Dollar Dumps In April As S&P Does Something It’s Never Done Before

April saw gold, bonds, and stocks (The Dow) all rise around 2% while the dollar fell around 2% against its fiat peers…

Source: Bloomberg

All major US equity indices ended April higher with Nasdaq 100 leading the way and Small Caps lagging…

Source: Bloomberg

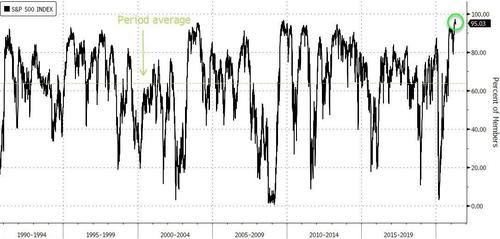

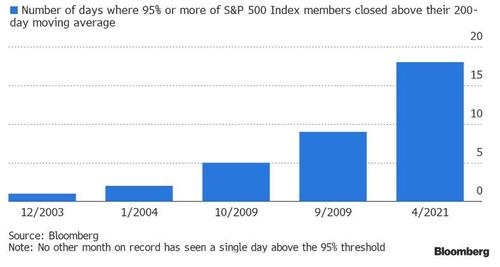

And while the 5%-ish gain for the month in S&P is notable, during 18 sessions this month through trading on Thursday, 95% or more of the index’s members traded above their 200-day moving average.

Source: Bloomberg

That’s the most days ever observed in a single calendar month and double the previous high of nine days in September 2009.

Source: Bloomberg

“The fact that 95% of the S&P 500 is now above its 200-day moving average is NOT a bullish sign,” Matt Maley, chief market strategist for Miller Tabak + Co., wrote in an April 26 note.

“Yes, a high number of stocks above their 200 DMA’s is usually positive, BUT it is NOT bullish when the number becomes extreme (like it is now…at 95%). In other words, this data point is much like sentiment. When it is strong, it is positive…but when it becomes extreme, it becomes a contrarian indicator!”

Remember, if stocks are up…

Trannies continue their all-time record streak of weekly gains (now 13 weeks in a row) while the other US majors struggled on the week (with Nasdaq 100 the biggest laggard)…

Source: Bloomberg

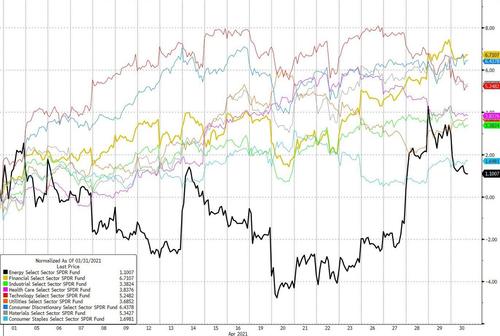

Financials managed to lead the S&P sectors on the month (despite lower yields) and the Energy sector was laggard (despite surging oil prices)…

Source: Bloomberg

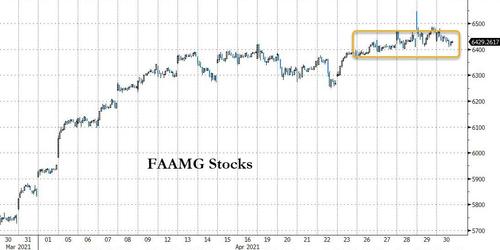

Despite crushing earnings this week, FAAMG stocks went nowhere (though were up large on the month)…

Source: Bloomberg

Treasury yields were lower on the month with the long-end down 11bps, 2Y unch. This was the first monthly drop in yields since November (and biggest 10Y Yield drop since July)

Source: Bloomberg

Treasury yields were higher on the week with the long-end up around 7bps

Source: Bloomberg

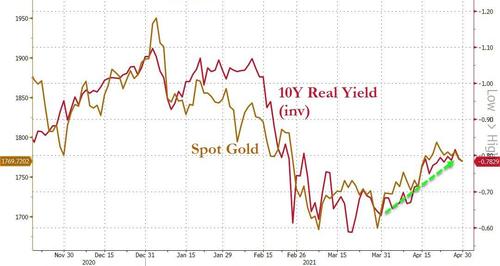

April saw Real Yields tumble (and drag gold higher with them)…

Source: Bloomberg

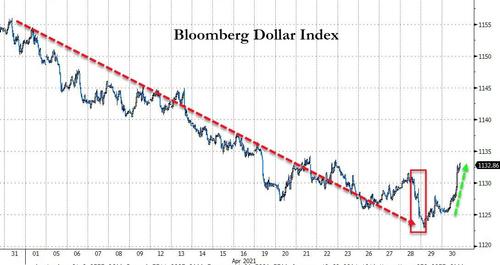

April saw the dollar on a one-way dump all months, ending down almost 2% – the first monthly loss since Dec 2020. The last three days saw the dollar whipsawed as Fed losses were reversed and stops run…

Source: Bloomberg

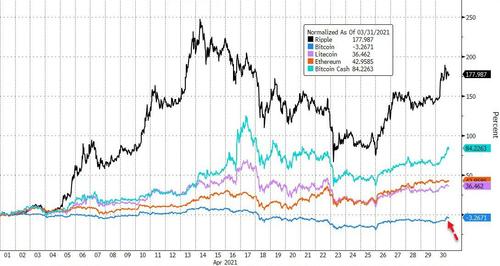

Bitcoin surged today, reversing some of April’s Ethereum outperformance…

Source: Bloomberg

Ripple was up 177% in April, Ethereum was up 43%… and Bitcoin slipped 3%…

Source: Bloomberg

After reaching record highs at $65,000, Bitcoin saw its first monthly loss since September…

Source: Bloomberg

Ethereum ended the month at its record highs, despite a couple nasty drawdowns…

Source: Bloomberg

Commodities soared in April – the best monthly return since Feb 2014…

Source: Bloomberg

Copper was among the best performers in April – back near record highs – and crude also performed well. Gold saw its first positive month of the year..

Source: Bloomberg

Copper and Crude rallied this week as PMs modestly lagged.

Source: Bloomberg

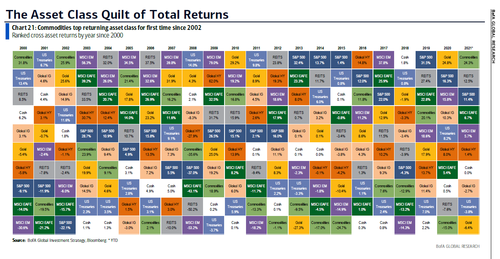

Commodities are the top-performing asset for the first time since 2002…

Finally, after 8 straight months of yields rising with soaring commodity prices, April saw that correlation regime collapse with bonds bid (yields dropping) despite spike commodity prices.

Source: Bloomberg

We wonder who’s right? Bonds or Commodities?

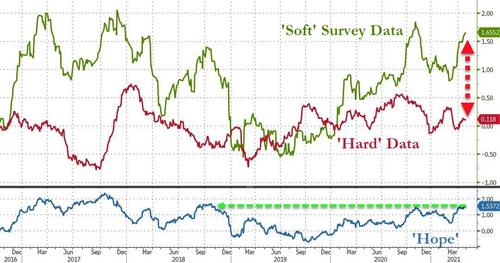

Depends if you trust ‘real’ economic data or ’emotion’-based surveys?

Source: Bloomberg

“Hope” is still not a strategy.

Tyler Durden

Fri, 04/30/2021 – 16:00

via ZeroHedge News https://ift.tt/3vDzhwB Tyler Durden