“Don’t Expect Anything From The Fed”: This Will Be The Last “Uneventful” Meeting Before The Taper Discussion

Last night we quoted Std Chartered’s Steven Englander who explained why unlike the Fed’s upcoming June meeting (when there is a high chance Powell will bring up tapering), markets should not expect much if anything from today’s FOMC meeting.

Others, such as Jones Trading chief market strategist Michael O’Rourke, agree: “I don’t expect anything from the Fed,” he said in an an interview with S&P Global Market Intel.

This week’s Fed meeting “promises to be rather uneventful,” said Aneta Markowska, chief financial economist at Jefferies, in an interview. The committee will likely acknowledge that the U.S. economy has “inflected,” drawing on Fed Chairman Jerome Powell’s comments to CBS’s “60 Minutes” earlier this month. “I don’t really see scope for a more significant tone change,” Markowska said. “It’s definitely too early for any strong taper signals. I think they start ‘talking about talking about’ tapering in June.”

Deutsche Bank economists are also in the “it will be boring” camp, writing that today should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting. And in the press conference, they expect Powell will likely continue his subtle shift in tone in a more optimistic direction. However, they also think that given the remaining gaps in the labor market and the Fed’s focus on seeing actual rather than forecasted progress, April is too soon for the return of taper talk, and those discussions will heat up during the summer instead. So as with last week’s ECB meeting, today is likely to act as more of a placeholder rather than see any major headlines.

Echoing this, Goldman writes that while it expects the April FOMC statement to feature a more upbeat description of recent economic activity, beyond that the FOMC meeting should be uneventful: “we think it is clearly too soon for the FOMC to hint at tapering with core inflation low, the unemployment rate at 6%, and broader slack higher still”

While JPMorgan agrees that nothing market-moving is likely to emerge from today’s “nonevent” meeting which will have a “mostly unchanged statement”, and that the Fed is unlikely to change near-term holding pattern, it warns that taper talk + higher yields & dollar still around the corner. The bank does warn that this may be the last “uneventful” meeting before the taper discussion enters the formal Fed communication and the Fed ramps up into a policy normalization path. As such the risk is a bit skewed that there is some early hinting of this to come in the Powell press conference (though JPM Economists think it more likely appears first in the minutes to this meeting, which is published in mid-May). At the same time, there is minimal scope for the Fed to go the other way and inflame retracement lower in yields and the dollar. As the JPM team concludes,”we’ve continued to reiterate that the US exceptionalism theme as a source of support for the USD remains durable, and are staying long USD against low yielders (GBP, JPY, CHF, also NZD as a CB divergence RV trade).”

* * *

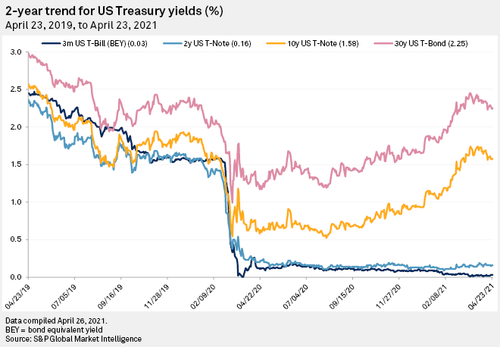

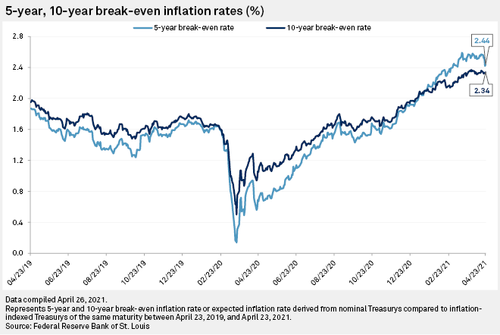

More importantly, as S&P Global reminds us, in its minutes from the March 16-17 meeting, the FOMC is now locked in on “outcome-based guidance” which dictates that monthly bond purchases will continue until “substantial further progress” is made toward the Fed’s maximum-employment and price-stability goals. Instead of altering policy in anticipation of a jump in inflation, the Fed now wants to see inflation run hot at or above 2% for some time.

Adherence to outcome-based guidance is “now part and parcel of the US central bank’s new policy of not reacting to perceptions of a direction of travel, but waiting until both goals of higher inflation and full employment has been achieved,” wrote Michael Hewson, chief market analyst at CMC Markets, in an April 26 note.

As market participants eagerly wait to see if the Fed will tap the brakes on its dovish monetary policy, Hewson, O’Rourke and many others expect no indication of change from the central bank at this week’s meeting.

And the Bank of Canada’s decision to cut its bond purchases will have no impact on the Fed’s quantitative easing path going forward.

“Not only are the QE programs of different scale and labor market progress at different points, but the Fed’s reaction function — starting tapering after substantial further progress is already made — is more dovish than the BoC’s reaction function — end tapering when the recovery is well underway,” wrote Matthew Hornbach, global head of macro strategy in an April 23 note.

Meanwhile, the bond and equity markets remain in the dark over when the Fed $120 billion in monthly bond purchases may be curbed. In an interview, James Knightley, chief international economist with ING, said he expects the Fed will make a formal taper announcement in December – well after many on Wall Street expect the first taper discussion some time in the summer – and he said a “volatile period” in asset markets is likely to follow.

“Transitioning from an environment where the Fed has the accelerator peddle pressed to the floor to one whereby they removing the foot from the accelerator and the perception is the next step will be to then tap the brake peddle is going to be one that carries the risk of higher bond yields,” Knightley said. “However, the greater risk for a bond market sell-off would be if the perception increasingly becomes one that the Fed is ignoring the threat of inflation and markets start to lose confidence.”

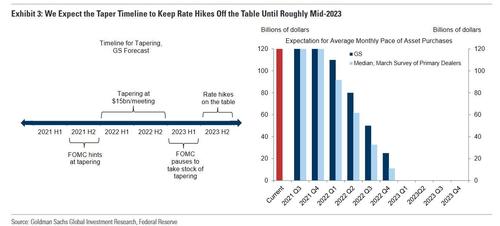

In an April 22 note, David Mericle, chief U.S. economist at Goldman Sachs, said he expects the FOMC to begin “hinting” at tapering in the second half of 2021 with actual tapering beginning in early 2022. The Fed would taper about $15 billion in bond purchases per Fed meeting, leaving about one year to complete the tapering entirely, he said.

“After that, we think the FOMC will want to pause to take stock of the impact of tapering for at least one and ideally two quarters, putting rate hikes on the table around mid-2023,” Mericle wrote.

“Market pricing implies about three hikes by the end of 2023, consistent with the FOMChiking at what we see as the earliest possible date and continuing at a steady once-per-quarter pace” Mericle said, adding that “that is certainly one plausible outcome, but we think it is somewhat more likely that inflation will not pass the bar for liftoff until early 2024. We would chalk up market pricing of one to two hikes by end-2023 to a mean vs. mode distinction that is not necessarily indicative of a genuine difference with our view.”

Futures markets have begun to price in a potential rate hike as soon as next year despite signals from Fed officials that one is not coming until at least 2024. According to the Goldman strategist, “pricing three hikes puts insufficient weight on a range of plausible scenarios in which the Fed would not hike in 2023, such as inflation being too low, or the economy slowing enough naturally as fiscal support fades or financial conditions tightening enough after tapering that the Fed sees a hike as superfluous.”

* * *

With all that in mind, here is the FOMC statement and Powell press conference preview from our friends at Newsquawk:

-

The FOMC is expected to reiterate an accommodative policy stance while expressing cautious optimism in the medium-term outlook.

-

There are no forecast updates due, and accordingly focus will fall on any constructive upgrades within the statement language (nothing major expected) and Chair Powell’s post-meeting press conference, which could offer some insight on the timeline and sequencing of the Fed tapering its asset purchases The Fed Chair might also begin defining the parameters of “substantial progress” means.

-

Despite the encouraging tone within recent economic data, Chair Powell will keep his optimism grounded in the context of the large slack that remains within the labor market relative to pre-pandemic; and analysts believe that should keep the risk of any explicit taper signal at bay.

GROWTH: The tone of incoming economic data has improved since the last meeting, and the Fed Chair has recently acknowledged that the economy was at an “inflection point”. There remains debate among economists regarding the sustainability of the recent growth impulse and labour market metrics (and how much of it is already priced in), with an argument that the series of fiscal stimulus may have engineered a front-loaded growth spurt, leaving the prospect of a more tepid performance ahead. The lack of visibility at this stage in the context of the 8-10mln Americans that remain out of work relative to pre-pandemic levels may keep Powell’s optimism somewhat anchored. Additionally, Powell will again emphasise that in the Fed’s new policy framework, it wants to see actual data that demonstrates that the economy is on track, not just expectations and forecasts.

INFLATION: On inflation, monetary policy officials globally have been making the point that they see any short-term spike higher in price pressures as a “transitory” phenomenon, related to pandemic base effects, higher energy prices, and possibly pent-up demand releasing as economies begin reopening. Expect Powell to stick to this script; the Fed chair recently responded to a Senator concerned about the risks posed by excessive monetary accommodation, stating that the Fed “does not seek inflation that substantially exceeds 2%, nor does it seek inflation above 2% for a prolonged period”. At least a couple of Fed officials have begun murmurings on this theme, so the Fed Chair may make this point again in his press conference.

TAPER: The Fed Chair has said that it is likely to take “some time” for “substantial further progress” to be achieved; his opening remarks will be scrutinised to see how these phrases evolve, which may offer insight into when the Committee will seriously debate tapering monthly asset purchases. Powell has previously said that when the Fed sees the economy “on track” to achieve this “substantial further progress”, it would communicate that observation, which would presumably result in firmer guidance on the timeline and sequencing of scaling back its purchase rate. Powell is yet to define the exact parameters of what “substantial progress” implies. A consensus seems to be building that any taper announcement might be flagged in June, ahead of a move later in the year. And while some expect the taper to begin in June, others note that the Fed will not want to rush and repeat previous mistakes of tightening too quickly.

BOND BUYING: Recent remarks made by a NY Fed official gave the impression that the Fed might tweak the weighted average maturity of its asset purchases to match the Treasury’s issuance profile (which has been lengthening). This did not transpire when the NY Fed published its latest purchase schedule. Any tweaks will be framed as purely technical– which is likely why the notion was discussed by a NY Fed official rather than a member of the policymaking FOMC–and not a sign of a change in monetary policy stance

IOER: There remains a risk that the Fed will lift the IOER rate due to the pressure on money market rates as bank reserves swell amid an abundance of liquidity chasing a limited collateral pool. Once again, however, these types of changes will be framed as technical, and not a signal about the direction of monetary policy. But some analysts have warned that it might be too soon to make IOER, or Overnight Reverse Repo rates, which may be more appropriate should the effective Federal Funds Rate slips beneath 5bps.

Tyler Durden

Wed, 04/28/2021 – 12:50

via ZeroHedge News https://ift.tt/3dXJRII Tyler Durden