Ugly, Tailing 2Y Auction Is Ill Omen As Bid-To-Cover; Indirect Bid Both Plunge

With the FOMC scheduled to take place on Wednesday, it means that we have an abbreviated Treasury auction schedule this week and with coupon sales all expected to fit before Wednesday, we have the 2Y and 5Y auctions today, the first of which just concluded in a surprisingly ugly sale of $60BN in 2-year paper.

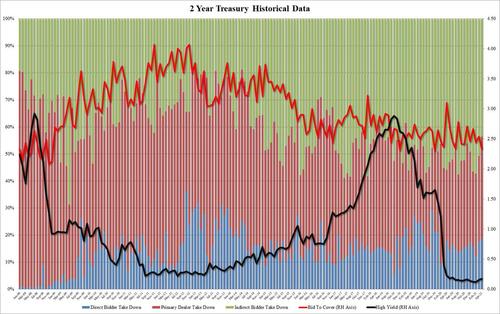

The 2Y note tailed the When Issued 0.171% by 0.4bps, pricing at a high yield of 0.175%, which was the highest since Jun 2020, and well above both March’s 0.152% and the recent six-auction average of 0.142%.

The bid to cover was even uglier: at 2.339, it slumped from 2.542 last month an the 2.54 recent average, and was the lowest since March 2020.

Finally, the internals were a mess, with Indirects plunging to just 43.56%, the lowest since July 2019, and with Directs at 18.5%, or just above last month’s 17.58% and the highest since Jan 2020, Dealers were left holding 37.9% of the final allocation.

Overall, a surprisingly ugly 2Y auction, which may have unpleasant consequences for today’s 2nd auction – the sale of 5Y coupons at 1pm – and especially tomorrow’s 7Y belly buster. As a reminder, it was the woeful 7Y auction sale in February that launched a rout in the Treasury market and sent yields sharply higher and stocks reeling.

Tyler Durden

Mon, 04/26/2021 – 11:48

via ZeroHedge News https://ift.tt/3sUsblx Tyler Durden