Brace For Extremely Busy Week: Fed, GDP, CPI, Biden Tax Plans And Earnings Galore

Buckle up for an extremely busy week dotted with a flood of tech earnings, central banks galore and a the latest US GDP and CPI prints.

The Federal Reserve (Weds) and the Bank of Japan (Thurs) are both making their latest policy announcements with the former the obvious focal point for the week, even if the outcome will likely be uneventful (unlike the June meeting when the Fed is likely to hint at tapering for the first time). On top of that, there are an array of earnings releases, including 180 companies in the S&P 500. Tesla today might be one of the more headline grabbing ones but to be honest there are plenty of them. Meanwhile President Biden will give his first speech to a joint session of Congress (Weds) and finally, there are some important data releases, including the first look at Q1 GDP for the US (Thurs) and the Euro Area (Fri).

The biggest scheduled event on this week’s calendar for markets will be Wednesday’s Federal Reserve meeting and Chair Powell’s subsequent press conference. In their preview, Deutsche Bank economists write that this meeting should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting. And in the press conference, they expect Powell will likely continue his subtle shift in tone in a more optimistic direction. Nevertheless, given the remaining gaps in the labor market and the focus on seeing actual rather than forecasted progress, April is too soon for the return of taper talk, and they expect those discussions to heat up during the summer instead.

As Bloomberg’s Laura Cooper writes, while waiting for that “substantial further progress”, Chair Powell is likely to affirm patience and take upbeat data in stride. Market watchers are becoming less convinced, with 45% of economists anticipating a 4Q tapering. No wonder when strong economic data is likely to extend, led by an anticipated 6.9% 1Q GDP print on Thursday and President Biden’s push for infrastructure mid-week. That recovery optimism has bolstered S&P 500 earnings expectations, with massive beats so far and ~30% of the index reporting this week. As we said two weeks ago, guidance will matter more than profit surprises with heightened focus on inflation, resulting margin compression and re-opening impacts given optimism baked in to valuations. Bellwether tech firms take the spotlight with Tesla announcing today, setting up for bouts of market volatility.

The other major central bank deciding on rates is the Bank of Japan (tomorrow), when it will also be releasing its quarterly Outlook Report. The BoJ is likely to retain its current policy stance next week, having only just fine-tuned their framework after the policy assessment last month. For the Outlook Report, the expectation is that it will raise the overseas growth projections, but the main focus will be on the new figures for FY2023, where our economist is looking for a real GDP growth forecast of 1.2% and

The Covid pandemic will also remain in the spotlight as the number of global cases rose at their fastest weekly pace yet last week. India has seen fresh record cases over the weekend with around 350k new daily positive tests and a million over 3 days. There have been reports that’s various models are predicting this could hit over 500k per day this week which will gain huge headlines. While Indian case loads are so high there will be concerns about the unevenness of the global recovery and the ability of variants to escape. So this is undoubtedly a big story.

In the political sphere, this week will see President Biden give his first speech to a joint session of Congress on Wednesday. We’re expecting a number of measures to be discussed, including the American Families Plan, which is expected to include fresh proposals on childcare and education. This sits alongside the American Jobs Plan, that Biden has already unveiled, where he proposed investing over $2tn in infrastructure and other priorities, to be financed through higher corporate taxes.

Commodity watchers will also be focusing on the OPEC+ meeting this Wednesday and with Iran talks progressing, there are obvious catalysts for oil volatility this week.

The current earnings season moves into full flow this week, as 180 companies in the S&P 500 report, along with a further 113 from the STOXX 600. Among the highlights include Tesla today, then tomorrow, we’ll hear from Microsoft, Alphabet, Visa, Novartis, Eli Lilly, Texas Instruments, UPS, Amgen, Starbucks, Raytheon Technologies, General Electric, HSBC, 3M and UBS. Wednesday then brings Apple, Facebook, Qualcomm, Boeing, Sanofi, GlaxoSmithKline, Santander, Ford, Lloyds Banking Group and Sony. On Thursday, releases include Amazon, Mastercard, Comcast, Merck, Thermo Fisher Scientific, McDonald’s, Bristol Myers Squibb, Royal Dutch Shell, Caterpillar, Total, American Tower, Twitter, NatWest Group and Samsung Electronics. Finally on Friday, there’s Exxon Mobil, Chevron, AbbVie, Charter Communications, AstraZeneca, BNP Paribas and Barclays.

Finally, there are also a few highlights among this week’s data releases, with the initial estimates of Q1 GDP coming out for numerous countries, including the US, the Euro Area, Germany, France and Italy. It’ll also be worth watching out for the weekly initial jobless claims data from the US, as that’s one of the most timely indicators we get, and has fallen to a post-pandemic low this last week, so it’ll be interesting to see if that decline is sustained.

Day-by-day calendar of events, courtesy of Deutsche Bank

Monday April 26

- Data: Germany April Ifo business climate indicator, US preliminary March durable goods orders, nondefence capital goods orders ex air, April Dallas Fed manufacturing activity

- Earnings: Tesla

Tuesday April 27

- Data: Italy April consumer confidence index, US February FHFA house price index, April Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: Bank of Japan monetary policy decision

- Earnings: Microsoft, Alphabet, Visa, Novartis, Eli Lilly, Texas Instruments, UPS, Amgen, Starbucks, Raytheon Technologies, General Electric, HSBC, 3M, UBS

Wednesday April 28

- Data: Japan March retail sales, Germany May GfK consumer confidence, France April consumer confidence, US preliminary March wholesale inventories

- Central Banks: Federal Reserve monetary policy decision

- Earnings: Apple, Facebook, Qualcomm, Boeing, Sanofi, GlaxoSmithKline, Santander, Ford, Lloyds Banking Group, Sony

- Politics: Joe Biden addresses joint session of Congress

Thursday April 29

- Data: Germany April unemployment change, preliminary April CPI, Euro Area March M3 money supply, final April consumer confidence, US weekly initial jobless claims, advance Q1 GDP, personal consumption, core PCE, March pending home sales

- Central Banks: ECB’s Schnabel does Twitter Q&A and ECB’s Centeno speaks

- Earnings: Amazon, Mastercard, Comcast, Merck, Thermo Fisher Scientific, McDonald’s, Bristol Myers Squibb, Royal Dutch Shell, Caterpillar, Total, American Tower, Twitter, NatWest Group, Samsung Electronics

Friday April 30

- Data: Japan March jobless rate, preliminary March industrial production, final March manufacturing PMI, China April non-manufacturing PMI, manufacturing PMI, composite PMI, preliminary Q1 GDP readings from Euro Area, Germany, France and Italy, preliminary April CPI from Euro Area, France and Italy, Euro Area March unemployment rate, Canada February GDP, US Q1 employment cost index, March personal income, personal spending, April MNI Chicago PMI, final April University of Michigan consumer sentiment index

- Central Banks: ECB’s Holzmann and Fed Vice Chair Quarles speak

- Earnings: Exxon Mobil, Chevron, AbbVie, Charter Communications, AstraZeneca, BNP Paribas, Barclays

* * *

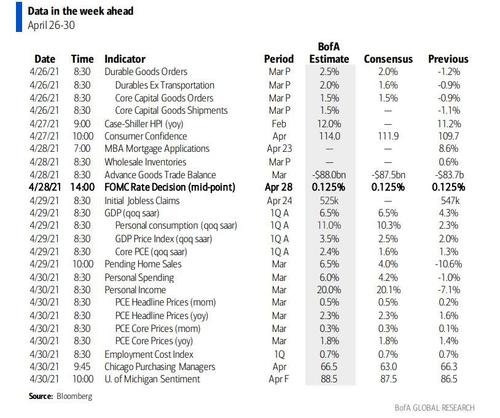

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Monday, Q1 GDP release on Thursday, and PCE inflation and the employment cost index on Friday. The April FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM. There are no other major speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, April 26

- 08:30 AM Durable goods orders, March preliminary (GS +2.0%, consensus +2.5%, last -1.2%); Durable goods orders ex-transportation, March preliminary (GS +2.1%, consensus +1.6%, last -0.9%); Core capital goods orders, March preliminary (GS +2.1%, consensus +1.8%, last -0.9%); Core capital goods shipments, March preliminary (GS +2.1%, consensus +1.5%, last -1.1%): We estimate durable goods orders rose 2.0% in the preliminary March report, reflecting mixed net orders for commercial aircraft. We estimate a 2.1% rebound in both core capital goods orders and core capital goods shipments, reflecting continued industrial-sector resilience, the rebound in business equipment production, and improvement following the February Texas storms.

- 10:30 AM Dallas Fed manufacturing index, April (consensus 30.0, last 28.9)

Tuesday, April 27

- 09:00 AM FHFA house price index, February (consensus +1.0%, last +1.0%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, February (GS +1.1%, consensus +1.10%, last +1.20%); We estimate the S&P/Case-Shiller 20-city home price index rose by 1.1% in February, following a 1.20% increase in January.

- 10:00 AM Conference Board consumer confidence, April (GS 113.5 consensus 112.0, last 109.7): We estimate that the Conference Board consumer confidence index increased by 3.8pt to 113.5 in April. Our forecast reflects stronger signals from other consumer confidence measures.

- 10:00 AM Richmond Fed manufacturing index, April (consensus +22, last +17)

Wednesday, April 28

- 08:30 AM Advance goods trade balance, March (GS -$88.5bn, consensus -$87.7bn, last -$88.0bn): We estimate that the goods trade deficit increased by $0.5bn to $88.5bn in March compared to the final February report, reflecting increased imports.

- 08:30 AM Wholesale inventories, March preliminary (consensus +0.5%, last +0.6%): Retail inventories, March (consensus -0.3%, last flat)

- 02:00 PM FOMC statement, April 27-28 meeting: As discussed in our FOMC preview, we expect that the April FOMC meeting will be uneventful. The pace of recovery has accelerated since the FOMC last met in March, and we expect the April FOMC statement to feature a more upbeat description of recent economic activity. However, we think it is clearly too soon for the FOMC to hint at tapering with core inflation low, the unemployment rate at 6%, and broader slack higher still. We continue to expect the FOMC to start hinting at tapering in the second half of this year and to begin tapering in early 2022.

Thursday, April 29

- 08:30 AM GDP, Q1 advance (GS +7.5%, consensus +6.9%, last +4.3%); Personal consumption, Q1 advance (GS +10.7%, consensus +10.3%, last +2.3%): We estimate GDP growth accelerated to +7.5% annualized in the advance reading for Q1, following +4.3% in Q4. Our forecast reflects very strong growth in consumption driven by the reopening and the stimulus (+10.7% annualized) that embeds a sizeable increase in virus-sensitive services categories in March. We expect another large rise in residential investment (+25%) and double digit gains in business capex categories. We expect a sizeable drag on GDP growth from inventories (-2.3pp qoq ar) and net trade (-1.0pp) reflecting the late quarter surge in goods spending, and we will hone our estimates based on the advance economic indicators report on Wednesday.

- 08:30 AM Initial jobless claims, week ended April 24 (GS 560k, consensus 550k, last 547k); Continuing jobless claims, week ended April 17 (consensus 3,590k, last 3,674k): We estimate initial jobless claims increased to 560k in the week ended April 24.

- 10:00 AM Pending home sales, March (GS +6.0%, consensus +4.0%, last -10.6%): We estimate that pending home sales rebounded by 6.0% in March.

Friday, April 30

- 08:30 AM Employment cost index, Q1 (GS +0.6%, consensus +0.7%, prior +0.7%): We estimate that the employment cost index rose 0.6% in Q1 (qoq sa), which would lower the year-on-year rate by two tenths to +2.3%. Labor market slack remains somewhat elevated despite the sharp declines in recent quarters, and we believe this exerted downward pressure on annual wage increases in some industries. Our wage tracker has also edged down on a composition adjusted basis.

- 08:30 AM Personal income, March (GS +20.3%, consensus +20.0%, last -7.1%): Personal spending, March (GS +4.3% consensus +4.2%, last -1.0%); PCE price index, March (GS +0.50%, consensus +0.5%, last +0.23%); Core PCE price index, March (GS +0.34%, consensus +0.3, last +0.09%); PCE price index (yoy), March (GS +2.33%, consensus +2.3%, last +1.55%); Core PCE price index (yoy), March (GS +1.86%, consensus +1.8%, last +1.41%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.34% month-over-month in March, corresponding to a 1.86% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.50% in March, corresponding to a 2.33% increase from a year earlier. We expect a +20.3%, increase in personal income and a 4.3% increase in personal spending in March.

- 09:45 AM Chicago PMI, April (GS 65.5, consensus 64.2, last 66.3): We estimate that the Chicago PMI declined by 0.8pt to 65.5 in April, reflecting mean reversion after a surge in the previous month but a continued boost from the supplier deliveries component and strong fundamentals

- 10:00 AM University of Michigan consumer sentiment, March Final (GS 88.2, consensus 87.5, last 86.5): We expect the University of Michigan consumer sentiment index to increase by 1.7pt to 88.2, reflecting further improvement in other consumer sentiment measures.

Source: Deutsche Bank, BofA, Goldman Sachs

Tyler Durden

Mon, 04/26/2021 – 09:10

via ZeroHedge News https://ift.tt/3aC3NhZ Tyler Durden