The SALT Deduction Distorts The Supply & Demand Of State & Local Government

Authored by Brian McGlinchey via Stark Realities,

At first glance, Washington’s ongoing skirmishes over the state and local tax (SALT) deduction feels like something out of DC Comics’ Bizarro World: Democrats are pushing a tax break expansion that would primarily benefit the wealthy—opposing Republicans who capped the deduction a few years ago.

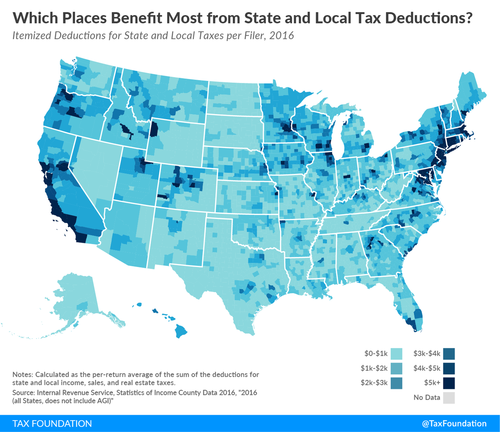

A closer look at the SALT deduction, however, reveals a more relatable partisan dynamic: State and local tax burdens vary greatly, and the highest levies are generally concentrated in states and cities run by Democrats. Before the break was capped by the GOP-led Tax Cuts and Jobs Act of 2017, 91% of the benefit went to people with income over $100,000, with residents of California, New York, New Jersey, Illinois, Texas and Pennsylvania leading the way.

Beneath the Red-vs-Blue maneuvering lies an important question of principle: Should the federal government cushion the blow of high-priced state and local government?

How the SALT Deduction Works

The SALT deduction is a federal tax break taken on personal income tax returns. It lets filers reduce their federal taxable income by the amount of their state and local income and property taxes.

It’s only available to those who itemize deductions, rather than taking the standard deduction—which, in 2021, is a hefty $25,100 for married couples and $12,550 for singles. That threshold alone shifts the SALT deduction benefit toward the wealthiest Americans, who are far more likely to itemize.

If the limit on the SALT deduction were removed, 96% of the benefit would go to the top 20% of income earners, with 25% going to the top 0.1%, who would enjoy an average tax cut of $143,860, according to the Tax Policy Center.

However, the SALT deduction shouldn’t only be thought of as a tax break for individuals. In effect, it’s also a partial federal reimbursement of state and local income taxes. In that way, it serves as a federal subsidy of state and local governments and, absent the current GOP-imposed cap, the higher those state and local taxes, the higher the federal subsidy.

SALT Encourages Bad Behavior by Governments and Individuals

Like all subsidies, the SALT deduction distorts the economic decisions of individuals and entities. To understand why, let’s first visit the economic concept of “price signals.”

Prices aren’t just numbers—they carry embedded information that drive the behavior of market participants. A change in the price of a product or service signals market participants to either increase or decrease the quantity that’s supplied and/or the quantity that’s demanded.

When you disrupt those signals, you drive distortions in the behavior of market participants. For example, federal college loans encourage buyers of higher education to spend more than they would have otherwise. Making it easy for buyers to spend more also encourages the producers of higher education to charge more. Thus, an intervention that seeks to make college more affordable has the opposite effect.

Similarly, the SALT deduction distorts the “market” for state and local government by making residents less sensitive to increases in its price, which comes in the form of taxes. Consider a couple in the 37% federal tax bracket. Without a limit on the SALT deduction, a $10,000 increase in their state income taxes only costs them $6,300 after the federal tax deduction/subsidy.

By cushioning the blow, that federal subsidy makes residents less likely to demand a reduction in the size and scope of their state and local governments—or to move to a lower-priced alternative—and makes it easier for governments to expand their undertakings and raise taxes.

Tax debates often center on varying perceptions about what’s “fair.” Putting aside the higher benefit to the wealthy, there’s very little that’s fair about a tax break that disproportionately benefits high-priced state and local governments and the people who choose to live within their reach.

Put another way, there’s no rational federal government interest in providing a discount on the price of state and local government. Indeed, rather than removing the $10,000 cap, there’s an argument to be made for eliminating the SALT deduction altogether—ideally as part of a broader program to simplify the tax code so it’s no longer used as a federal mechanism for social engineering and rewarding cronies—both in and out of government.

Read more and subscribe at https://starkrealities.substack.com/

Tyler Durden

Sun, 04/25/2021 – 15:20

via ZeroHedge News https://ift.tt/2QXVSog Tyler Durden