Exxon Pays Down Billions In Debt Thanks To Soaring Cash Flow

After loading up to the gills during the 2020 oil crash, Exxon is slowly but surely emerging from the crisis period (which it survived without slashing its dividend unlike so many of its peers) and moments ago the former world’s largest company reported stellar earnings which beat across the board, but more importantly, revealed a surge in cash flow as oil prices have rebounded, allowing Exxon to not only comfortably pay its dividend and capex, but also aggressively pay down debt: the key line from CEO Darren Wood.“Cash flow from operating activities during the quarter fully covered the dividend and capital investments.”

Here are the Q1 highlights which as noted, were solid across the board:

- Revenue $59.2bln (exp. $4.60bln);

- EPS $0.64 (exp. 0.59),

- Capex $3.1bln (exp. 3.33bln, -4bln Y/Y)

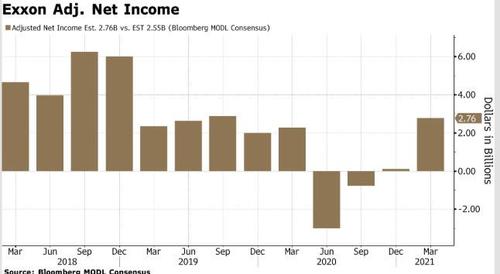

The company’s Adjusted net income of $2.76BN (above the $2.55BN expected), was the first profitable quarter for XOM since Q1 2020:

Needless to say, higher commodity prices drove Exxon’s first-quarter profit. Exxon’s average realizations for crude oil rose 42% from the fourth quarter, while natural gas realizations climbed 33%.

As for CapEx, Exxon said it was keeping its capital budget at $16 billion-$19 billion this year, a level that management has said is rock bottom, probably below maintenance levels, adding that “If market conditions continue above the company’s planning basis, additional cash will be used to accelerate deleveraging.”

Some more details on Q1 financials:

- Upstream earnings 2.55bln (exp. 2.62bln)

- Chemical earnings 1.42bln (exp. 970mln)

- Cash flow from operations and asset sales 9.57bln (+50% Y/Y)

- Downstream loss 390mln (exp. loss of 134mln)

Here Bloomberg notes that as with Shell, Exxon enjoyed the strong upswing in the chemical market. The company generated $1.4 billion in adjusted net earnings (total adjusted earnings were $2.7 billion). Exxon said it benefited from “continued strong demand, global shipping constraints, and ongoing supply disruptions, particularly in North America, where the polyethylene and polypropylene markets were affected by severe winter weather in Texas.”

And some more on chemicals, which is benefiting from the current rage in house-building, a trend that should be enough to move the needle even for an oil giant the size of Exxon. As such, BBG notes that “Its chemicals division is being lifted by surging prices for plastics.” The cost of PVC, used in pipes, and polypropylene, which packages consumer goods, reached record levels earlier this year, driven by a combination of strong demand and production outages caused by the winter storm and back-to-back hurricanes last year.

Volumes/production:

- Worldwide Net production of BOE/D: 2.258mln

- Refinery throughput 3.75mln BPD (-7.6% Y/Y)

- Natural gas production (mcfd): 9.173mln (exp. 8.870mln)

- Chemical prime product sales (KT): 6,446 (+3.4% Y/Y)

- Downstream petroleum product sales: 4.88mln BPD (-7.7% Y/Y)

The numbers would have been even stronger had it not been for the freak February Texas freeze: Like Chevron, Exxon reported a hit to earnings from the winter storm that pummeled Texas in February, amounting to nearly $600 million: “the severe weather event reduced first-quarter earnings by nearly $600 million across all businesses from decreased production and lower sales volumes, repair costs, and the net impact of energy purchases and sales. All affected facilities have resumed normal operations.”

And yet, despite the storm-related disruptions, overall refining throughput last quarter was “essentially flat” with the fourth quarter as it managed refinery operations in line with fuel demand and integrated chemical manufacturing needs.

But while the top and bottom line were solid, what matters was the cash flow, and it was stellar, coming in at $6.1 billion (thanks to $9.3BN in cash from operations, more than the $6.3BN estimate) and more than enough to cover the $3.7 billion the oil giant pays in dividends each quarter. That freed up money to pay down debt, and fund a likely (small) increase the capital budget next year.

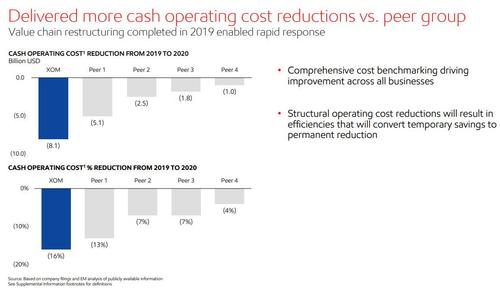

This was in large part thanks to some of the best operating cash cost reductions in the industry.

The company’s guidance was solid across all sectors: :

Upstream Guidance (via slides see below):

- Lower volumes with seasonal gas demand and higher scheduled maintenance

- UK North Sea sale expected to close near mid-year, subject to regulatory and third-party approvals

Downstream Guidance

- Continuing demand improvement with economic recovery

- Higher planned turnarounds and maintenance

Chemical Guidance

- Continuing tight supply/demand balance with increased industry maintenance

- Higher planned turnarounds and maintenance

Notably, Exxon said in its slide presentation that its Permian drilling and completion costs have declined 40% versus 2020, as have lease operating expenses. Last year’s pandemic has forced price reductions for oil services. In fact, that’s allowed producers to slash CAPEX without cutting too much of their oil production.

Finally, the presentation has several slides dedicated to the hostile proxy fight with Engine No 1 (which bought a few millions XOM shares and thinks it can decide strategy) as well as its much better relationship with that other, and far more respectable activist, DE Shaw.

Full presentation below

Tyler Durden

Fri, 04/30/2021 – 08:22

via ZeroHedge News https://ift.tt/2RcLPvM Tyler Durden