What Higher Corporate Taxes Mean For The Market: A Surprising Observation

Earlier this month, Joe Biden unveiled his Made in America Tax Plan, which proposes an increase in the US corporate tax rate to 28% from 21% which was followed by a Bloomberg report that the capital gains tax would be hiked to 39%. And while the tax plan and all of its details are unlikely to pass through Congress in its current form, the prospect of higher corporate taxes has immediately translated into angst among investors based on numerous client conversations (such as those of Goldman), despite historical market data indicating that changes to the corporate tax code should not be feared. In fact, a recent report from BMO’s Brian Belski shows that calendar years in which tax hikes went into effect have historically coincided with double-digit S&P 500 price returns and stronger US GDP growth, on average.

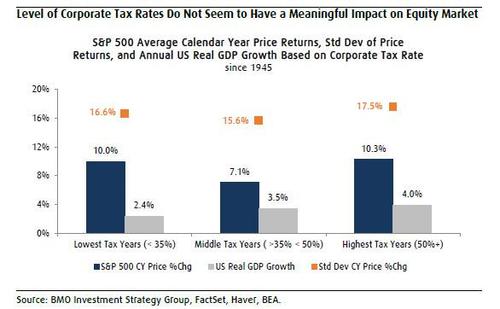

Belski also we found that the level of corporate tax rates does not seem to have a meaningful long-term impact on broader market performance as companies have been able to generate solid price returns and healthy earnings growth under various tax regimes throughout history.

And while an increase in corporate taxes will inevitably lead to a reduction in 2022 S&P 500 bottom-up EPS, with Goldman estimating that the Biden tax plan will cut 2022 EPS by 9%, all things equal…

… Belski argues that other factors are also at play that could potentially offset some of this earnings hit such as economic stimulus, infrastructure spending, and improving overall fundamentals for US stocks.

Below we summarize the main points from the BMO report:

Tax Increases Have Been Far From Detrimental to US Stock Market Performance

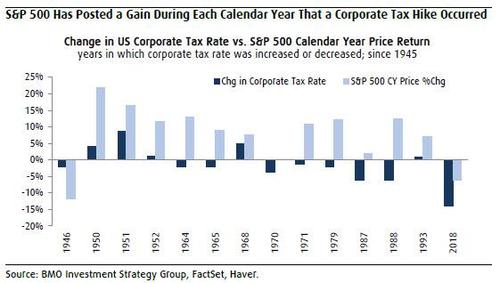

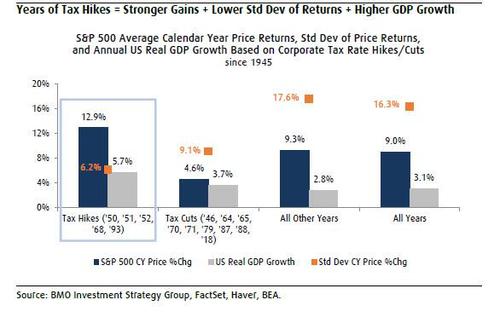

- According to BMO, during the five prior corporate tax rate increases, the S&P 500 posted an average calendar year gain of 12.9% with positive price returns in each instance

Companies Can Generate Solid Price Returns and Earnings Growth Under Various Tax Regimes

- Over past decades, tax environments appeared to have little long-term effect on broader market price returns and corporate profit growth

Investing Solely Based on Tax Rate Levels Is Not a Worthwhile Strategy

- Changes in tax policy can impact short-term performance trends in companies with the highest and lowest tax-rates, but these effects tend not to persist over time

Estimating the Impact of a 28% Corporate Tax Rate on S&P 500 EPS

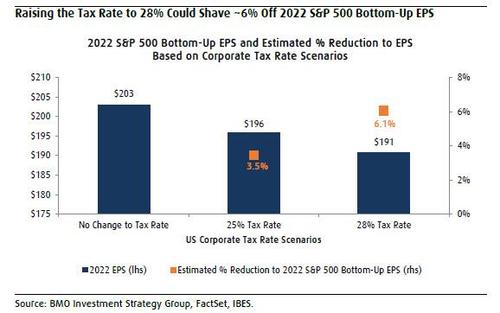

- BMO’s analysis shows that a corporate tax rate hike to 28% could shave 6.1% off 2022 S&P 500 bottom-up EPS – slightly below the 9% Goldman estimate, while an increase to 25% could reduce earnings by 3.5%

Some more details:

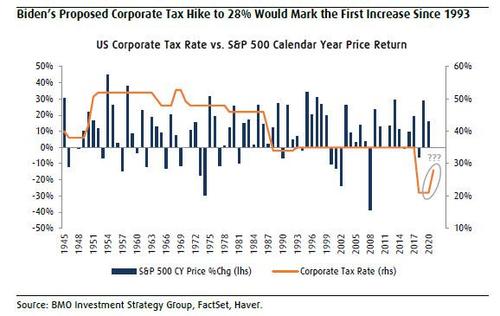

Biden’s proposal to raise the US corporate tax rate to 28%, from 21%, would mark the first increase since 1993 and sixth tax hike since 1945.

There is still a ways to go before the proposed tax hike by the Biden administration gets enacted and the finalized details of the legislation emerge. Nonetheless, the prospect of higher taxes tends to immediately translate into angst among investors – especially when coupled with fears about an imminent capital gains tax hike – despite historical market performance data indicating that changes to the corporate tax code should not be feared.

During the five prior corporate tax rate increases in 1950, 1951, 1952, 1968, and 1993, the S&P 500 index posted an average calendar year gain of 12.9% with positive price returns in each instance. This gain was well above the 4.6% average return registered during the nine annual periods when the tax rate was reduced and also higher than 9% price return for all calendar years going back to 1945. The standard deviation of price returns has also been substantially lower during these tax hike periods.

Increases in corporate tax rates have also coincided with stronger US economic growth as real GDP grew at a 5.7% average clip during annual tax hike periods vs. a 3.7% rate during tax cut periods and a 3.1% average growth clip in all years since 1945.

As BMO notes, from its perspective “this is not a matter of tax policy helping or hindering US equity gains, but instead more likely to do with the level of economic growth during these periods.”

* * *

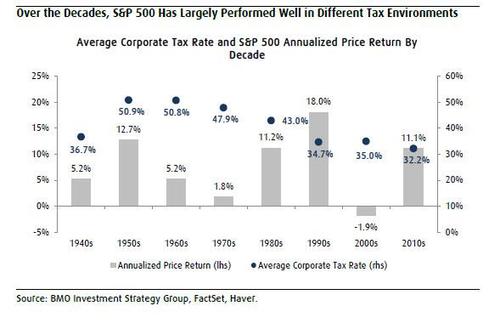

Along with looking at S&P 500 performance during years in which tax policy changes occurred, BMO also examined annual price returns based on the general level of corporate tax rates. Despite common perceptions to the contrary, the bank’s work shows that there is little evidence to suggest that corporate tax rates have any type of meaningful impact on US equity market returns.

For instance, going back to 1945, the S&P 500 has averaged a 10% gain during years in which the US corporate tax rate was below 35% compared to the 10.3% gain posted during years when the tax rate was 50% or higher. Keep in mind that the proposed 28% corporate tax rate would still rank among the lowest in US history after those seen in 2018-20.

Over the decades, US stocks have predominantly performed well regardless of the underlying tax regime in place.

The S&P 500 logged some of its best gains in the 1950s despite tax rates rising to >50%, and then posted subpar annualized returns in the 1970s even as tax rates decreased. During the 1980s and 1990s, US stocks did see solid gains while tax rates were lower, but then registered losses in the 2000s while taxes remained at 35% as the tech-bubble and financial crisis drove down stock prices. Simply stated, there are many other factors at play. According to BMO’s Belski, “it is not corporate tax rates that are dictating market performance.”

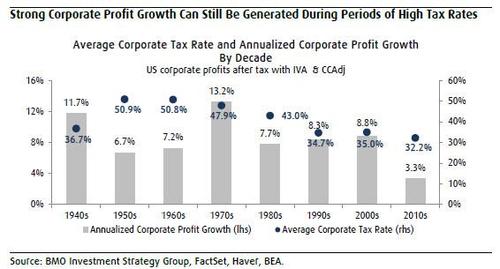

A similar story exists on the earnings front. Over past decades, US companies have been able to generate substantial earnings growth in different tax environments, including periods of high corporate tax rates.

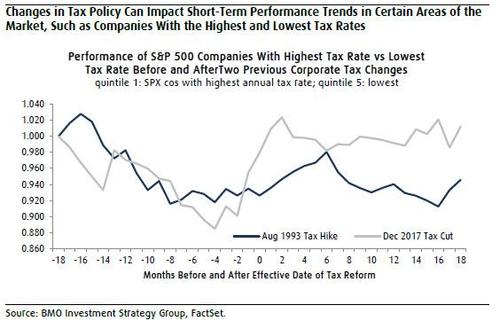

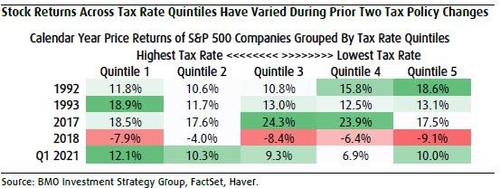

To further evaluate the impact of corporate tax reform on US stock returns, BMO grouped S&P 500 companies into quintiles based on their year-end effective tax rates (Q1= highest tax rates; Q5= lowest tax rates), and examined performance during the two previous major tax legislation changes in 2018 (tax cut) and 1993 (tax hike).

Leading up to the Trump tax cut in December 2017, the S&P 500 companies with the highest tax rates (considered tax reform beneficiaries), largely lagged their lowest tax rate counterparts until a short spell of outperformance occurred three months prior to the legislation being signed into law through two months after, which then eventually faded. Looking at calendar year price returns, companies in quintile 1 indeed outpaced those in quintile 5 in both 2017 and 2018.

However, the highest tax rate group was not the best performing quintile in either year as quintile 3 topped returns in 2017 while quintile 2 led the way in 2018.

The highest tax rate stocks also largely trailed the lowest tax rate stocks leading up to the Clinton tax hike in August 1993, which was then followed by bouts of outperformance and underperformance for quintile 1 vs. quintile 5. On a calendar year basis, the lowest tax rate group was the second best performer (13.1%) after quintile 1 (18.9%) in 1993, despite the tax increase, while quintile 2 (11.7%) was the biggest laggard. In 1992, the lowest tax rate names topped performance, outpacing quintile 1 by almost seven pct. pts with quintiles 2 & 3 the biggest laggards.

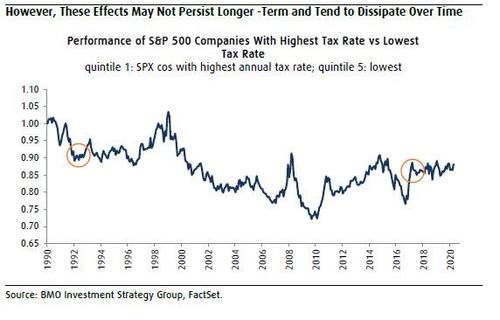

What is the takeaway here?

While changes in tax policy may very well impact short-term performance trends in certain areas of the market, the direction and magnitude of these impacts are not necessarily consistent, and tend to dissipate as time goes on. As such, BMO is not advise its clients and investor in general to use tax rates as a standalone factor in predicting longer-term forward returns, and instead should focus on fundamentals and the economy.

* * *

Finally, looking specifically at the potential impact of the Biden corporate tax proposal, which would raise the corporate income tax rate to 28% from 21%, impose a new minimum tax on US companies, and increase taxes on foreign income of many US-based multinationals, BMO’s analysis on the impact on S&P 500 earnings focuses on the headline corporate tax rate and the estimated reduction to bottom-up EPS given a 28% rate and a potential compromised rate of 25%.

- Looking at 2022 EPS forecasts for S&P 500 companies, bottom-up EPS for the index currently stands at $203. An increase in the tax rate to 25% could shave 3.5% off earnings, based on BMO’s work, lowering 2022 bottom-up EPS for the S&P 500 to $196.

- A corporate tax hike to the proposed 28% rate could reduce earnings by 6.1%, slashing 2022 bottom-up EPS for the S&P 500 down to $191.

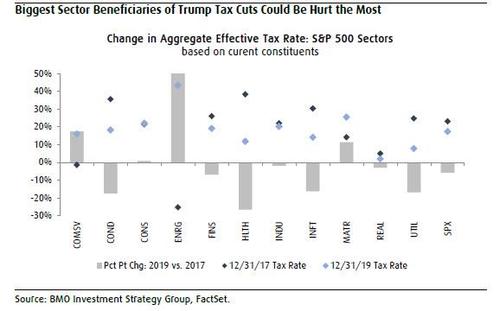

If the proposed 28% corporate tax rate were to get enacted, it would reverse half of the tax cuts imposed by Trump back in 2017-18, with the effects not necessarily being felt evenly across sectors.

S&P 500 sectors that were the biggest beneficiaries of the tax reform bill put forth by Trump and exhibited significant reductions to their overall tax rates, such as Health Care, Consumer Discretionary, and Technology, could be hurt the most. These sectors were identified by examining the change in the aggregate effective tax rates for all 11 S&P 500 groups for the end of 2017 (pre Tax Cuts and Jobs Act of 2017) vs. the end of 2019 (post Tax Cuts and Jobs Act of 2017).

It is important to keep in mind that any increase in taxes and reduction to EPS for US companies could also be offset to some degree by resulting positive factors of higher taxes, such as infrastructure spending and economic stimulus.

Tyler Durden

Sat, 04/24/2021 – 17:50

via ZeroHedge News https://ift.tt/3erWU41 Tyler Durden