MSFT Shares Tumble Despite Top- & Bottom-Line Beat

MSFT handily beat bottom-line expectations and modestly beat top-line:

-

Earnings: $1.95 per share vs. adjusted $1.78 per share expected

-

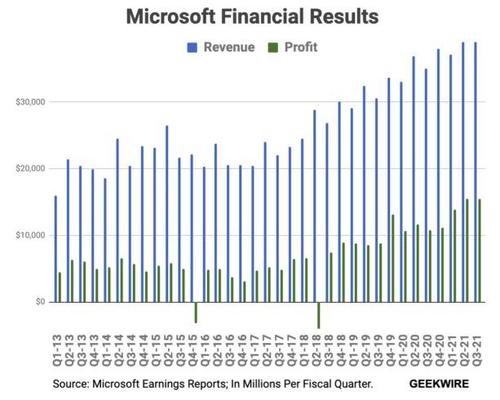

Revenue: $41.71 billion vs. $41.03 billion expected (up 19% – the biggest quarterly increase since 2018)

The GAAP results included a $620mm tax benefit.

“Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning,” said Satya Nadella, chief executive officer of Microsoft.

“We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform.”

Under the hood, the revenue beats were all modest…

-

*MICROSOFT 3Q INTELLIGENT CLOUD REV. $15.12B, EST. $14.94B

-

*MICROSOFT 3Q PRODUCTIVITY REV $13.55B, EST. $13.51B

-

*MICROSOFT 3Q MORE PERSONAL COMPUTING REV. $13.04B, EST. $12.61B

The Intelligent Cloud segment was driven by a 50% increase in revenue for Microsoft’s Azure cloud computing platform and related services. It follows another 50% growth rate in the December quarter, and a 48% growth rate in the September quarter.

The reaction in the stock was one of disappointment as MSFT dumped 4% after hours…

Microsoft shares are up 17% year to date, compared with a gain of about 11% for the S&P 500 over the same time period, so perhaps the drop is driven by simply not being a big enough beat (and a lack of Azure acceleration).

Tyler Durden

Tue, 04/27/2021 – 16:13

via ZeroHedge News https://ift.tt/2PwNGLA Tyler Durden