Obituary: SPACs

Submitted by Thomas Kirchner of Camelot Portfolios

Obituary: SPACs

-

SPACs no longer trade at premiums.

-

Their total size exceeds potential merger opportunities.

-

Many SPACs will liquidate unglamorously.

We last discussed SPACs in November, a few weeks before the mania went into overdrive. Since the beginning of April, however, issuance has crashed, as have SPAC prices. Despite being only one third into 2021, this year has already beaten prior year records with 308 SPACs raising just over $100 billioni, so a pause should not surprise anyone. Recent SPACs feature fashionable terms in their names such as “decarbonization” , “digital”, “climate” or “infrastructure” and often celebrities endorse the SPAC. Elon Musk seems to be the only celebrity not yet involved with a SPAC. But we believe he should, as we will explain below.

Return to rationality

Since late March, the market has found some sanity in pricing SPACs after their IPO and has returned to historical norms. While many SPACs traded at a premium to their $10 issuance price earlier this year, they have now returned to being priced at a discount to the per-share value of the trust account. (For readers not familiar with the mechanics of SPACs: IPO proceeds are placed in a trust account, which results in SPACs holding cash that is generally worth around $10 per share).

SPACs did not always trade at a premium to the issuance price, or to a premium to the cash trust. The return to this rational pricing alone could be called a bursting of a bubble. The mispricing earlier in the year was a strong sign of ignorance of many participants in the SPAC bubble. Moreover, while most SPACs traded at a premium to both the $10 issuance price and the value of the cash in trust, a small minority of SPACs held more than $10 in trust and had other shareholder-friendly features which would have justified a decent premium to $10. Yet, these SPACs traded at a discount to trust, albeit over $10. Clearly, many buyers bought SPACs without a rational understanding of the cash value.

… but what is rational can be debated

The problem is: a case can be made for both that SPACs should trade at discounts or premia to trust cash. Which one is right depends on the bigger picture.

On average, SPACs rise by 11% after the announcement of a mergerii . Therefore, it would be rational for SPACs to trade at a premium to cash to anticipate some of that future upside.

However, if you expect that most SPACs will fail to complete an eventual merger and will liquidate and pay out its trust cash, then SPACs should trade at a discount to trust cash.

If we work backward, then we can conclude from many SPACs trading at a discount to trust cash that the market expects the liquidation of most of them. This is consistent with press reports that cast doubt on the availability of sufficient private companies to complete SPAC deals.

Too many SPACs?

It is a sign of a bubble that market participants overestimate the potential size of the market. We believe that this is the case in the current SPAC market. Companies seeking to go public have multiple options. SPACs are not just competing with traditional IPOs, but also with direct listings, of which we have seen several examples during the last few years.

427 SPACs with a total of $138 billion in cash are currently looking to do deals. This includes 57 large SPACs with more than $500 million cash each, whose firepower totals $40 billion iii. These large companies are competing directly with the traditional IPO, where the bookbuilding process can actually add value in establishing relationships with investors, something that is lacking in a SPAC merger.

If you consider that SPAC mergers are done only in part for cash and that some of the target company’s pre-merger stock is rolled into the post-merger listed company, the total value of potential transactions is a multiple of the cash held by current SPACs. We see many SPAC mergers completed at enterprise valuations that amount to 3-5 times the amount of cash held in trust. Therefore, the current $138 billion held in trust could complete mergers with a total valuation of $414-$690 billion.

How plausible is it that this can happen? For comparison, total IPO volume in 2019 was $46.3 billion spread over 235 companies iv. We use 2019 as a reference instead of 2020 because that year was not yet impacted by the Covid crisis. This number represents the cash raised in IPOs, not the aggregate valuation of the companies taken public. This means that SPACs currently looking for companies to take private would have to find enough targets to result in three times the 2019 IPO volume.

This is unlikely to happen. Therefore, many SPACs will have to liquidate after failing to find a suitable target. It makes sense if the majority of SPACs trade at a discount to cash.

Which SPACs are likely to fail and liquidate?

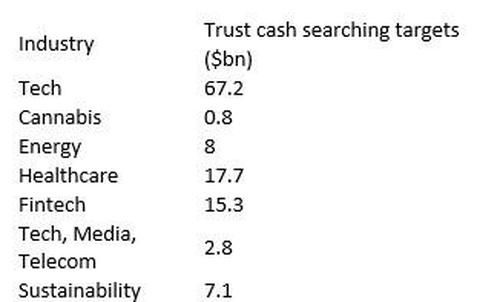

We can take this thought one step further and try to determine which SPACs are most likely to liquidate. SPACtrack.net has a helpful table that organizes SPACs by industry of prospective targets v:

Source: SPACtrack.net

SPACs are heavily geared to the technology sector, which is not a surprise because technology stocks tend to dominate the IPO market generally. With $67.2 billion currently in SPACs targeting this sector, technology alone would have to be twice the 2019 IPO volume. However, there is also ample supply of technology firms that need cash and would love to go public. Therefore, we believe that many of the SPACs in this group will complete a merger, although we would not expect them to be successful in the aggregate over a longer period of time as many of the targets will not be too early stage and will have low survival rates as they are common in venture capital-backed firms.

Particularly excessive also seems the dollar amount looking for fintech targets. While we have no doubt that there will more companies like Coinbase that will try to enter the public markets at very high valuations, we doubt that there are enough to allow SPACs to put $15 billion cash to work.

Healthcare, energy and sustainability are capital-intensive sectors where we believe that a few billion dollars can be invested without sponsors having to lower their standards and do bad deals for the sake of doing a deal.

What we find particularly striking is the small number of SPACs that target more traditional sectors such as finance (not fintech), mining and natural resources, consumer products and industrials (other than energy). Because of this scarcity, we believe that sponsors with expertise in these sectors should have an above-average likelihood of completing mergers that will turn out to be successful in the long run.

If Elon Musk had a SPAC for industrial and consumer products with a focus on the automotive industry we believe it could find a merger that could be successful long-term.

[i] spacresearch.com as of April 23, 2021.

[ii] Jason Draho,, Barry McAlinden, Jay Lee, Vincent Amaru: “SPACs: Investment considerations.” UBS, October 2, 2020. The analysis is based on SPACs that had an IPO and completed a merger between January 2018 and June 2020.

[iii] Camelot calculations based on spactrack.net data as of 4/23/21.

[iv] Source: Factset.

[v] spactrack.net/home/spacstats/ as of 4/23/21.

Tyler Durden

Wed, 04/28/2021 – 10:25

via ZeroHedge News https://ift.tt/332zUTP Tyler Durden