Bitcoin, Ethereum Face Huge $4.5BN In Friday Option Expiration: What To Expect

Authored by @bit_hedge

With Ether knocking at $3,000 (+280% ytd) and Bitcoin consolidating at the $1T market cap level after record 1-day BTC options volume last week on Deribit Exchange, the two cryptocurrencies face a combined $4.5BN in contract expirations this Friday.

Bitcoin in particular has been showing a particularly strong and positive ‘un-stick’ effect post expiration for the past few months, presumably as dealers unwind their hedges and remove liquidity in the days following.

#btc opex ‘un-stick’ in play next week? $3.7b to roll off on friday. @DeribitExchange pic.twitter.com/rVytdYPFvZ

— bithedge | gamma model wip (@bit_hedge) April 27, 2021

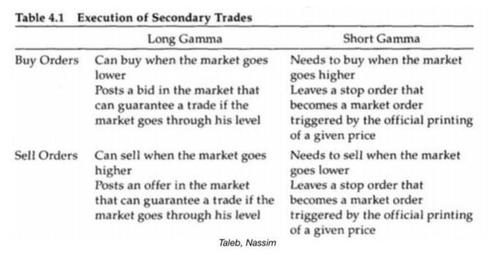

But with 18 hours remaining, as gamma ticks up at an accelerating rate into expiry options-driven flows could begin moving spot significantly right now – as market makers have to trade increasingly large clips to stay directionally neutral. The desks handling most options volume are there to collect at the spread… if they’re short calls and spot picks up, they’ll market buy into the rally to stay hedged.

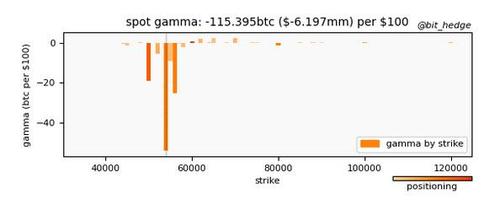

This can be a significant chunk of order-flow: right now our models have it estimated at $6.2mm to buy/sell for every $100 increase/decrease in spot.

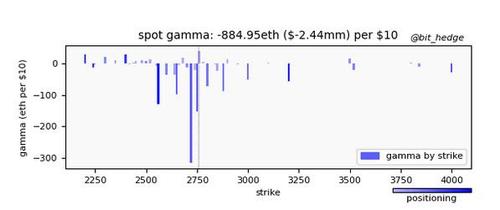

And for the smaller-market ETH, $2.4mm to buy/sell for every $100 increase/decrease in spot.

These large gamma strikes don’t necessarily have to be the areas of highest open interest (although they often are). What matters is if dealer inventory is skewed to long or short gamma – whether they have to chase price or suppress price. In this case both cryptocurrencies look to have the volatility amplifier that is short gamma (chase).

In fact, this is such a long-call and long-put heavy expiration, that there seems to be almost no positive gamma at all! Exception: 60k strike on BTC. However, spot would have to move significantly closer to that level for it to come ‘into play’.

Given ETH’s current position we’d expect increasing volatility into expiration with the potential for negative gamma at the 2560 and 3200 strikes to lead into a reflexive melt-down or melt-up should we push closer to either of those areas. Currently a cluster of long puts at 2720 is exhibiting the biggest ‘pull’ on spot.

For BTC, serious negative gamma to the downside at the 50k strike presents a possible target should things head south: although a v-shape recovery back as dealers re-buy into strength would be just as likely. Should we miraculously tap 60k before expiry, long-gamma ‘insulative’ flows there could lead to a ‘pinning’ as dealers pad the book. As spot currently stands, whip-lashing around the two large strikes at 54k and 56k looks likely to us.

We expect the continuing evolution of the crypto and crypto options markets to come with the ‘tail wags the dog’ options-driven phenomenon that has gripped the equity complex and look forward to watching it unfold.

Tyler Durden

Thu, 04/29/2021 – 13:04

via ZeroHedge News https://ift.tt/3gTpRbZ Tyler Durden