Goldman Reveals Its Favorite “Crypto-Exposed” Stocks

Wall Street’s infatuation with cryptos is shifting from a sordid and steamy love affair to full-blown full regalia wedding ceremony on the Caymans, which is understandable in a world where there is no fundamental analysis involved in picking stonks and so one can just as well make the “selection” of risky asset into an enjoyable gamble and with countless cryptos still soaring triple digits any given day, the retail public is increasingly gravitating toward the digital currencies which come embedded with the promise of overnight riches.

It is therefore hardly a coincidence that after years of furiously bashing bitcoin (remember when Jamie Dimon warned his employees they would be fired if they bought bitcoin?) JPM finally admitted what we said all along – that its almost daily hitpieces had one intention only: to convince its own clients to sell tokens to its own prop desk…

JPMorgan’s daily bitcoin hitpiece is out. Just how bad does JPM prop want to be long this?

— zerohedge (@zerohedge) January 25, 2021

… and on Monday, the largest US bank unveiled its own, actively managed bitcoin fund.

It is also hardly a coincidence that one day after JPM revealed its scheme, that Goldman’s Ben Snider last night published a report looking at blockchain-exposed stocks, and pitching them to the bank’s clients as all of Wall Street now “suddenly and inexplicably” turns from crypto permabear to uberbull.

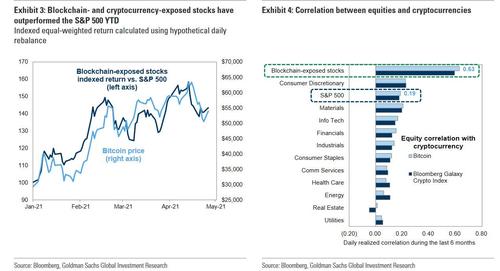

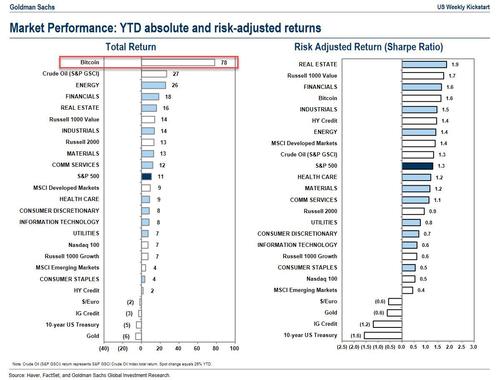

In this trading reco, Snider screens for US stocks with blockchain and cryptocurrency exposure (the screen yields 19 stocks with market caps greater than $1 billion; and on average each stock has outperformed the S&P 500 by 34% YTD (+46% vs. +12%) alongside an 86% rise in the price of Bitcoin and a 156% rally in the Bloomberg Galaxy Crypto Index). While these stocks lagged the market by 10% in the past two weeks as cryptocurrency prices dipped, they outperformed by 2% on Monday as cryptos reversed from their weekend slam.

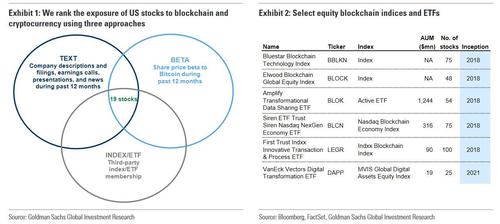

First, Goldman shows the Venn diagram below to illustrate how it picked its universe of crypto-linked stocks:

- Text search – Any relevant finding warrants 1 point; 10 or more findings warrant 3 points; explicit mention in Bloomberg or FactSet company description warrants 3 points

- Betas to Bitcoin– A beta ranking in the top 25% of stocks warrants 1 point; a beta ranking in the top 10% of stocks warrants 3 points

- Index and ETF membership – Membership in any index warrants 1 point; membership in two or more indices warrants 3 points

In its crypto screen, the bank includes any stocks in the universe with six or more points (amusingly, JPMorgan somehow has ended up here). Effectively, this means that each constituent must screen as highly exposed in at least two of the three approaches.

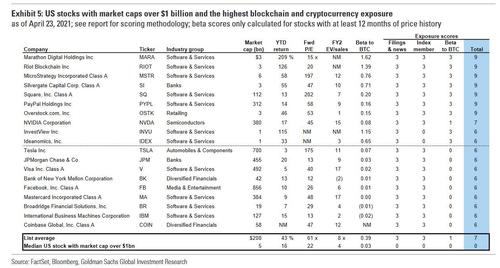

This approach results in a screen of 19 US stocks with market caps over $1 billion and high exposure to blockchain technology and/or cryptocurrency. Finally, the pitch itself:

“On average,these stocks have dramatically outperformed the S&P 500 during the last several months alongside the surge in the price of Bitcoin. An equal-weighted portfolio of the stocks has demonstrated roughly 60% correlations with Bitcoin and the Bloomberg Galaxy Crypto Index during the last several months, compared with 20% correlations for the S&P 500. Eleven of the 19 constituents are in the Software & Services industry group and four are in Financials.”

Translation: for those PMs and fund managers who are sick of generating S&P-level returns and want to track the best performing asset of the year…

… buy a basket of these 19 stocks and chill.

Finally, here is the full list:

Tyler Durden

Tue, 04/27/2021 – 10:30

via ZeroHedge News https://ift.tt/3xt2UCw Tyler Durden