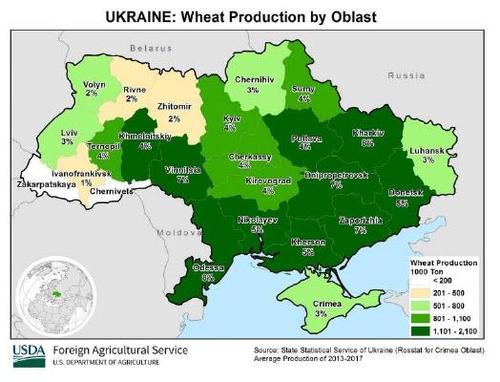

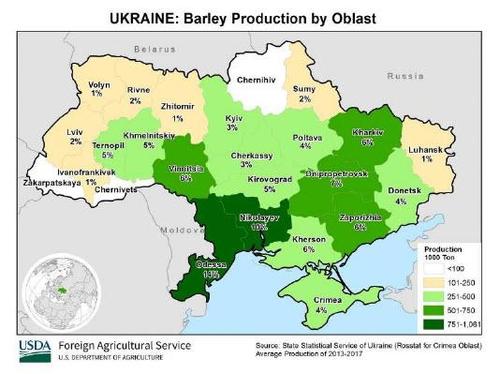

Russia and Ukraine are also crucial in global agri commodity supply chains. Although this is true in many areas, we want to focus on wheat and barley first.

Figure 2: “The bread basket”

Figure 3: “The beer basket”

As Figures 2 and 3 above show, assuming that a worst-case ‘Novorossiya’ scenario shown in Figure 1 were to occur, the areas of Ukraine that could see military disruption to activity or outright Russian seizure account for around half of Ukrainian wheat and barley production: and all of the key ports on both the Black Sea and the Sea of Azov from which they are shipped. That matters when Ukraine itself accounts for around 10% of global exports of wheat and 16% of barley – and when we are in a period of huge agri-commodity price inflation. (As flagged here, the risk was already of a major price spike if one of several conditions were met: war was not one we included.)

Any port in a price storm?

Even a far milder scenario where only the smaller Azov ports of Mariupol and Berdyansk are unusable –and recall the Kerch Strait leading to them are already closed to some vessels by Russia– we are talking about nearly 5% of Ukraine’s wheat production, or 1.9 million tonnes of production.

Of course, presuming other ports in Western Ukraine are available, the nearest is Ochakiv 480km away: then the back of an envelope maths suggests it would cost USD26.4 a tonne to move crops from Berdyansk to Ochakiv port by truck, and USD15.8/tonne to do so by train – all of which would have to be added to the sales price. A further list of ports and capacity lies below – all of which are on the pathway towards Odessa if the Russian military moves in that direction.

Over the past decade Ukraine has also emerged as the world’s fourth largest corn exporter, shipping 15% of the world’s exports. Additionally, for poultry meat Ukraine, while relatively minor in the global trade context, still ships 4% of world’s total out, albeit also partly via land routes rather than all by vessel – but these could again potentially be routes that are blocked.

In addition, fertilizers out of the broader region represent large global export shares, with 23% of world ammonia being shipped from Russia, 17% of potash, 14% of urea, and 10% of phosphates. However, most leave via Baltic, not Black, Sea ports.

In short, if real Russia-Ukraine war starts, wheat and barley prices are likely to shoot up, and the prices for other agri commodities like corn will follow; and at a time when many can least afford it.

What then of the potential for follow-on sanctions? Yet another hypothetical scenario to consider would be if ‘Novorossiya’ Ukrainian wheat, barley, corn or chicken de facto became Russian – and more so if Russia then deliberately mixed its own production in with them. Specifically, could the world afford to sanction Russian goods in this case?

Almost certainly not. We have already noted the risk of major price spikes in aluminum if the likes of Rusal are sanctioned. On agri commodities this also holds true. For example, stripping out Russia’s 45-50m tonnes of annual grains exports (some 20% of global wheat and 17% of barley) from the global market’s grains supply –at a time of pre-existing, rapid agri commodity inflation– would mean tremendous upward pressure on world market prices: and this would be incredibly disruptive to a large number of countries. Likewise, if Russia’s fish exports were sanctioned, this would also be felt by the imported livestock sector inputs like genetics or feed.

Liberal world disorder

On one hand this is good news: the world could not afford to boycott or sanction Russian agri goods, so trade can continue as normal. Isn’t that what markets like to hear?

Yet the downside is exactly that same message. What kind of signal does it send about our ‘liberal world order’ if a country could –hypothetically– be bifurcated and its output commandeered, but the world could not and would not sanction the aggressor’s behavior via trade because it needs the food too badly?

It implies the very rawest of geopolitical realpolitik would be back again, and yet basic food needs would remain more of a priority than principles.

That won’t go unnoticed by strategic planners at global net food exporters or, more so, net food importers: especially not when the US and China are at loggerheads, and the former is a major net food exporter, and the latter a major huge net importer – at a time of rising prices.

As such, while economic and market purists would look at the presumed continued smooth operations of global trade as a positive after the hypothetical dust in Russia-Ukraine settles, the underlying reality would be anything but: might would make right, which is a problem for those with none; and world prices would come before world liberalism or world order, which is a problem for almost everyone.

For many reasons, one can only hope that President Putin offers a road-map to rapid de-escalation on Wednesday.

Tyler Durden

Wed, 04/21/2021 – 14:10

via ZeroHedge News https://ift.tt/3atdwY5 Tyler Durden