The Worrisome 1999 Vibe To Markets

For equity markets, the parallels between current conditions and those of 1999 are striking and worrisome.

The investor mood in markets has been in ebullient territory since last November, when high-efficacy vaccine news lifted spirits as a budding light at the end of the tragic pandemic tunnel.

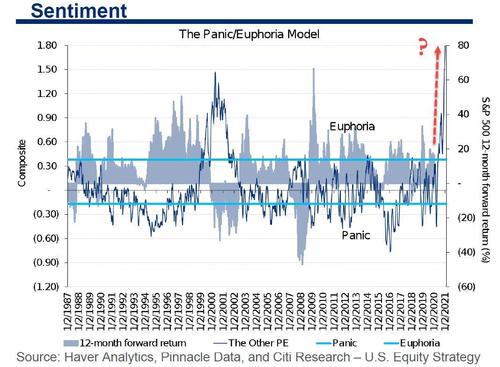

That is the signal from Citigroup’s gauge of investor sentiment – the Panic/Euphoria Model – which takes into account factors including the amount of investor positions anticipating a fall in stocks, the level of funds borrowed to purchase securities and commodity price futures.

The last time we saw such an upbeat zeitgeist that did not coincide with an immediate equity market correction was in 1999 when the dotcom bubble was in full bloom.

Typically in the past, when our gauge is at such high levels, it would indicate a 100 per cent probability of lower share prices over the next 12 months. This is despite the current powerful US economic growth expectations buoyed by fiscal stimulus and business reopening.

The notion that “this time is different” can be noted in various institutional client conversations. A pliant US Federal Reserve, massive consumer savings, substantial free cash flow generation, powerful government spending, money on the sidelines with negative real bond yields are the fodder that allegedly can sustain the rally even after a gain of nearly 90 per cent from 2020 lows.

A significant and recent recovery of equity inflows also is boosting shares due to ‘fomo’ (fear of missing out) for professional asset allocators: ‘fomu” (fear of meaningfully underperforming). As such there is an element of trend-following, or “chasing the tape”.

Yet, the US household sector’s ownership of equities as a per cent of their financial assets is hovering at 50-year highs and, as a result, it is difficult to argue that Americans are underinvested.

Additionally, our late-March poll of money managers showed median cash as a proportion of assets under management had dipped to 3.5 per cent from 10.0 per cent a year earlier, and is below the historical average of 5.0 per cent. Thus, it appears that most investors are all in already.

While bottom-up consensus estimates are calling for 20 per cent earnings growth for the S&P 500 companies to $174 per share this year, many think upside surprises are likely given predicted rapid GDP growth and cost efficiency initiatives undertaken by management teams during Covid-related shutdowns. Furthermore, we believe that stocks are baking in growth of around 30 per cent to something closer to $190 per share, leaving little room for disappointment.

Our “lead margin indicator” on profitability — based on surveys by trade group NFIB on the ability to raise prices relative to rising input costs — implies that there could be trouble ahead.

Additionally, the feeling is palpable that every development is being treated as good news even though higher corporate taxes could bite into the earnings expansion thesis.

While determining the catalyst for changes in market direction and timing them can prove tricky, vulnerabilities exist and therefore chasing the rally does not appear to be prudent now.

Investors will also need to take into account the rotation away from so-called growth companies towards more undervalued stocks. Secular growth companies account for as much as 55 per cent of the market capitalisation of the S&P 500 index while value stocks in the cyclical and financial sectors comprise less than 30 per cent. Hence, the overall index could slip some (up to 10 per cent) because of the weight differential, but stock pickers still do well. Note that in the first quarter this year, almost 33 per cent of the S&P 500 constituents beat the market by more than 10 per cent, suggesting it is not just a few names that can make or break a portfolio. Moreover, in the fourth quarter of last year, 37 per cent did the same. In this context, it is less about the index and more about the stocks within it.

Given this less-than-compelling backdrop, we contend that one may be best off looking at companies that have pricing power (to offset labour or input expense escalation) as well as those names that have strong balance sheets and offer better than average dividend yields.

There is also a procyclical bias to our investing approach. We particularly favour areas encompassing capital goods, financials and leisure. In the latter, explosive demand should evolve as inoculations allow people to move about more freely and indulge in the activities they have sorely missed.

Tyler Durden

Fri, 04/23/2021 – 16:20

via ZeroHedge News https://ift.tt/3exTmNY Tyler Durden