Goldman Is Surprised At How “Narrow” Biden’s $1.8TN American Families Act Is: Full Reaction

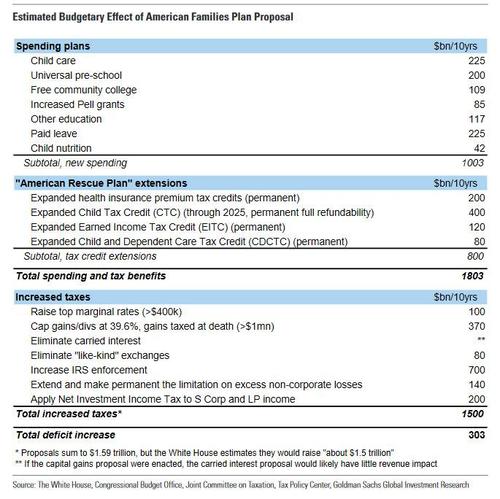

Earlier today, we previewed Joe Biden’s American Families Plan (AFP) which provides $1.8 trillion over ten years in new benefit spending and tax credits.

Commenting on the proposal, Goldman economist Alec Phillips writes that he was surprised by the focus of the released plan which is “somewhat narrower than we had initially expected several weeks ago, as it omits any housing or Medicare proposals and focuses solely on child care and nutrition,education, paid leave, and extending a number of the tax credits Congress enacted earlier this year.”

On the payment side, the White house proposes $1.5 trillion over ten years in additional taxes to cover most of the cost, with a capital gains tax hike contributing to this, but in today’s release the White House has provided few new details on the topic. The $303BN funding balance will come from an increase in the US budget deficit.

Biden will present the plan when he addresses a joint session of Congress at 9pm ET tonight.

Below we list the main points from the plan as summarized by Goldman:

1. The spending would be spread roughly evenly over the next ten years.

The White House release provides no details on the timing of spending, but judging by the types of spending President Biden proposes, it appears that the spending will be spread roughly evenly over the next ten years. An exception would be the expanded child tax credit that Congress recently enacted, which Biden proposes to extend only through 2025 (he proposes to make permanent a less expensive aspect of recent expansion). However, in essentially all other cases, the White House appears to propose to make these policies permanent. Some policies appear to phase in over several years (e.g., the paid leave proposal). The plan would increase federal spending (including tax credits) by around 0.75% of GDP in 2023-2024, and by a bit less in 2022, according to Goldman calculations.

2. The proposed savings from IRS enforcement are likely to look smaller once they reach Congress.

The White House estimates the proposal would produce $1.5 trillion in additional revenue, of which $700bn would come from closing the gap between what taxpayers owe and what they pay. The White House proposes to require banks to increase reporting of financial flows to the IRS, and to increase funding for IRS enforcement activities (media reports indicate this would raise $80bn over ten years, but the proposal does not include a figure). But according to Goldman, Congressional Democrats might have to look elsewhere to gain this much revenue. A reporting requirement is probably beyond what is allowed to be included in a reconciliation bill, and congressional budget scorekeepers seem unlikely to credit additional IRS funding with $700bn in new revenue. (Last year, CBO estimated a $40bn/10yr bump in funding would produce $100bn in additional revenue, for total savings of $60bn.)

3. The proposed capital gains tax hike also looks likely to face resistance.

President Biden proposes to tax capital gains and dividends at the top marginal rate (39.6%) and to tax gains greater than $1mn at death (under current law, the basis of an asset steps up at death to the transfer value, so the recipient has no taxable gain upon receiving it). The Tax Policy Center has estimated such a policy would raise around $370bn/10yrs. Even with exceptions for active businesses and even with a long payment schedule for any payments due—a recent congressional proposal would allow such taxes to be paid over 15 years — it seems likely that at least a few Democrats will raise concerns about the impact on family businesses and farms. In our view, a capital gains tax increase looks more likely to come in around 28% and to eliminate the step-up in basis at death but to stop short of actually taxing those gains upon death.

4. Health care is notably absent from the proposal.

The proposal includes an extension of the recently expansion of health insurance subsidies, but it omits the other Biden campaign proposals, like lowering the Medicare eligibility age to 60. The proposal also omits a substantial drug pricing reform proposal that the House passed last year and which might have cut Medicare drug spending by as much as $500bn over ten years. The omission is likely due to expected resistance from a few congressional Democrats whose support would have been necessary to pass the bill, and the fact that some of the proposal also omits the Medicare eligibility change. That said, there is still a chance that Congress will include more incremental savings measures in the upcoming legislation.

5. Congress will want to add and subtract.

At a minimum, we expect that congressional Democrats will want to add a reinstatement of the deduction for state and local taxes (SALT) that congressional Republicans capped in 2017. The policy would cost on the order of $80bn per year, or $400bn to reinstate it through 2025, after which it is already set to revert to the pre-2017 policy. Since most of the benefit would go to those with very high incomes, it looks unlikely that there will be sufficient support to fully reinstate it. Instead, we expect Congress to raise the cap to something like $50k,or reinstate it for taxpayers under a certain income threshold, which could be done at a fraction of the cost. Congressional Democrats might also have to choose among some of the new spending proposals, since Senate rules prohibit reconciliation bills from adding to the deficit after ten years. If the capital gains tax hike is scaled back or the IRS enforcement funding raises less revenue than the White House claims, some provisions will need to be made temporary or dropped from the bill.

6. The legislative strategy should be clearer in a few weeks.

Goldman outlined three potential scenarios for passing the White House proposal:

- pass one large reconciliation bill comprising the American Jobs Plan and the American Families Plan;

- pass two smaller reconciliation bills dealing with those separately, or

- pass bi-partisanbills dealing with traditional infrastructure and, separately, manufacturing and R&D incentives, with the remainder passing in a single reconciliation bill.

All 3 options appear to be under discussion. The congressional committees that handle infrastructure are assembling legislation they hope to pass under regular order (i.e., with bipartisan support), as are the committees dealing with manufacturing and R&D. They appear to be aiming for passage by late May or June.

7. The details will probably remain in flux until Q3.

Over the next several weeks, additional information on these proposals (particularly the scope of potential tax increases) is likely to come in three forms. First, informal comments in the media from centrist Democrats might clarify where the boundaries are on some issues. Second, at some point in May, the Biden Administration should submit a formal budget to Congress (so far the White House has sent only a partial proposal). This is also likely to include more technical detail on the proposed tax increases. Third, the committees with jurisdiction over some of the relevant issues—such as the tax-writing committees—are likely to begin to release details of their legislation that builds on the Biden proposal. However, the most important step in the process won’t come until July or September, which is when we expect the Senate to debate and pass the reconciliation bill. This process can be unpredictable, since congressional Republicans are apt to offer hundreds of amendments to the bill, some of which centrist Democrats might feel political pressure to support.

Tyler Durden

Wed, 04/28/2021 – 11:07

via ZeroHedge News https://ift.tt/2S2sP3u Tyler Durden