Google Soars On Blowout Earnings, $50BN Stock Buyback

Judging by the just released Q1 blowout earnings from Google, the one thing that companies just can’t do without during the biggest government recession stimmy handout in history, is advertising.

Moments ago, Google parent Alphabet reported Q1 earnings (at the abc.xyz URL) that blew expectations out of the water powered by an increase in digital ad spending by businesses looking to expand during the pandemic reopening:

- EPS $26.29, smashing expectations of $15.64

- Revenue $55.31B, slamming expectations of $51.61B

- Revenue ex-TAC $45.60 billion pounding theestimate $42.61 billion

- Google Cloud Rev. $4.05B, est $3.99B

- Google Services revenue $51.18 billion, -3.2% q/q

- Other Bets revenue $198 million, estimate $161.9 million

- Oper Income $16.44B, trouncing expectations of $12.02B

- Oper Margin 30%, steamrolling the consensus est. 22.4%

Of note, YouTube ads and Google Cloud, two key growth areas for Google, posted solid gains. YouTube ads rose about 48% from the prior year, and Cloud went up 46%.

Amusingly, Google’s “other bets” category came in at $198 million, up from $135 million in the year-ago quarter.

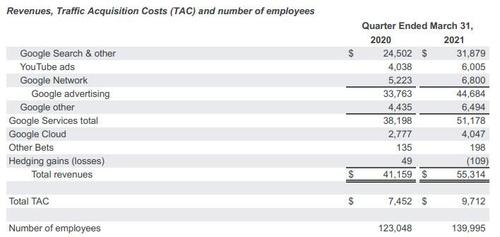

The revenue breakdown visually:

Some more headlines:

- Accounting Change Reduced 1Q Depreciation by $835M

- Co. Revised Useful Life of Servers, Some Network Equipment

- Accounting Change Added 95c/Shr to 1Q EPS

Now the not so great news: Google Cloud continues to lose money — about $974 million last quarter, after burning $1.7BN a year ago, while Google Bets lost $1.1BN.

Commenting on the quarter, CEO Sundari Picahi said that “over the last year, people have turned to Google Search and many online services to stay informed, connected and entertained. We’ve continued our focus on delivering trusted services to help people around the world. Our Cloud services are helping businesses, big and small, accelerate their digital transformations.”

CFO Ruth Porat chimed in too: “Total revenues of $55.3 billion in the first quarter reflect elevated consumer activity online and broad based growth in advertiser revenue. We’re very pleased with the ongoing momentum in Google Cloud, with revenues of $4.0 billion in the quarter reflecting strength and opportunity in both GCP and Workspace.”

With Google reporting nearly $110BN in marketable securities, investors were delighted to learn that after years of avoiding buybacks, Google finally caved and on April 23, 2021, the Board of Directors of Alphabet authorized the company to repurchase up to an additional $50.0 billion of its Class C capital stock: “The repurchases are expected to be executed from time to time, subject to general business and market conditions and other investment opportunities, through open market purchases or privately negotiated transactions, including through Rule 10b5-1 plans.”

Separately, Bloomberg reminds us that there was some concern about the fate of marketing spending as Apple and Google plan to eliminate ad-tracking cookies. Google’s upcoming plan is called FLoC. But the results removed some of those concerns. Here’s a fresh comment from Tom Johnson, chief digital officer for Mindshare, part of mega ad agency WPP PLC.

“Alphabet is becoming a one-stop-shop for companies in the Platform Age and dependence on that one-stop-shop may increase in a cookieless world as Google attempts to build a privacy first future for the web through its Floc initiative.”

Bottom line: a few blemishes, but overall a blowout result and solid beat of expectations, with Bloomberg’s Nico Grant writing that “Covid-19 restrictions have limited travel and trips to physical stores, two key areas of Google’s search business. However, Alphabet shares are up about 30% this year on optimism vaccinations in the U.S. will revive these activities…. These results are a reminder that the rising number of vaccinated people in the U.S. are fueling a return to regular life, and businesses are eager to compete for their money.”

Predictably, the stock has soared nearly 4% in the after hours.

Tyler Durden

Tue, 04/27/2021 – 16:19

via ZeroHedge News https://ift.tt/3vm1s2Q Tyler Durden