Income Transfer Schemes: US Versus China – Which Country Is In The Worst Shape?

Authored by Mike Shedlock via MishTalk.com,

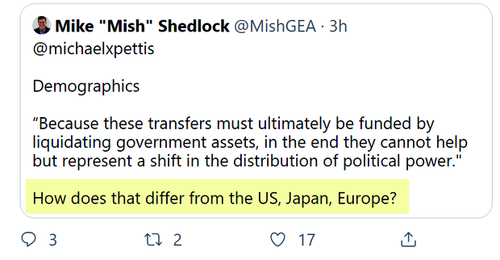

Governments take money from here and distributes it there. Michael Pettis discusses difference between China, the US, Japan and Europe in a series of Tweets.

China’s Aging Demographics

Consider the following series of Tweets by Michael Pettis at China Financial Markets.

-

China had great demographics between the 1970s and until about a few years ago, when the working share of the population surged from the mid-50s (below the global average) to the low 70s (well above the global average).

-

Now that the working share of the population is set to decline quite rapidly, mainly because of a surge in retirees, this should put upward pressure on household savings, in which case the extent of implicit and explicit income transfers to ordinary households needed to…

-

rebalance demand towards consumption must be even greater. Because these transfers must ultimately be funded by liquidating government assets, in the end they cannot help but represent a significant shift in the distribution of political power.

Demographics and Redistribution Question

Pettis Reply

-

The extent and direction of the transfers are different, Mish, so I’d argue that the political implications are likely to be different, but one way or another we should expect political changes. You can’t shift income without affecting the distribution of power.

-

The needed income transfers in the US and Europe are much lower than in China, and they mostly should involve transfers from the very rich to workers and the middle classes, rather than from government to households, as in China.

-

I think Japan is somewhere in the middle, and my understanding is that it is the elderly in Japan who retain a disproportionate share of income and who would ultimately have to absorb the costs of rebalancing income.

Tweet Threads

Population of China Has Peaked

This chain of Tweets and replies started with the South China Morning Post article China Facing Economic Crisis as Population Peak Nears

-

Consumption set to slump after population tops out in 2025, says Cai Fang, a member of the central bank’s monetary policy committee

-

Beijing must ‘increase labour participation and social security benefits’ for the elderly to shore up consumer demand, he says

-

If people of working age were faced with the additional financial burden of looking after an elderly relative while trying to raise a family it would make them more likely to save than consume.

Andrew Batson, director of China research at consultancy firm Gavekal made this comment: “The government is not preparing to raise revenue to finance a major expansion of the welfare state.”

What Will China Do?

If China sells assets to fund retirees, the immediate question is “what assets?”

State owned enterprises of questionable value because they need continual government support.

US treasuries perhaps? If not what? Or does China put things off until there is political upheaval?

I do not know what China will or won’t do. But the repercussions of China’s actions could profound.

Tyler Durden

Thu, 04/22/2021 – 20:25

via ZeroHedge News https://ift.tt/3avg5Ji Tyler Durden