“Our Bullish Conviction Is Now Lower”: JPM Joins Major Banks In Turning Bearish On “Easy” Market Gains

On Tuesday, JPM chief global markets strategist and Wall Street’s biggest bull, Marko Kolanovic, said in a note on Tuesday that the recent pullback in areas like cyclical stocks and Treasury yields will soon prove to be temporary, and that in his view, “the reflation and reopening trade will resume, with yields moving higher and rotation from growth, quality and defensives to value and cyclicals. Beneficiaries will include Energy, Financials, Materials, Industrials, small caps, high beta stocks, and various reopening and inflation themes.”

Kolanovic also said that these developments “are not priced in, as we can see a strong reaction on incremental news flow related to reopening and COVID-19” and that it is likely that the move “will accelerate as we go into late spring and summer with reopening of economies.”

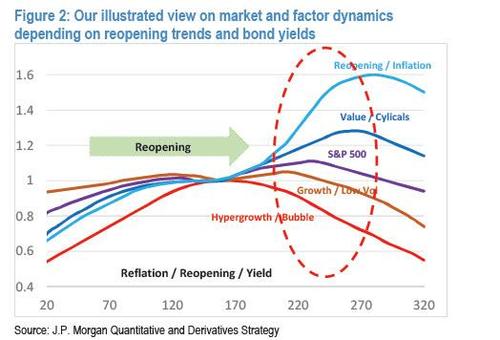

To illustrate his point, Kolanovic then showed the following chart where on the horizontal axis he showed bond yields as a proxy measure of reflation/reopening and on the vertical axis the performance of various equity market segments, writing that “as the COVID-19 recovery takes place, reopening, reflation and inflation themes, and value likely will significantly outperform growth and defensives. Note that factor volatility increases (relative to market volatility) with rising yields and declining market volatility.”

Late on Thursday, Kolanovic appeared on CNBC to bring his message to the masses in a 6 minute hit whose message can best be summarized with Kolanovic saying that “It’s time to buy the dip.”

JPMorgan’s Marko Kolanovic on how President Biden’s reported proposal to raise the capital gains tax could affect the markets pic.twitter.com/nXrRzDhGly

— CNBC’s Fast Money (@CNBCFastMoney) April 22, 2021

Alas, all of Marko’s fancy chartwork and the CNBC pitch were for nothing, because just one day after Kolanovic urged CNBC’s viewers to rush and buy the “dip” – which we assume is what JPM staffers call the S&P trading 1% below its all time high – one of Marko’s Croatian JPM colleagues, Dubravko Lakos-Bujas, joined the bearish bandwagon we described previously and which now includes such bank as Morgan Stanley, Goldman and Deutsche Bank, when following yesterday’s market puke on Biden’s capital gains tax news from Bloomberg (which as we said wasn’t new at all but a rehash of information that was publicly available since last fall), the other JPM strategist said that after “aggressively pushing the upside case for equities” for the last 12 months, and arguing “for a continued melt-up with S&P 500 reaching 4,000 in 1Q and the majority of the upside to our year-end PT of 4,400 being realized during 1H”, the JPM chief equity strategist – which reportedly puts him higher in the JPM chain of command that Kolanovic – said that “easy equity gains for the broad market are likely behind us” and as a result JPMorgan’s “bullish conviction is now lower.”

But why the sudden reversal, and just hours after Marko Kolanovic was out there urging everyone to do the opposite and just BTFD? It turns out, the catalyst for JPM’s newly found skepticism is the the same reason for Marko’s endless optimism – higher yields.

Here is Lakos-Bujas:

As the second phase of global reopening gets confirmed by a pickup in mobility and pent-up demand, we expect yields to retrace higher thereby constraining the equity multiple with S&P 500 entering a period of consolidation. On March 8th, we argued the risk-reward for the Growth trade had tactically improved after the February Momentum crash and Growth derisking. Since then Growth has strongly outperformed, but mainly defensive/bond-proxy Growth, making this segment again vulnerable to rates.

But… wait a minute. Just on Tuesday Kolanovic said that higher rates – or rather yields, which of course is the same – is a bullish thing, to wit:

Our view is that the reflation and reopening trade will resume, with yields moving higher and rotation from growth, quality and defensives to value and cyclicals. Beneficiaries will include Energy, Financials, Materials, Industrials, small caps, high beta stocks, and various reopening and inflation themes.

So to summarize, higher yields, er rates, are both bullish and bearish? Apparently at JPmorgan, the answer is yes, and the above is just another great example of how Wall Street goalseeks each and every datapoint to its own advantage.

In any case, after JPMorganwas euphorically bullish through Thursday night and urging everyone to buy the 1% dip in the S&P from all time highs because higher yields, on Friday everything changed, and JPMorgan now expects the equity multiple of the S&P 500 to be constrained, push the market to a ‘”priod of consolidation” because – you guessed it – higher yields.

To be sure there is more, with JPM suddenly also concerned about “further out” catalysts such as monetary policy normalization (i.e. tapering) and higher corporate taxes “both of which have emerged as the largest risks for equities” but none of these are actual news to either JPM of the bank’s clients, as it was JPMorgan which first flagged both Fed tapering and higher taxes as a risk months ago, so how the bank suddenly decided that these well-known triggers are now, a reason to worry about stocks, remains a mystery.

Clearly one can just stop reading here, since what will follow is just more noise and no signal – actually, we take that back as we explain at the end of this post – but for those who are curious how JPM goalseeks higher yields first as super bullish and then as a reason to no longer expect “easy equity gains”, read on for the key excerpts from Dubravko’s report:

Higher yields should drive another rotation back into reopening and epicenter plays from yield-sensitive low-vol stocks. In particular, we would again highlight Consumer Recovery plays, Energy, Financials, non-US (e.g. EM) and SMid stocks. Investors will need to be more selective in the second phase of global reopening as some stocks (e.g. airlines) appear rich while others still have strong upside (e.g. retail, oil producers, banks, consumer tech). We recommend investors take this opportunity to revisit our COVID-19 recovery themes, and in particular the International Recovery Basket, which has not only lagged the Domestic Recovery Basket but has reversed most of its relative gains YTD.

Looking further out, we see monetary policy normalization (i.e. indication of tapering) and higher corporate taxes as the largest risks for equities. There is also a potential risk from higher capital gains tax if we get indication that it will materialize and go into effect starting next year (vs. retroactive to 2021) causing certain investors to take profits early. However, this proposal would be contentious and likely to face significant opposition.

With respect to corporate taxes, S&P 500 companies are now better positioned to absorb a potential tax increase given: (1) robust economic and earnings recovery; (2) elevated corporate cash balance of $2.1T ex-financials (up 28% vs. 4Q19); (3) partial offset from large NOL balance of ~$290B; and (4) the spending component of the plan should boost aggregate demand.

Obviously, there are significant unknowns including time, scope, and probability of any successful legislation. Since it is much easier to spend than increase taxes in DC, some are even suggesting little or nothing will get done. Regardless, this will remain a topic for investors for some time.

While there is a bunch more in the full report, including some assumptions and pretty charts on the implication of Biden’s American Jobs Plan and Made in America Tax Plan on S&P 500 earnings, the key message is simple:

While we think the equity and business cycles should remain intact on global reopening and strong earnings recovery, easy equity gains for the broad market are likely behind us. Our bullish conviction is now lower. As the second phase of global reopening gets confirmed by a pickup in mobility and pent-up demand, we expect yields to retrace higher thereby constraining the equity multiple with S&P 500 entering a period of consolidation.

Which probably means no more bullish hits for Kolanovic on CNBC for at least a few weeks, when the S&P will either break out above 4,400 forcing JPM to once again turn ravingly bullish, or stocks indeed fall. Which, however, we find unlikely for one simple reason: as we said first thing this morning when we read JPM’s report, “JPM has joined the bearish bandwagon, there is no big bank that is bullish on stocks in the mid-term.” The implication is simple: stocks will go up…

Now that JPM has joined the bearish bandwagon, there is no big bank that is bullish on stocks in the mid-term. You know what that means.

— zerohedge (@zerohedge) April 23, 2021

… and sure enough, the S&P is on pace to close at a new all time high.

Tyler Durden

Fri, 04/23/2021 – 14:30

via ZeroHedge News https://ift.tt/3xkpD3v Tyler Durden