TSLA Slides After Beating EPS, But All Net Income Comes From Regulatory Credit Sales

As we previewed earlier, Wall Street expectations from TSLA’s earnings today are rather stratospheric, but as Bloomberg notes, even if the company misses big, the S&P 500 likely won’t be in the doldrums tomorrow because of it. Why? Simply put, the electric-vehicle maker matters less than other high-profile stocks in the broad market gauge.

Alphabet, Amazon.com, Apple, Microsoft and Tesla are among the most influential companies in the stock market. But by one simple measure, Tesla looks different than the others. The S&P 500’s 30-day positive correlation with the stock has fallen to ~0.44 from an early March peak of almost 0.8. That pales in comparison with Microsoft at ~0.77, Apple at ~0.72, Amazon at ~0.68 and Alphabet at ~0.65. In fact, the S&P 500’s correlation with old-school cyclical Caterpillar — which also reports this week — is higher than Tesla at ~0.51. This falling correlation is inevitable as Tesla has gained less than 5% this year compared with over 11% for the S&P 500, with value sectors such as energy and financials outperforming. This has happened as meme stocks like GameStop have pushed Tesla out of the limelight, while Bitcoin has attracted almost all the buzz.

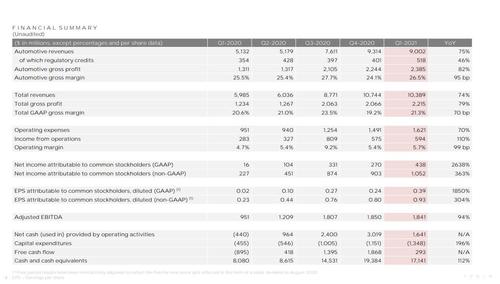

With that in mind, here is what TSLA reported shortly after the close for Q1:

- Adjusted EPS of 93C, beating est. 80c

- Revenue $10.389BN, missing est. $10.42 billion (range $8.20 billion to $12.34 billion)

- Free Cash Flow $293MM, beating estimate of cash burn of $82.8 million

But here is the problem: TSLA reported $594MM in income from operations, but regulatory credits accounted for a whopping $518MM of it, the highest on record and up from $401MM in Q4 2020, while GAAP net income was just $438MM meaning that for yet another quarter the company did not generated actual net income without regulatory credits. Of course, some will claim that this does not matter, and that TSLA has in fact generated 7 consecutive quarters of profits.

The results visually:

Discussing its profitability, TSLA said that its operating income improved in Q1 compared to the same period last year to $594M, resulting in a 5.7% operating margin. “This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $299M in Q1, driven by an increase in market capitalization and a new operational milestone becoming probable.”

On a year over year basis, Tesla said that positive impacts from volume growth, regulatory credit revenue growth, gross margin improvement driven by further produt cost reducstions and sale of bitcoin were mainly offset by a lower ASP, increased SBC, additional supply chain costs, R&D investments and other items. Model S and Model X changeover costs negatively impacted both gross profit as well as R&D expenses.

The company also disclosed that it is on track to start production from Berlin factory in 2021, adding that first deliveries of the new model S should start shortly.

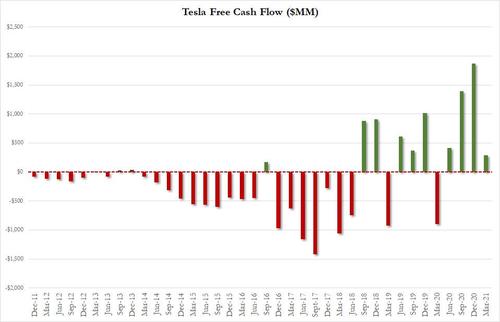

On the cash flow side, TSLA revealed that it had a $1.2BN net cash outflow related to bitcoin in Q1, as well as net debt repayments of $1.2BN offset by free cash flow of $293MM, which was above the estimate of $83MM in cash burn:

Quarter-end cash and cash equivalents decreased to $17.1B in Q1, driven mainly by a net cash outflow of $1.2B in cryptocurrency (Bitcoin) purchases, net debt and finance lease repayments of $1.2B, partially offset by free cash flow of $293M

Looking ahead, Tesla said it expects to achieve 50% average annual growth in vehicle deliveries over a multi-year horizon. But the company notes that rate of growth will depend on equipment capacity, operational efficiency and capacity and stability of supply chain.

In kneejerk response to the earnings, Tesla shares were first up, but then slide more than 1% in postmarket, which nonehteless was a much tamer reaction than what options trading was pricing in ahead of the results.

Tyler Durden

Mon, 04/26/2021 – 16:23

via ZeroHedge News https://ift.tt/3aGLV5N Tyler Durden