“We Haven’t Seen This Before” – Wealthy Americans Panic-Chase Million Dollar Listings

Wealthy Americans are taking advantage of cheap mortgages, increased savings, and the ability to remote work for them to search for homes listed above $1 million.

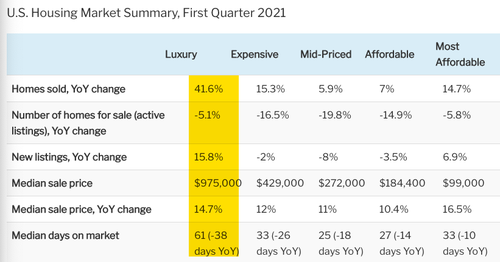

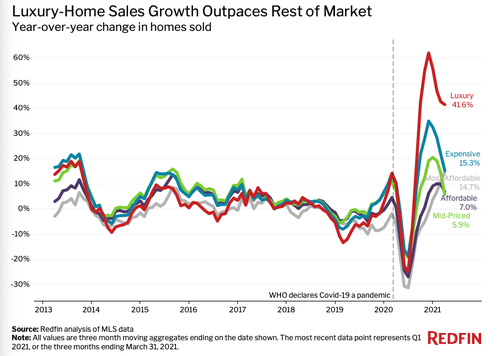

Redfin reports luxury home sales in the first three months of the year are soaring. Sales jumped by 41.6% over the quarter versus the same period last year. It’s a sharp contrast from sales of affordable homes that increased by 7%, and sales of mid-priced dwellings that rose by 5.9%.

Sales growth of homes in all tiers has historically been similar. Still, the latest divergence identified by Redfin outlines how the coronavirus pandemic and policy action by the Federal Reserve and political elites in Washington have exacerbated the great wealth divide that developed long before the pandemic. Affluent folks had access to cheap mortgages, while lower-income earners had limited access to cheap credit as millions of them fell into instant poverty during shutdowns. As a result of government and central bank interventions, a K-shaped economic recovery developed and also manifested in the real estate market.

“Affluent Americans with the flexibility to work from anywhere are taking advantage of low mortgage rates and buying up high-end houses—particularly in popular vacation destinations—which is contributing to the surge in luxury home sales. Meanwhile, many lower-income Americans have lost their jobs and lack the means to become homeowners,” said Redfin.

Lawrence Yun, the chief economist for the National Association of Realtors, said Americans are demanding larger homes driven by a desire for more space that could be used as offices, gyms, and outdoor entertainment during the pandemic. He added: “The larger space automatically means that it is more expensive.”

Redfin said sales of luxury homes during the quarter saw the biggest gains in Miami, where luxury-home sales erupted by 101.1% from a year earlier—followed by San Jose, CA (92.3%), Oakland, CA (82%), Sacramento, CA (79.3%), and Las Vegas (72.7%). These areas were some of the top migration destinations during the pandemic.

“Luxury properties, even those in the $3 million range, are getting multiple offers and going for well over the asking prices,” said Oakland, CA Redfin real estate agent Katy Polvorosa. “That’s something we haven’t seen before, even though the Bay Area has many affluent residents. Everyone just wants more space and big backyards, whether it’s because they’re stuck at home during the pandemic or because they have a growing family.”

Jefferies recently told clients the US is short 2.5 million homes. The National Association of Realtors said the existing housing inventory could run out in two months. However, the shortage is less severe in the luxury market.

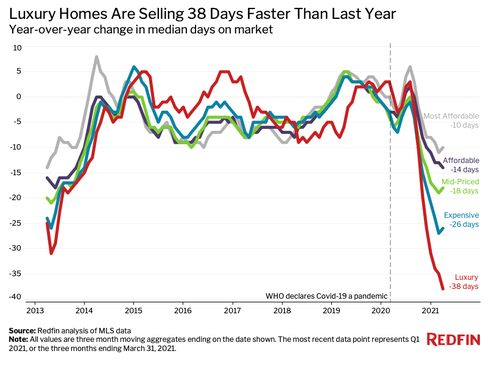

The typical luxury home sat on the market for 61 days in the first three months of the year, 38 fewer days than the same period in 2020.

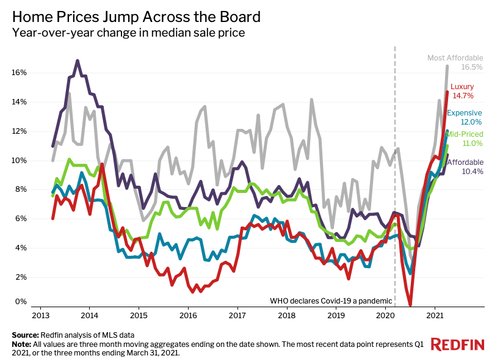

… and what has this meant for luxury home prices over the year? Well, an explosion, of course. Increases were also seen across all tiers.

So how long will the housing frenzy last?

Well, the latest housing data dimmed the outlook. Existing home sales data was worse than expected and have declined for the second month as prices soar at a record pace.

This should not have been a huge surprise, as Christophe Barraud warned earlier. Housing affordability has been under pressure since January. On the one hand, mortgage rates started rebounding, with the 30-year recently hitting the highest level since June 2020 in late March.

Like any frenzy, there’s a beginning (start of the pandemic) and an end (when rates rise). The question: When does the music stop playing?

Tyler Durden

Tue, 04/27/2021 – 19:00

via ZeroHedge News https://ift.tt/3eBNQcX Tyler Durden