Why Interest Rate Management Fails

Authored by Alasdair Macleod via GoldMoney.com,

This article explains why attempting to achieve economic outcomes by managing interest rates fails. The basis of monetary interventionist theories ignores the discoveries of earlier free-market thinkers, particularly Say, Turgot and Böhm-Bawerk.

It also ignores Gibson’s paradox, which demolishes the theory that managing interest rates controls price inflation. And incredulously, the whole basis of banking regulation assumes that commercial banks are just intermediaries between depositors and borrowers. That model of banking fails to address the simple fact that banks create credit out of thin air and that deposits are the property of the banks, and not their customers.

The process of credit creation is described herein and is markedly different from that commonly assumed. Changes in the level of outstanding bank credit have nothing to do with interest rates, except perhaps in extremis.

It is hardly surprising, therefore, that critical mistakes are being made by policy planners. And we find that the US bank cohort is now reducing outstanding bank credit for the non-financial economy, which will make it impossible for businesses to deliver sufficient product to satisfy expected consumer demand. Far higher consumer prices than currently discounted in financial markets will follow.

Consequently, bond yields are set to rise much further, marking the end of the global financial asset bubble, and the failure of the fiat currency regime.

Introduction

It must be a mystery to central bankers that reducing interest rates to the zero bound hasn’t stimulated their economies as expected. It is also a surprise to the vast majority of economists and financial commentators. Part of the problem is the modern habit of taking government statistics as Gospel, another part is not understanding what individual statistics truly represent, and finally there are the fault lines in neo-Keynesian macroeconomics. And at the root of it is the cost of production theory of prices.

For the establishment, interest is a cost, which along with other costs plus a margin for profits is the basis of setting consumer prices. Reduce the cost, it is argued, and with prices targeted to increase at two per cent annually, there is a strong incentive for businesses to invest in production. We see the cost theory of prices reflected in government regulations and government spending as well, which forces everyone into paying monopoly prices — regulated, of course, to stop profiteering.

The error has a long history, starting with Adam Smith and continuing with Marx where it took a more distinct form in his cost of labour theory of prices. But there were early dissenters, such as the French economist Jean-Baptiste Say (1767-1832), who about prices wrote, “subject to the influence of the faculties, the wants and the desires of mankind, they are not susceptible of any rigorous appreciation, and cannot, therefore, furnish any data for absolute calculations”. In other words, the idea that prices are simply a matter of a cost-plus basis is wrong. With respect to interest, it was another early French economist, Turgot (1727-1781), who gave the relationship with capital its proper context. He understood that the capitalist-entrepreneur required capital to finance production; to pay wages and other costs before anything could be sold. It was capital that had to be accumulated from savings for which a return must be paid in the form of interest.

Turgot was the first economist from the time of the early industrial revolution to explain the role of capital and why providers of capital had the right to expect to be compensated for their temporary parting with it. Interest rates were a matter for negotiation between lender and borrower. The interest “profit” was no different from profits from other activities, and the rate included factors such as the risk that the money would not be returned, and the loss of its possession for a period of time. Turgot anticipated the Austrian school and in particular the work of Böhm-Bawerk (1851-1914) on time preference.

These findings were passed over by later economists, particularly Keynes. In the process, Keynes noted and named Gibson’s paradox, which demonstrated a strong positive correlation between price levels and long-term interest rates, and not between interest rate borrowing costs and the rate of price inflation, as commonly supposed. Keynes declared it to be “one of the most completely established empirical facts in the whole field of quantitative economics” before he succumbed to his macroeconomic visions which denied its existence.

The history of borrowing for industrial production

All capitalist ventures require the assembly of raw materials, plant and equipment, premises, labour skilled and unskilled, additional services and monetary capital. Arguably, the most important of all these is monetary capital, because the time taken between assembling these factors and the sale of a final product requires funding. A businessman or entrepreneur must calculate all the costs, the length of the period of the absence of any income and make assumptions about the volumes and prices of the final product he can expect to achieve.

These factors are all interrelated and require estimation. What initially concerns us are the assumptions an entrepreneur makes about the value of the final product. For him it all hangs on his estimates of final sales and the prices he can expect to obtain. When he has estimated them and calculated his costs, he will know how profitable the venture should be, and only then can he estimate what he is prepared to pay in interest to obtain the capital to fund the project. To calculate margins any other way is to put the cart before the horse.

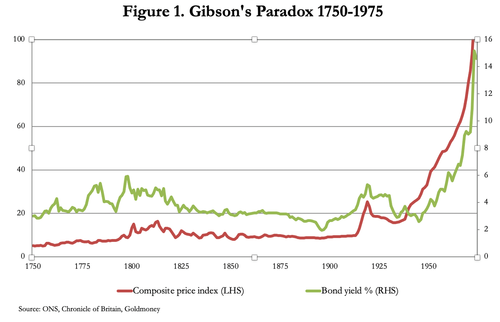

The basis of business calculation must therefore reflect a basic correlation between prices and the cost of business funding, and Figure 1 illustrates this correlation in the UK over a 250-year period.

Even in the 1970s, when money was fully fiat and the trend of prices was rising more than at any time since 1750, the relationship held. In a business recession, when the level of business activity declines, an entrepreneur uses the same factors in his calculations as in better times, so business cycles are irrelevant to the process. And with respect to the price for his final product, his assumptions can only be based on prices at the time of calculation. What he actually achieves in terms of final prices is not something he guesses at the beginning of a project, and this is why medium- and long-term financing costs usually track prices.

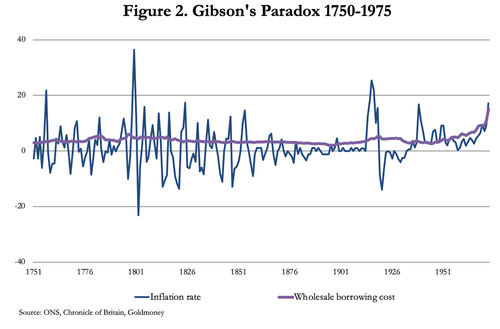

The other side of this correlation was the non-correlation between price inflation and borrowing costs, since the latter are tied to the general price level as illustrated in Figure 1 and not its rate of change. At least, that was the case until central banks increasingly distorted money relationships in the post-war years. This is illustrated in Figure 2, again for the UK.

The non-correlation shown in Figure 2 demolishes the basic assumptions behind interest rate management by central banks. For interest rates to relate to the change in prices, and therefore their effect on the cost of funding, there would have to be a correlation between the rate of price inflation and borrowing costs. Even allowing for a time lag and differences between short- and longer-term rates, this should still hold true. But the history shown in Figure 2 says otherwise. The implications go even further: Gibson’s paradox tells us that interest rate management by central banks can never achieve their objectives, and that it is predicated on incorrect assumptions about how capitalistic markets work.

For this reason, various economists since Keynes have tried to explain the paradox unsuccessfully. The problem they faced was that their statist approach to interest rate management ignores the lessons of Gibson’s paradox, which proves that attempts to influence the course of the economy by varying interest rates will always fail. The explanation why this was so turned out to be very simple: borrowing rates for industrial investment were set by borrowers bidding up for capital within the confines of their business calculations. It turns out that it is not greedy capitalists that set interest rates at all, but entrepreneurial demand for scarce capital. Keynes, in particular, had a thing about the idle rich rentiers living off their money without doing a day’s work. His prejudice had blinded him, and all who have subsequently subscribed to his macroeconomic theories.

The erroneous assumptions regarding bank credit

When policy planers reduce interest rates, they expect commercial banks to pass on the benefits to their borrowing customers in order to stimulate production, and in recent decades in order to stimulate consumption as well. It is not only over interest rates that policy planners are mistaken, but they seem to wilfully misunderstand the role of commercial banks. If this allegation is correct, then it is an accusation of gross incompetence on the part of the monetary authorities concerning interest rate policy, so it must be tested.

The basis of state intervention in the banking system is based upon the premise that they act as agents between depositors and borrowers. At first sight the supposition appears reasonable, but there are in fact two other theories of banking; that they operate on a fractional reserve basis, creating bank credit regulated by the levels of required bank reserves set by the central bank, or that they simply lend money into existence. All three theories have been favoured at different times and in different jurisdictions.

Generally, the fractional reserve model is now regarded as redundant, with global bank regulation having moved to Basel-imposed standards. These standards and their approach are consistent with the assumption that banks intermediate between depositors and borrowers, and that depositors need protection from loan failures by requiring banks to have sufficient capital buffers.

While the regulators and authorities assume an intermediation model, it is widely understood that banks do indeed lend money into existence, and we even refer to it as bank credit. It is just that central banks still attempt to manage money and interest rates through the banks on an intermediation basis. Additionally, in some major jurisdictions, notably the US, UK, Eurozone and Japan, central banks have been attempting to replace savings deposits with monetary inflation as the source of capital for industrial investment by quantitative easing. But while monetarists avidly monitor the expansion of central bank money, they often fail to understand that the leading creators of fiat money are the banks themselves, and they have been so certainly since the 1844 Bank Charter Act in English law, if not before.

In our quest to explain further the fallacies behind interest rate policies we must examine the creation process of bank credit. The common assumption in the credit creation theory is that when it is drawn down, a loan created by a bank results in new deposits being created as the borrower makes payments to his creditors. With loans being created by all commercial banks all the time and existing loans being drawn up, all banks see new deposits, and at the same time see existing deposit levels changing. But is a closed loop system. Any imbalances, such as with banks ending up short of deposit funding at the end of the day, are adjusted in the wholesale interbank markets by borrowing from banks with surplus deposits on their books.

It turns out that while banks do create credit, the procedures are significantly different. In 2014, Richard Werner, a banking expert, conducted an experiment with a small German bank which entailed the bank lending him €200,000 euros so that he could follow all the accounting procedures behind the loan.

Professor Werner discovered that when a bank makes a loan it credits the asset side of the balance sheet, as one would expect. But at the same time, it enters in its balance sheet a liability to the borrower in the full amount of the loan. There is no outside involvement with the central bank or any other bank, nor internally with the transfer of any funds from any other customer accounts held by the bank. The fact that the bank signs with the customer a loan contract not only creates the loan, but also the bank’s liability (booked as a deposit), which is why when you walk out of the bank having signed on the dotted line, the bank says the funds are now in your account. Operations in wholesale markets have nothing to do with the creation of bank deposits, as commonly supposed, and the creation of bank credit does not depend on their being balanced with deposits through wholesale money markets as it is drawn down.

This leads to Professor Werner making an extremely important point. Not only do banks create money out of thin air but being no more than obligations resulting from money creation, deposits are fictitious in every sense. They are created as a counterpart of the loan process, and any transfers from other banks will have originated in the same way: they are loans to the bank and the so-called depositor is a mere creditor. Werner quotes Henry Dunning Macleod in his Theory of Credit (1891): “A bank is not therefore an office for ‘borrowing’ or ‘lending’ money, but it is a Manufactory of Credit”.

Some of this we knew already, such as the legal status of bank deposits, which are the bank’s property with only an obligation to its creditors. But there are consequences that should be taken into account, particularly from the central bankers’ misapprehension that banks are offices for borrowing and lending money, and that they are as a matter of fact no more than Manufacturers of Credit.

The limitations on bank credit creation

We have now established that there is no common interest between central banks and their commercial charges, because the intermediation theory is bunkum. Commercial banks will go about their business, with the advantage that they can create money whenever they like and for whatever purpose. The only limitations are the risks they are prepared to take, and the most important factor in this regard is the relationship between total assets and the bank’s balance sheet equity.

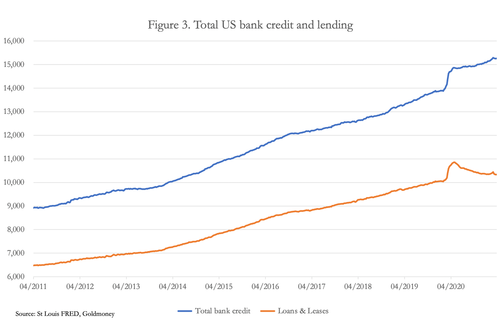

Of course, lending is just one activity. Investing in bonds, derivatives, and mortgage-backed securities are others. The differences between headline bank credit and loans to the non-financial US economy are illustrated in Figure 3.

Over the last ten years, the proportion between the two held reasonably steady with loans and leases at about 72% of total bank credit until early last year. The sudden jump in both series between March and early May 2020 meant that the relationship still held initially, before loans and leases declined while investment in US Treasuries and agency debt continued to increase, such that the ratio is now under 68%. We should further note that with over-night interest rates held at the zero bound since March 2020, commercial banks are not increasing their lending to non-financial businesses, as conventional central bank monetary policy suggests should be the case, but they are reducing them instead.

In defiance of these clear trends, forecasters are expecting a rapid economic recovery in the coming months. But so long as commercial banks continue to contract bank credit, that cannot happen.

For this recovery to take place requires the banks to act on a pass-through basis, allowing helicoptered money to be credited to consumers’ accounts and to increase the production capital available by increasing revolving loans for businesses in order for them to respond to consumer demand. But this is not happening, and the error analysts appear to be making in their economic forecasts is to misunderstand the interests of the banks. They are not simple intermediaries but businesses which have the luxury of creating money, elevating the returns for their shareholders. But with that elevation comes risk. And looking at the balance sheets of the largest US banks — the G-SIBs, the relationship between their total assets and the sum of their shareholders’ equity is an average of 10.5 times. For these banks, bad debts, which are now an increasing risk, will wipe out balance sheet equity at over ten times the rate on total assets.

The chart in Figure 3 tells us that US banks regarded the first few months of the coronavirus pandemic as an interruption to business as normal, and we will recall that at the time there was a widespread consensus of a V-shaped recovery. By default, bankers would have initially believed the recovery would indeed occur and be V-shaped, until evidence began to mount that bad debts would increase as the time for economic recovery was increasingly delayed. It is understandable that banks are now withdrawing credit from the non-financial economy and are redeploying resources in favour of the trading opportunities arising from the Fed’s expansionist monetary policies. But the thoughtful analyst will see that the US banking community is at a dangerous crossroads: headline trading conditions are hiding a rapidly deteriorating situation on their mainstream lending to the non-financial sector, and the banks’ survival requires them to unwind their past credit creation with increasing urgency.

These are developing into the conditions recognised by Irving Fisher when commenting on the reasons for the banking crisis in the 1930s. Fisher described how banks selling collateral to recover debts reduced the value of all similar classes of collateral, triggering foreclosures on otherwise creditworthy borrowers. Not only did these actions intensify the slump, but it led to multiple bank failures.

In short, the conditions are developing for a rerun of the 1929-32 financial and economic crisis, and the Fed in common with other major central banks is powerless to stop it.

The effect of rising bond yields

Another aspect of the desire of banks to reduce their exposure to bad debts in the non-financial economy is their increased dependency on the bull market in financial assets. At the root of it is interest rate suppression by central banks, with the Fed by no means being the most extreme. In addition to zero rates, every month the Fed is pumping $120bn of indirect buying of risky financial assets through quantitative easing targeted at pension and insurance funds who have to reinvest the proceeds.

With no change in the Fed funds rate which has been held at the zero bound since 19 March 2020, the yields on US Treasuries have begun to rise, with the 10-year bond yield tripling from a low point of 0.54% last July to 1.73% recently. The reason for this increase must concern us.

For a ten-year US Treasury bond to yield as little as 0.54% was an aberration only explained by the initial consequences of money flooding financial markets at a time of zero interest rates on overnight money. That moment has passed, and market participants are reassessing the situation. They will have noted that since the Fed cut its funds rate to the zero bound, commodity prices have increased significantly, indicating to commercial holders of dollars, both at home and abroad, that their balances are buying less when measured in the commodities and raw materials relevant to their production.

In that context, even a yield of 1.7% is paltry, with the purchasing power of the dollar falling measured against a basket of commodities. And with the threat of prices for goods and services now rising significantly above the 2% target (due to the contraction of bank credit and therefore working capital for producers), bond yields are set to rise even more. There will come a point when rising bond yields undermine financial asset prices more widely, and no amount of QE puffery will rescue markets from a collapsing bubble.

The next rise in bond yields will probably do the trick. Having switched their balance sheets away from credit creation for the non-financial sector in favour of financial asset activity, the banks will then face unexpected losses arising from rising bond yields and deflating equity bubbles. Furthermore, with most of their lending secured against financial assets and commercial property, their values are tied to interest rate prospects and so the pressure to foreclose on loans is bound to increase.

Can CBDCs rescue the situation?

There is growing publicity being given to central bank digital currencies as a means of targeting monetary stimulation. It involves something never done before, with everyone and all businesses having an account with the CBDC issuer, either the central bank or a subsidiary organisation under its control. It allows the central bank to select the recipients of a digital currency, so that it can target areas of the economy it decides needs stimulating, and by putting an expiry date on it, even stimulate consumption to be more immediate. It is not clear how this will work, because the illusion that fiat money has value would almost certainly be undermined by free distributions of CBDCs.

Commercial banks are bypassed. Having pointed out earlier in this article that central banks have no control over commercial banks, it appears that CBDCs might be a solution; only that having demonstrated their wilful ignorance over money and interest rates in general, central banks seem unsuited to make this judgement. And it should be noted that nowhere in the growing quantity of literature on the subject is there any suggestion that CBDCs are not supplemental to existing fiat currencies. By diluting the total stock of money, they are to be an additional means of inflation, transferring wealth from the general population to the central bank to be deployed as the central bank sees fit.

To have monetary planners drawn from central banks and their governments directing economic activity through the selective application of CBDCs would be the final nail in the coffin for personal freedom. Fortunately for those who cherish what’s left of their freedom, to get a CBDC up and running will take time, and the factors that are leading towards the end of existing fiat currencies suggest that time is one commodity not available for the introduction of working CBDCs. Just imagine a government bureaucracy processing anti-money laundering and KYC for every citizen and business — with all the testing and trial runs required, it probably takes years to implement.

Economic outcomes

It therefore seems that CBDCs will be irrelevant to economic outcomes. And the economic and monetary future is being managed by forces which ignore reasoned economic and monetary theory, and the legal basis of banking. So established have the planners’ deceptions become that we can begin to map the developments likely to lead to the death of neo-Keynesian fallacies over money and the role of interest rates. We can pencil in the following order of events.

-

The lack of production capacity, restricted by contracting bank credit will lead to an increase in marginal prices far greater than expected, when post-lockdown cash balances begin to be restored to their customary levels. This will lead to an anticipation of higher bond yields than currently discounted.

-

A rise in bond yields will expose government finances to be entrapped in debt, with debt finance having increasingly replaced government revenues as the principal source of public sector finance. 48% of US Government finance in the last year was by debt. The Congressional Budget Office forecast is for an improvement in the current budget deficit on last year’s, which is unlikely given President Biden’s lavish spending plans and undue optimism over the economic outlook and tax revenues.

-

Stock markets will be undermined by higher government bond yields and the bubble will burst, taking other financial asset values down with it. The next increase in bond yields — perhaps a matter of only weeks away — threatens to plunge equities into sudden bear markets.

-

Supply chains are unlikely to return to full functionality before the end of the calendar year, which with the banks’ determination to scale back on outstanding credit undermines current economic assumptions, and therefore tax revenues, as being far too optimistic.

-

With contracting bank credit beginning to be fuelled by bad debts and falling collateral values, banks in some jurisdictions such as the Eurozone and China seem destined to fail and require state intervention. International counterparty risk becomes a dominant issue.

-

The future of currencies, and particularly the US dollar, have become tied to their respective bubbles in financial assets. In a desperate attempt to contain imploding asset bubbles, to compensate for contracting bank credit and to rescue failing supply chains, the pace of monetary creation by central banks is bound to accelerate, because the authorities have no other policy. It will mark the beginning of a rapid end for fiat money.

The application of modern macroeconomic theory will have not only failed to rescue economies from a slump and fiat currencies from collapse, but it will have been demonstrated that attempts to achieve economic outcomes through the manipulation of interest rates will have resulted in catastrophe. We will have seen the establishment having run with ill thought-out concepts. Instead of abandoning them, they are doubling down, blind to the chaos being caused. They are following the same interventionist policies as Presidents Hoover and Roosevelt did in the 1930s, modified for contemporary factors and unbacked fiat money. Sadly, this demonstrates how little has been learned about the fallacies of state intervention over the last ninety years.

Tyler Durden

Sat, 04/24/2021 – 13:30

via ZeroHedge News https://ift.tt/2QVcmgS Tyler Durden