Goldman Goes All-In Commodities, Sees “Biggest Jump In Oil Demand Ever” Over Next 6 Months

It’s time again for Goldman’s commodity permabulls to rise again.

Four months after the bank’s strategists declared the start of a new commodity supercycle, a declaration which quickly fizzled as oil slumped amid renewed covid shutdown fears and a bursting of the reflation trade, Goldman published a note overnight in which it goes “balls to the wall” long commodities, predicting that over the next six months we will see “the biggest jump in oil demand ever – a 5.2 mb/d rise over the next 6m, 50% larger than the next largest increase over that time frame since 2000 and almost twice as large as the biggest 6m supply rise since 2000.”

Here is the gist of Goldman’s argument:

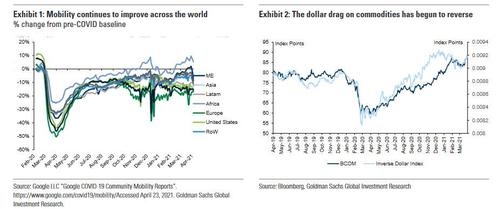

At the center of this recent period of consolidation in commodity prices was a plateau in activity levels due to renewed lockdowns in Europe, the shoulder months in commodity demand, and a macro headwind from a stronger dollar driven by rising rates. Now, all three of these factors are in the process of reversing.

Activity levels as measured by mobility have resumed their upward trajectory, particularly with the vaccination rollout in Europe now gaining momentum.

Alongside this resumption in rising activity levels is the seasonal upswing in transportation, manufacturing and construction that begins now and accelerates into June. It is important to remember that commodity markets are driven by volume, or the level of demand. Simply put, when the volume of demand exceeds the volume of supply, a scarcity premium is created which cannot be priced in ex ante.

* * *

The magnitude of the coming change in the volume of demand– a change which supply cannot match – must not be understated. At the same time the commodity supply is near inelastic in the short run – you cannot dig another mine or grow another crop in a matter of months.

As a result, Goldman’s Jeffrey Currie writes that commodity markets have looked through a sharp rise in COVID cases in India, even as “the macro headwind has turned into a tailwind with lower rates and a weaker dollar.”

In summary, Goldman now sees commodities rallying another 13.5% over the next six months, with oil reaching $80/bbl and copper reaching a new all time high of $11,000/t “with risks to the upside.”

Some more details from the report which is clearly having an (upward) impact on oil prices today:

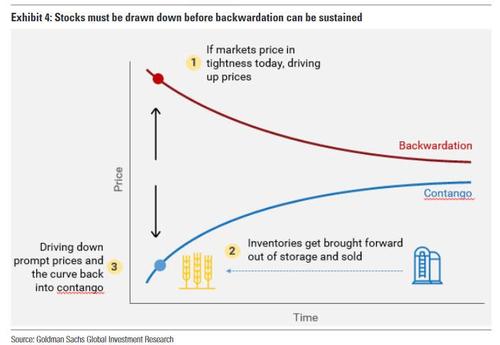

You cannot price future tightness today:

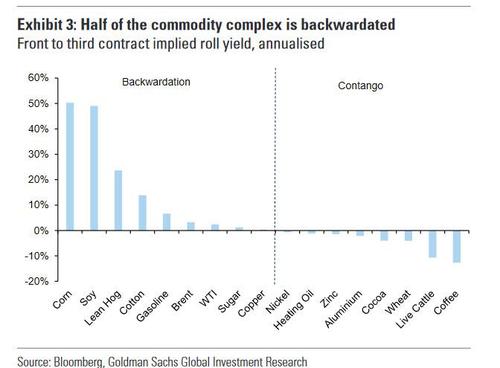

This expected surge in activity has been well flagged to the market. This begs the question – why haven’t commodities already priced this in? The key here is that commodities must price to equate the physical volume demand and supply in the market today – they cannot be forward-looking like equities. Stocks must be drawn down before a commodity scarcity premium – backwardation – can be sustained. If time spreads become backwardated in anticipation of future scarcity and tighter inventories, the current physical surplus would be pulled out of inventory and sold against the higher prompt prices, pushing the market back to where it started. Only physical scarcity can sustain backwardation, and importantly,backwardation is now in over half of all commodity markets (Exhibit 3).

This move toward backwardation across the complex also indicates a lack of inventories required to limit such rallies as physical markets get tighter. Precisely because commodities depend upon the level of demand, and only the level of demand exceeding the level of supply can create a physical scarcity premium in markets, can we be confident that sustained backwardation is showing us how commodity markets are becoming progressively tighter today.

Watch for the reopening re-rate in oil.

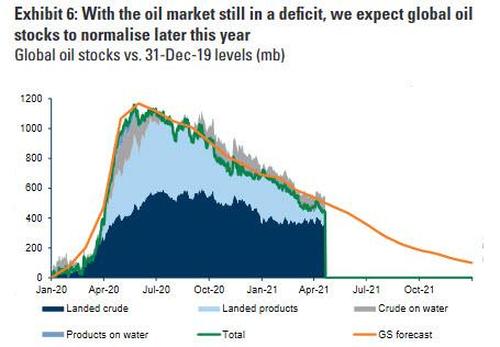

The level of global oil demand has been flat – around 95 mb/d over the past six months. While this was initially a positive surprise through the large second wave of COVID infections this past winter, it has become a speed bump to the recovery in oil prices so far this spring as demand levels flattened in India, Latin America, and parts of Europe. Importantly, we expect a significant rebound in global oil demand in coming months, key to our forecast for higher oil prices by this summer. First, we see a weakening link between lockdowns and economic activity/mobility due to more targeted policies and the ongoing ramp-up in vaccinations(with warmer weather likely to help as well). Cases already appear to be inflecting in Brazil, Chile and Europe, and plateauing in the first hit Indian state of Maharashtra. We are in turn seeing clear evidence of higher mobility in countries of advanced vaccination(US, Israel, UK), with for example US gasoline demand near 2019 levels and domestic jet demand up 20% since March.

As a result, we expect global oil demand to increase sharply by June, from 94.5 mb/d currently to 99 mb/d in 3Q21, as the pace of vaccination accelerates in Europe, finally unleashing pent-up travel demand. In particular,we expect the easing of international travel restrictions in May to lead global jet demand to recover by 1.5 mb/d (despite remaining 30% lower than pre-COVID levels this summer).

A broad-based policy-driven demand surge.

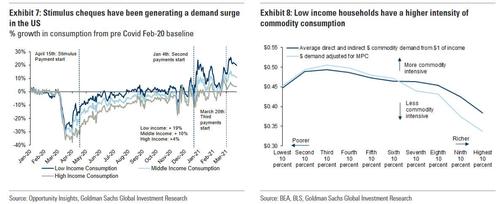

We stress that the tightness in commodity markets extends not only across the entire complex, but also across geographies and sectors, from the US, China and Europe, to construction, autos and retail. Everywhere is seeing large rises in the volume of demand. As we have argued since last year, at the center of this demand rise is a greater preference for tackling social need from policy-makers, rather than focus on macro-stability. From the European Recovery Fund giving 50% of the funding to Italy and Spain, to President Biden’s latest stimulus package, the focus on lower-income households has been clear. Recent high-frequency data in the US show a large surge in late April consumption that was driven by the $1400 checks that went out to 80% of US households last month.

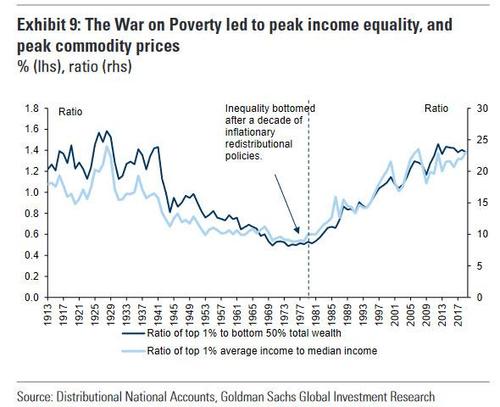

Policies to address income and wealth inequality shift unspent savings from a few high-income households to a large number of low-income households with a higher propensity to spend. Regardless of whether this is achieved through borrowing,taxing or other methods, it almost always assures the strong volumetric demand growth that lies behind an overheating economy and physical inflationary pressures. Today thisis visible in the US — from growing gasoline demand to greater meat consumption raising feed demand in grains. It’s perhaps no surprise, then, that all major commodity bull markets and inflationary episodes have been invariably tied to redistributional, or populist, policies that have reduced income and wealth inequality (Exhibit 9).

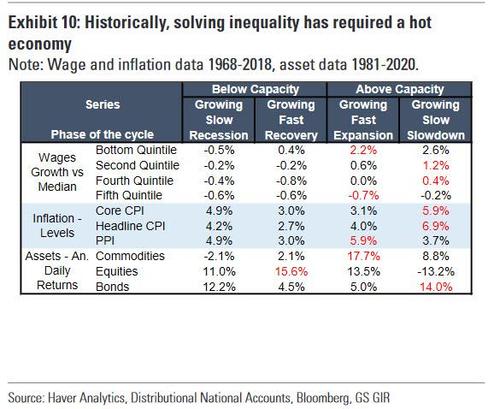

Indeed, we find that wage growth compression historically has only been achieved in overheatinge conomies as it requires reaching deep into the labor pool (Exhibit 10).

This can only occur late in the business cycle when scarcity makes sticky labor look more attractive than flexible capital.

Decarbonisation is now the backdrop for macro policy.

From discussion of a‘green leveling’ in the US to Chinese industrial policy based on ‘carbon security’, decarbonization is forming the overarching backdrop to a swathe of policy programs. This ascension of climate to policymaker’s top of mind reduces the left-tail risks to green capex, cementing the policy support at the center of our structural bull thesis for commodities. President Biden concluded his recent climate summit with a focus on how green capex creates jobs, an example of how ‘green leveling’ is being used to promote income equality.

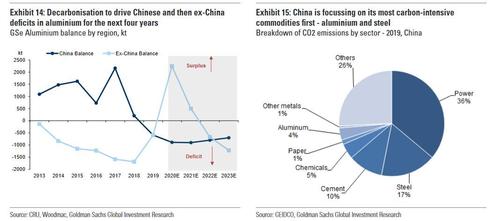

This is not dissimilar from past power-related infrastructure projects, like the Tennessee Valley Authority in FDR’s New Deal, which also had the benefit of addressing the environmental and social issues of the day. This extends to trade policy, where after focusing on agriculture, technology transfer and manufacturing jobs – areas associated with traditional protectionist policy – the US, China and Europe are all starting to shift their discussions of trade policy toward one centered around carbon border taxes and strategic competitiveness. Indeed, ‘carbon security’ is now becoming an issue of national importance – do countries have access to low carbon technologies, and the raw materials to expand key green sectors domestically? Members of both the Biden administration and the CCP are highlighting risks to sectors that cannot decarbonize before the imposition of these taxes. China’s imposition of national capacity caps alongside provincial emission targets sets the stage for tightening commodity supply. Within the metals complex, this is most impactful on steel (17% of current China emissions) and aluminum (4% of current China emissions).

Unlike the fleeting supply reform measures of the mid-2010s, the long-dated nature of decarbonisation targets suggests capacity constraints should remain in place and in turn have more sustained impact on fundamentals and price. We would note that China’s emphasis on moderating metal exports as part of rightsizing supply to domestic demand is an important bullish dimension for Western pricing.

Tyler Durden

Wed, 04/28/2021 – 10:10

via ZeroHedge News https://ift.tt/2Pvz8M5 Tyler Durden