“Crash Up” Possible As “Demand For Downside Rages On” Despite Gains, Nomura Warns

As equity markets slowly push to higher highs, Nomura’s Charlie McElligott notes something odd is going on in the options markets.

The demand for downside rages-on, with Put Skew crazy bid (1m 89.7%ile, 3m 93.2%ile, 6m 96.5%ile!), while upside Call Skew remains Charmin-soft (1m 24.1%ile, 3m 29.8%Ile, 6m 28.9%ile)

This trend has been in place for about a month, and notably the last week or so has seen it re-engaged… As stocks have rallied, a bid for hedges has accelerated.

Source: Bloomberg

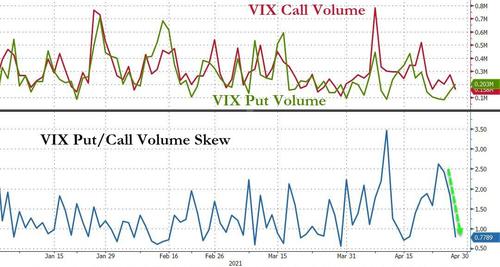

On the other hand, the demand for VIX downside (bullish stocks) has recently surged relative to VIX upside (bearish stocks)…

Source: Bloomberg

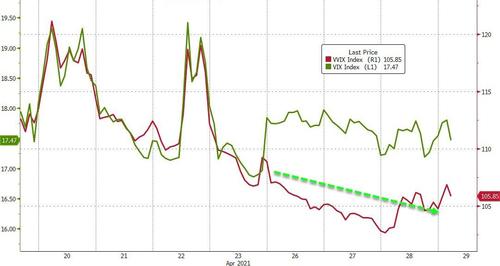

Additionally, ‘vol of vol’ has started to signal downside risk for VIX (bullish) for stocks…

Source: Bloomberg

Finally, we note that SpotGamma’s analysis also suggests short-term bias to the upside:

We still track ~20% of S&P gamma and ~30% of QQQ gamma expiring Friday.

These are large amounts.

Everything we’re seeing seems to point to a fairly volatile period over the next several days, particularly to start next week.

This volatility does not have to necessarily manifest in lower markets, it could also indicate a breakout to the upside.

We are currently giving the “upside” an edge due to the negative gamma position in QQQ/IWM.

All of which fits thematically with McElligott’s view that continues to see “Crash UP” in “Cyclical Value” / economically-sensitive stuff maintaining its bid.

So, is today’s tumble a fake-out for the next push to record highs, forcing the heavily-hedged to puke their protection, send stocks to higher-highs before the reality of 50%-plus capital gains taxes and all that the Biden admin has to offer along with surging interest rates start to bite into equity valuations.

Besides, even Fed Chair Powell admitted stocks are “frothy”.

Source: Bloomberg

Tyler Durden

Thu, 04/29/2021 – 12:27

via ZeroHedge News https://ift.tt/3eMsl9E Tyler Durden