Crypto Investors Are Spending Millions Buying NFTs On Virtual Real Estate

With the invention of non-fungible tokens during the midst of an insane real estate boom fueled by the Fed’s ongoing coke-bender of a stimulus package, it was only natural that crypto “investors” would start buying up virtual real estate.

In the virtual world, now being called the “metaverse”, people aren’t just spending $69 million for digital art, like Vignesh Sundaresan recently did. They are also spending on “land, buildings, avatars and even names” as NFTs, Reuters reported.

Sundaresan counts himself among the world’s biggest NFT investors, amassing a $189 million fund of NFTs and digital assets.

Anand Venkateswaran, aka Twobadour, who runs the Metapurse fund, said: “The current Cambrian explosion of NFTs that you see is all about acquisition – people want to buy up NFTs, gobble as many of them as they can. But it’s just the tip of the iceberg. The real explosion will happen when they’re able to … experience these NFTs as they were intended. If it’s a plot of virtual land, you ought to move around in it, have an immersive experience in it.”

Corporations are starting to join the party, as well. For example, Atari said it’s going to be launching its own blockchain-based virtual world. Frederic Chesnais, head of Atari’s blockchain division and the company’s former CEO, told Reuters online environments would be “very very big”. NFT real estate could fetch millions eventually, he said.

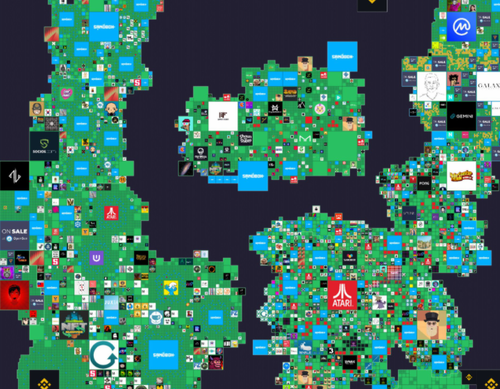

The most well known blockchain-based environments are Decentraland, Cryptovoxels, Somnium Space and The Sandbox. Decentraland sports $50 million in total sales, and has sold patches of “land” for as much as $572,000 and $283,567. There were 334 buyers in March in Decentraland and monthly sales volumes blew past $4 million, up from $767,000 in February.

The “rush” is being compared to the early days of snapping up domain names.

Another NFT investor named “Whale Shark” has a portfolio of more than $20 million in “assets”. The $60,000 he shelled out for real estate in “The Sandbox” is now worth about $400,000. Meanwhile, Decentraland’s MANA currency has itself risen more than 3500% over the last year.

Twobadour said: “All of virtual land and these virtual spaces are basically real estate on which experiences will start to centre, on which attention will start to focus. That’s where all of the attention is and that’s monetisable in a million different ways.”

But it isn’t all optimism. Ben Nolan, founder of the virtual world Cryptovoxels, said: “I expect that there’ll be a crypto winter in the next couple of months, the whole NFT boom will explode and then all the value will absolutely collapse. Doing NFTs as an investment or as a way to make money is really ill-advised.”

“Do I think most people will use virtual worlds? Probably not, but I think a lot of people will and I think NFTs are a big part of that growth. Actually walking around with another person in a virtual space and looking at art together is a really nice way to spend time.”

Tyler Durden

Fri, 04/23/2021 – 22:40

via ZeroHedge News https://ift.tt/3evVdmj Tyler Durden