Stocks & Bonds Shrug Off Biden Battering, Dollar & Cryptos Tumble

Today’s sudden panic-bid at the US cash open, dragged stocks back to unchanged-ish on the week (Small Caps outperformed, ending up around 1% on the week after being down 4% by Tuesday close)…

Recovering all of yesterday’s Biden Tax Plan losses, until the late-day tumble…

So, aside from paying away over 50% of your capital gains to fund gawd-knows-what social justice agenda, on the week, you get nothing too… and like it…

Nasdaq’s trading patterns this week were somewhat comical…

Healthcare stocks outperformed on the week as Energy stocks lagged…

Source: Bloomberg

Growth and Value stocks were unable to distinguish themselves this week, ramping back to unch today…

Source: Bloomberg

Treasuries ended the week practically unchanged after roundtripping up and down around 4bps either way on the week…

Source: Bloomberg

10Y has traded in a very tight range the last three days…

Source: Bloomberg

The dollar dived again this week – to its lowest since Feb – and we note an interesting pattern at the EU open where the dollar was dumped every day… This was the 3rd weekly drop in a row, the longest such losing streak since December

Source: Bloomberg

The Turkish Lira tumbled back near record lows after Biden announced he would call Armenian massacre a genocide…

Source: Bloomberg

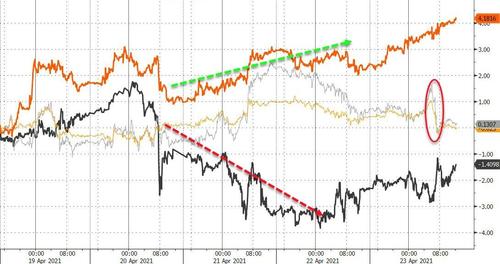

Cryptos were down for the second week in a row with Ripple worst and Ethereum the bad horse in the glue factory…

Source: Bloomberg

Bitcoin broke back below $50k and made all the headlines but we note that this is the 4th such plunge the leading cryptocurrency has suffered in the last 8 months and each previous one has seen dip-buyers move in rapidly…

Source: Bloomberg

But by the end of the day, bitcoin was back above $50k…

Source: Bloomberg

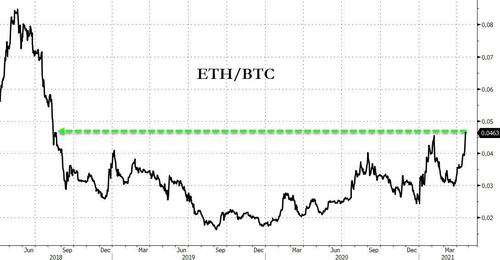

Ether outperformed on the week, reaching a new record high before today’s tumble, but relative to bitcoin, it’s at its highest since Auguest 2018…

Source: Bloomberg

Crude was down on the week as copper rebounded, with PMs flat, after taking a hit today…

Gold futures failed to top $1800…

WTI ended the week on a higher note but down overall, closing around $62…

Finally, after this morning’s surge in PMIs, it is now clear that once again the world is awash in “hope” as ‘soft’ survey data is dramatically decoupling from ‘hard’ real economic data…

Source: Bloomberg

Tyler Durden

Fri, 04/23/2021 – 16:00

via ZeroHedge News https://ift.tt/3tIiyYe Tyler Durden