Bond Traders Laugh Off Commodities Supercycle Dreams

Authored by Garfield Reynolds via Bloomberg,

Treasury yields are signaling the global economy will be too weak in the coming years to sustain the explosion in commodity prices.

Source: Bloomberg

Ten-year yields dropped some 11 basis points this month amid a resurgent pandemic and uneven vaccine progress. In contrast, the Bloomberg Commodity Spot Index is up ~8% so far in April – heading for its best month since August.

Source: Bloomberg

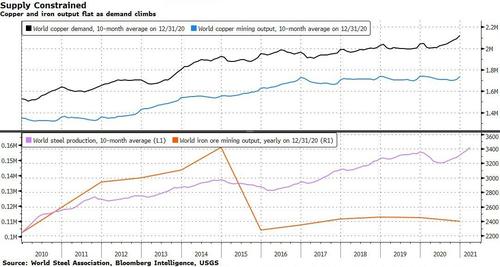

Much of that has been powered by idiosyncratic issues, such as iron ore supply shocks in Australia and Brazil that combined with an acceleration in Chinese demand ahead of an expected crackdown on steel output later this year.

The coronavirus is suddenly making Asia an unexpected weak link in the recovery narrative, with India and Japan now likely to see growth forecasts downgraded. That’s a problem for the global outlook given the Asia-Pacific region is projected to expand at a 4.9%/yr pace in 2021-3, quicker than the world’s 4.4% rate.

Pandemic-related disruptions to supply chains threaten to further drag on growth, while causing demand spikes that will prove only temporary.

Source: Bloomberg

Even as copper climbs toward $10,000, there’s evidence of a reluctance to spend on fresh mines. Miners don’t see a repeat of the 2000s, when China had an insatiable demand for raw materials. Today’s drivers — pandemic recoveries, stimulus spending and the shift toward decarbonization — are perceived as being transitory.

Raw materials producers are dealing with three major distortions to the demand outlook:

-

First, the trade war shifted the world’s two largest economies to a confrontational bias from a cooperative one.

-

Then the pandemic hit just as the worst of the trade turmoil seemed over. The resulting disruptions are being compounded by a stimulus-fueled recovery that has outpaced anything anticipated a year ago, but that won’t be the permanent state of affairs.

-

And, finally, the challenges surrounding climate change are complex. Copper, for example, is soaring partly on a greener future that looked to have been put on the back-burner a couple of years ago. However, the recent nickel price decline flags the dangers of seeing such gains as a one-way bet. For now there’s little to validate that decarbonization efforts will generate supercycle-level demand.

There is the potential that bond traders are underestimating inflation dangers, meaning they could once more suddenly adjust to the commodities rally. However, as I flagged before, if yields do spike that’s likely to then bring commodities crashing down.

The longer-term economic outlook, once we get past the immediate stimulus-fueled rebound, was looking anemic even before the pandemic intensified, and bonds are justifiably reflecting those dynamics. Commodities traders may want to take note.

Tyler Durden

Wed, 04/28/2021 – 12:08

via ZeroHedge News https://ift.tt/3nw9Ry8 Tyler Durden