“Steady As She Goes”: Why Powell Won’t Rock The Boat Tomorrow

Be Steve Englander, head global G10 FX at Standard Chartered

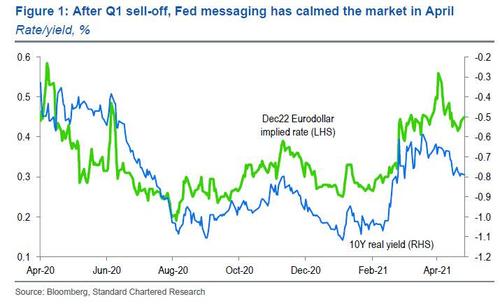

The Fed put a lot of effort after the March FOMC meeting into convincing bond investors that it was not thinking of changing its view of low inflation and low policy rates through 2023. There is increased optimism but not additional economic data since, so we think the Fed will try and keep the message as unchanged as possible. The lack of bond yield reaction to sharp data surprises has led investors to be cautious on the immediate upside to bond yields. Real yields are almost 20bps lower than at the March FOMC (Figure 1). There is no real appetite to fight the Fed now and the Fed has little incentive to rock this boat just yet.

This makes it hard for the FOMC to convey a dovish message beyond what the market has absorbed already. The risk is that normally innocuous statements like ‘the next few months may give us more information on the strength of the recovery’ could be seen as signalling an early consideration of tapering or as defining substantial progress. While some market participants think the FOMC may intentionally convey a slightly more hawkish stance, we think the risk is that an inadvertent comment scares the market. There seems little upside in trying to nuance bond prices and reigniting premature tightening fears.

Yields may not immediately spike higher, but bond prices could be increasingly vulnerable if near-term data continue to surprise to the upside. We think the 10Y UST will most likely trade in a 1.50-1.75% range near-term but see the risks as skewed towards travelling towards the top of that range if the Fed and data-flow play out as we expect. (see Early Indications Point To 1.5 Million Jobs Number).

The one dovish signal that Powell could convey is that the Fed would measure its success by how few people were left without work once job creation began to level off, not how many jobs were created in the early stage of reopening. This would mean that the Fed would be looking at late Q3 and early Q4 data to decide whether sufficient progress has occurred.

We doubt Powell is ready to provide a full definition of ‘sufficient progress’ that would encourage a Taylor rule type of market reaction. On the whole we think he will convey that the FOMC is not yet thinking about shifting its dovish stance – if March was too early, then April with a few added data points is unlikely to shift the dovish stance. This is an instance where the Fed wants to dampen investors’ forward-looking instincts.

Tyler Durden

Tue, 04/27/2021 – 22:00

via ZeroHedge News https://ift.tt/3vuzDWd Tyler Durden