Futures Slide On Last Day Of April Despite Blowout Earnings And Econ Data

U.S. index futures slumped on the final trading day of April, dragged lower alongside European and Asian markets, despite stellar economic data and blockbuster earnings as traders took a month-end breather amid a record high for the S&P 500 Index and some earnings disappointments. The dollar pared April losses, and the VIX jumped.

Russell 2000 futures tumbled 1.1% and Nasdaq 100 futures dropped 0.8% after China’s antitrust crackdown weighed on Asian technology shares. Twitter plunged 13% in premarket trading after forecasting second-quarter revenue below some expectations, while Amazon’s blockbuster earnings helped push the stock to all time highs, although gains were trimmed in the premarket.

As Bloomberg notes, confidence in the U.S. economy has surged amid a string of positive data culminating in a report Thursday that showed quarterly growth at an accelerated 6.4%. Given the Federal Reserve’s dovish resolve, that emboldened investors to stay bullish on stocks despite concern about high valuations. Some speculated Fed Chair Jerome Powell will come under pressure later this year to reassess the extent of accommodation.

Meanwhile, earnings continue to be impressive and with just over a half of S&P 500 companies reporting earnings, about 87% beat market expectations, the highest level in recent years. For both the MSCI world index and the S&P500, analysts are expecting earnings in the next 12 months to recover to above pre-pandemic levels.

“The trouble is the asset froth that results from this — we see asset valuations very, very stretched,” said Yves Bonzon, chief investment officer at Julius Baer Group Ltd. “Will Chairman Powell blink and start to guide for slightly less accommodative policy sooner than expected? That could be a risk as early as the third quarter.”

But not yet, and the MSCI’s index of world stocks covering 50 markets dipped 0.1% but remained close to a record peak touched the previous day, up 5% on the month.

“The Federal Reserve continues to support, Biden has this huge stimulus programme as well and the earnings season continues — so far we have seen relatively benign as well as strong earnings,” said Eddie Cheng, head of international multi-asset portfolio management at Wells Fargo Asset Management.

Europe’s Stoxx 600 Index reversed earlier gains and fell as much as 0.4% to a session low, with basic resources the worst-performing European sector, sliding 1.6%; Technology -1%, Travel & Leisure -0.9%, Energy -0.9%; Telecoms, Healthcare and Insurance are only industry groups out of 20 that are in the green. Here are some of the biggest European movers today:

- AstraZeneca shares rise as much as 4.4% after the company reported profit and sales that exceeded analyst estimates in the first quarter and reiterated FY guidance. The company’s cancer drugs are among key products helping overcome disruption from Covid-19.

- Signify shares jump as much as 7.9% to a record after first-quarter results that Degroof Petercam said were “much stronger than anticipated,” saying results were supported by robust consumer demand for digital products.

- Banco Sabadell shares jump as much as 7.4% to highest in more than a year after the Spanish lender reported earnings that Barclays says are good, with solid commercial trends.

- Barclays shares drop as much as 7.5% after the bank warned that costs are rising and reported a quarterly bad debt provision of GBP55m, despite peers releasing funds this week. Strength in the investment banking arm came at a cost, adding to the firm’s bonus expenses.

- Scatec shares drop as much as 12% after earnings. Pareto says the Norwegian solar firm had a “mixed quarter” and adding that long- term it “will be difficult for Scatec to live up to what we view as unrealistic market expectations on future growth and profitability.”

Eurozone GDP and inflation data surprised to the upside, with economic growth shrinking -0.6%, better than the -0.8% expected, while HICP came in at 1.6%, in line with expectations as unemployment of 8.1% was also better than tha 8.3% expected. France, the euro zone’s second-biggest economy, saw stronger than expected growth in the first quarter.

“The speed of the vaccinations is picking up and the EU recovery fund is also finally getting off the ground” said Commerzbank analysts adding that “there is increasingly bright light at the end of the tunnel.”

It wasn’t all roses: Q1 GDP in largest economy Germany fell more than expected on a seasonally adjusted basis. Germany’s 10-year Bund yield, which moves inversely to price, slipped 0.009% to -0.202%. The German economy contracted by a greater than expected 1.7% in the first quarter as a lockdown in place since November to contain the coronavirus stifled private consumption in Europe’s largest economy, data showed on Friday.

“The coronavirus crisis caused another decline in economic performance at the beginning of 2021,” the Federal Statistics Office said. “This affected household consumption in particular, while exports of goods supported the economy.” A Reuters poll had pointed to a first-quarter contraction of 1.5%.

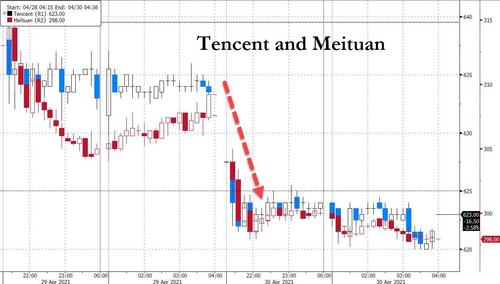

Earlier in the session, Asian stocks fell as China’s crackdown on technology and its disappointing economic data damped sentiment. The MSCI Asia Pacific Index was down 0.9% on Friday, with Hong Kong’s Hang Seng Index leading the region lower, falling 2% after Chinese regulators imposed wide-ranging restrictions on the financial divisions of 13 companies. Tencent and Meituan, which dropped 3.6%, were among the biggest drags on the MSCI Asia Pacific Index.

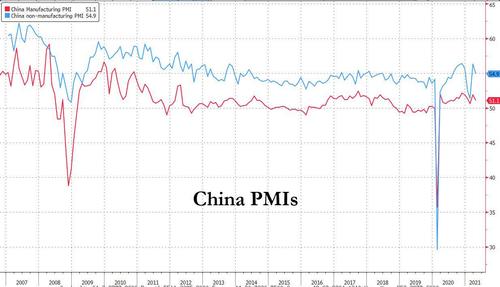

Chinese shares also took a hit after data showed manufacturing slipped in April and the services sector weakened. The April NBS manufacturing PMI fell to 51.1 from 51.9 in March and below the 51.8 consensus while Caixin manufacturing PMI improved to 51.9 from 50.6 in March. Mixed signals from two manufacturing PMI surveys due to sample differences likely suggest relatively faster growth in machinery manufacturing sectors in April and solid external demand. Overall, manufacturing growth remained decent in April. The NBS non-manufacturing PMI moderated to 54.9 from 56.3 in March, also missing the 56.1 consensus. Construction activities decelerated more meaningfully than services.

Energy and financials pushed the CSI 300 Index down 0.8%. Asian stocks are still headed for a gain of more than 1.6% in April, their third monthly advance in four. Material and tech stocks are leading the advance as investors continue to bet on a global economic recovery. Taiwan’s Taiex index, which is closed for a holiday along with Vietnam, gained almost 7% in April, the best performance in the region so far. Taiwan equities are “set to keep EM Asia leadership,” driven by a brighter outlook on exports as developed market economic activity continues to pick up, Bloomberg Intelligence analyst Marvin Chen wrote in a note.

New coronavirus infections in India surged to a fresh record and France’s health minister said the dangers of the Indian variant must not be underestimated. “Risky assets have had quite a few wobbles within the month,” said Eddie Cheng, head of international multi-asset portfolio management at Wells Fargo Asset Management.. “We need to get used to the fact that this is not going to be a straight line.”

In rates, the 10-year Treasury yield was steady and on course for the biggest monthly decline since July. Treasuries were little changed as U.S. trading gets under way after paring Asia-session declines that were led by a supply-induced selloff in Australian bonds. Yields are higher by less than 1bp across the curve, 10-year 1.64% vs session high 1.658%; 50-DMA at about 1.59% Friday continues to provide support. Yields are higher on the week, in which stocks, commodities and inflation expectations have moved up, but Treasuries remain on pace for their first monthly gain since November. 10-year yield touched 1.686% Thursday, highest since April 13, and is 8bp higher on the week, reflecting inflation concerns that persist despite the Fed’s view of a still-fragile U.S. economy.

In FX, the Bloomberg Dollar Spot Index was higher as the greenback advanced against most of its Group-of-10 peers after it got some traction as London trading got underway. The dollar advanced beyond the 1.21 handle versus the euro despite mostly better than forecast data out of the euro zone. The pound trailed both the dollar and euro as investors prepared for next week’s Bank of England meeting; banks are divided over whether policy makers will taper bond purchases or wait until later. Scandinavian currencies were the worst G-10 performers but were still set to end the month as peer-group winners. The Australian dollar was steady while the nation’s bond yields rose, tracking higher Treasury yields and ahead of a 2031 bond auction; kiwi bonds slid after a very large offer emerged at the central bank’s QE operation. The yen rebounded from a two-week low as a decline in equities supported demand for haven assets ahead of a holiday in Japan next week.

In commodities, oil prices took a breather after hitting six-week highs on strong U.S. economic data, on concerns about wider lockdowns in India and Brazil. Brent slipped 0.54% to $68.19 per barrel, after having hit a high of $68.95 on Thursday, while U.S. West Texas Intermediate (WTI) fell 0.78% to $64.50 per barrel.

To the day ahead now, in the US we get the personal income and personal spending data for March, the MNI Chicago PMI for April and the final University of Michigan consumer sentiment index for April. From central banks, the Fed’s Kaplan will be speaking, while earnings releases include Exxon Mobil, Chevron, AbbVie and Charter Communications.

Market Snapshot

- S&P 500 futures down 0.3% to 4,191.25

- MXAP down 0.8% to 207.06

- MXAPJ down 0.9% to 698.55

- Nikkei down 0.8% to 28,812.63

- Topix down 0.6% to 1,898.24

- Hang Seng Index down 2.0% to 28,724.88

- Shanghai Composite down 0.8% to 3,446.86

- Sensex down 1.4% to 49,046.71

- Australia S&P/ASX 200 down 0.8% to 7,025.82

- Kospi down 0.8% to 3,147.86

- Brent Futures down 0.83% to $67.99/bbl

- Gold spot down 0.15% to $1,769.56

- U.S. Dollar Index up 0.2% to 90.793

- STOXX Europe 600 was little changed at 439.11

- German 10Y yield fell 1 bps to -0.202%

- Euro down 0.21% to $1.2096

Top Overnight News from Bloomberg

- The euro-area economy slid into a double-dip recession at the start of the year as strict coronavirus lockdowns across the region kept many businesses shuttered and consumers wary to spendU.K. house prices surged at the strongest pace since 2004 this month as the country eased out of lockdown and buyers rushed to take advantage of an extended tax break on purchases

- Copper’s surge toward a record high is starting to cause stress for industrial consumers in China, such as manufacturers of electric wire and end-users such as power grids and property developers

- World powers are working to restore their nuclear agreement with Iran by the middle of May, before a key monitoring deal expires, with talks now in their third week bogged down over which sanctions the U.S. intends to lift

- UBS Group AG will relocate its Tokyo-based rates trading business to Sydney by the end of this year as the Swiss bank reorganizes its Asia-Pacific operations

Quick look at global markets courtesy of Newsquawk

Asian stocks traded subdued after the momentum from yesterday’s intraday rebound and fresh record highs on Wall Street waned, with the region tentative on month-end and as participants digested an influx of earnings and mixed data releases, while an extended weekend for key markets in which Japan and China will remain closed through to Wednesday also contributed to the paring of risk. ASX 200 (-0.8%) declined with broad early pressure across all sectors. In addition, the recent pullback in copper from a decade high and announcement by ANZ Bank of a substantial impact to its H1 net also added to the sombre mood. Nikkei 225 (-0.8%) was dragged lower by currency inflows and amid an overload of recent earnings releases ahead of its 5-day closure but with losses stemmed following stronger than expected Industrial Production data and after the Japanese cabinet approved the use of JPY 500bln in reserve funds to support businesses impacted by pandemic and curbs. Hang Seng (-2.0%) and Shanghai Comp. (-0.8%) weakened heading into the Labor Day holidays for the mainland and amid a deluge of corporate results including the largest banks which were pressured after relatively tepid earnings growth amongst China’s big four banks although PetroChina was bolstered following a jump in earnings. There were also concerns regarding a crackdown on the tech sector after Chinese regulators warned of tighter oversight for its tech giants and ordered 13 firms to adhere to tighter regulation of data and lending practices, while markets also reflected on the latest Chinese PMI data in which official Manufacturing and Non-Manufacturing PMI disappointed but remained in expansionary territory and Caixin Manufacturing PMI topped estimates. Finally, 10yr JGBs were steady after the indecisiveness in T-notes and amid the lack of BoJ purchases in the market today, while the central bank also recently announced its bond buying intentions for May whereby it maintained the amounts and frequency of JGB purchases across all maturities.

Top Asian News

- Pertamina Exploration Unit Said to Mull $3 Billion Jakarta IPO

- China Policy Banks Postpone Earnings, Echoing Last Year’s Delay

- Taiwan’s Economy Grows Fastest Since 2010 on Export Boom

- China Stocks Fall After PMI Data, Tech Leads Drop in Hong Kong

Major bourses in Europe are again subject to lacklustre morning trade (Euro Stoxx 50 -0.1%), as newsflow remains quiet on month-end, and earnings take focus. State-side futures are subdued vs their counterparts across the pond, with relatively broad-based and modest downside experienced across peers. It’s also worth noting that Japanese and Chinese players will be away from their desks next week until the 5th of May amid domestic holidays – thus overnight volume is likely to be low during the first half of next week. Back to Europe, Germany’s DAX (+0.5%) narrowly outperforms regional peers after yesterday’s underperformance coupled with some gains across large-cap stocks, albeit the breadth among European cash bourses remains narrow. In-fitting with the indecisive tone, sectors across Europe are mixed and again it is difficult to observe a particular theme given earnings distortions. The healthcare sector is the clear outperformer as AstraZeneca (+3.3%) soars post-earnings after side-lining reports that point to a delay in its vaccine’s US FDA approval. On the flip side, the basic resources sector stands as the laggard amid a pull-back in base metal prices, whilst banks also reside towards the bottom of the pile as yields waned from yesterday’s best levels and following corporate updates from Barclays (-4.7%), BNP Paribas (-1.0%) and BBVA (+0.9%), although the latter has nursed opening losses. Some attribute the downside in Barclays and BNP to sluggish fixed income trading performances vs rivals including JPM, Goldman Sachs and Deutsche Bank (+0.1%). Finally, Darktrace (+35%) shares were bolstered on their London debut whereby shares traded above GBP 3.50 at one point vs guided range GBP 2.20-2.80.

Top European News

- Euro-Area Economy Slips Into Double-Dip Recession: GDP Update

- Ogury Said to Pick BofA, BNP for IPO at $2.4 Billion Valuation

- DoorDash Goes on European Deal Hunt Just Months After IPO

- Synlab Rises After $813 Million IPO as Covid Testing Ramps Up

In FX, only one day left for the Dollar to evade any residual month end selling, and so far so good as it continues to defy bearish rebalancing signals and the ongoing dovish overtones imparted by the Fed with some assistance from a back-up in yields and curve re-steepening. However, the Buck is also benefiting at the expense of others and a degree of consolidation or corrective price action approaching the end of a 4th successive week of depreciation. Looking at the DXY as a proxy, a marginal new recovery high from sub-90.500 lows in the index was forged at 90.822 after the Euro filled remaining bids in to 1.2100 and tripped a layer of stops on the back of weaker than forecast prelim German Q1 sa q/q GDP. However, Eur/Usd has found a base nearby and 2.1 bn option expiries at the round number could be keeping the headline pair underpinned alongside bids in the Eur/Gbp cross around 0.8700 that may be due to RHS fix and/or month end demand. Accordingly, Sterling is facing a task to retain grip of 1.3900 vs the Buck after topping out below yesterday’s 1.3975+ peak and failing to breach a double top against the Euro circa 0.8674, irrespective of Pound positives in the form of a super strong Nationwide UK house price survey and upbeat Lloyds business barometer.

- AUD/CAD/JPY/NZD/CHF – All more rangebound and narrowly mixed vs their US counterpart, as the Aussie and Loonie continue to derive traction from recent rallies in metals and oil among other commodities like palladium hitting Usd 3k/oz for the first time ever. Aud/Usd is holding above 0.7750, while Usd/Cad is hovering around 1.2275 following a decline to new multi-year lows sub-1.2270 in the wake of last week’s hawkish BoC policy meeting. Elsewhere, the Yen is back above 109.00 with the assistance of greater Japanese participation for a session in between Showa Day and Golden Week market holidays, plus data on balance as ip confounded downbeat expectations and the unemployment rate fell against consensus for a steady print to offset weaker than anticipated Tokyo CPI. Back down under, the Kiwi is lagging between 0.7255-30 parameters in the absence of anything fresh on the NZ front and the Franc remains tethered to 0.9100 after a big base effect boosted Swiss retail sales in March and KoF’s leading indicator smashed forecasts in April.

- SCANDI/EM – Although crude prices have come off the boil, the Nok is still comfortably above 10.0000 vs the Eur in stark contrast to the Sek that has slipped to fresh weekly lows near 10.17000, with traction from an unexpected decline in Norway’s jobless rate, a firmer credit indicator (albeit due to a back month revision) and steady Norges Bank daily foreign currency sales for next month (Nok 1.8 bn equivalent). Meanwhile, the firmer Usd bounce is taking its toll on almost all EM currencies, bar the resilient Cnh and Cny that are close to w-t-d pinnacles of 6.4607 and 6.4654 respectively regardless of somewhat disappointing Chinese official PMIs that were only partially compensated by a stronger Caixin manufacturing survey.

In commodities, WTI and Brent front-month futures trickle lower in early European trade as catalysts remain light and the tone across the market tentative. WTI, at the time of writing, has dipped back below USD 64.00/bbl (vs high USD 64.95/bbl) while its Brent counterpart hovers around USD 67.25/bbl (vs high USD 67.97/bbl). Barring any other macro headlines, the focus will be on the state of the Iranian nuclear talks – with cautious optimism expressed by the US and Iran, whilst others stated they expect a deal within weeks. That being said, commentary from the Iranian delegation has suggested there remain difficulties in discussions and a deal hasn’t yet been reached. In case of any agreement, eyes will likely turn to the details surrounding the oil-related sanctions. Elsewhere, spot gold and silver are uneventful within recent ranges around USD 1,775/oz and on either side of USD 26/oz respectively. Spot palladium meanwhile has reached USD 3,000/oz for the first time with some citing a supply shortage. Turning to base metals, LME copper has waned back below USD 10,000/t ahead of the Chinese and Japanese holidays through to next Wednesday, whilst Chinese steel rebar and futures posted weekly gains amid an improved demand outlook.

US Event Calendar

- 8:30am: March Personal Income, est. 20.2%, prior -7.1%

- 8:30am: March Personal Spending, est. 4.1%, prior -1.0%

- 8:30am: March PCE Deflator MoM, est. 0.5%, prior 0.2%; Core Deflator MoM, est. 0.3%, prior 0.1%

- 8:30am: March PCE Deflator YoY, est. 2.3%, prior 1.6%; Core Deflator YoY, est. 1.8%, prior 1.4%

- 9:45am: April MNI Chicago PMI, est. 65.2, prior 66.3

- 10am: April U. of Mich. Mich. Sentiment, est. 87.5, prior 86.5; Current Conditions, est. 97.6, prior 97.2; Expectations, est. 81.0, prior 79.7;

- 10am: April U. of Mich. 1 Yr Inflation, prior 3.7%; 5-10 Yr Inflation, prior 2.7%

DB’s Jim Red concludes the overnight wrap

After what is probably more than 6 months I’m actually going to a restaurant tomorrow night. Reservations are like gold dust here in the U.K. at the moment so my wife and I are very lucky to join a couple who have one. Only a few problems. We have to eat outside, it’s going to be cold, it might rain, and my old school friend who booked it hasn’t replied to me confirming it. The good news is that he reads the EMR so I’m hoping he’ll confirm once this hits inboxes. Unless of course we’ve been replaced by a more exciting couple. In that case I’m keen to shame him. I hope not as my wife and I are like caged tigers waiting for social interaction that isn’t each other at the moment.

After a little bit of consolidation over the last month, bond yields have acted a little like a caged tiger this week with yesterday seeing another big climb higher. 10yr US Treasuries were up as much as +7.8bps intra-day yesterday to 1.686% after being as low as 1.53% intra-day last Friday. It was the highest yields had traded since April 13. However the benchmark rate finished a more moderate +2.5bps higher on the day at 1.634%. This still left the week-to-date rise at +7.7bps, which would be the first weekly increase in yields since the week ending April 2 unless there is a massive rally in bonds today. Real rates (+2.5bps) drove much of the final move as inflation expectations (+0.1bps) were more muted. However, inflation expectations did rise for the 5th straight session (+9.4bps in all over this period), with the 10yr breakeven measure closing at 2.426% – its highest level in just over 8 years. In Europe there was a similarly large selloff, with yields on 10yr bunds up +3.8bps to -0.19%, marking the first time in over a year that they’ve closed above the -0.20% mark, while 10yr French yields (+4.4bps) likewise closed at a 1-year high.

Although rising bond yields seemed to clip their wings a little as the move higher accelerated, US equities still moved to fresh all-time highs yesterday as the combination of strong economic data and better-than-expected earnings releases helped to buoy investor sentiment and fuel fresh life into the reflation trade. By the close, the S&P 500 had gained another +0.68% to end the session above the 4,200 mark for the first time, and the MSCI World index was up +0.39% at its own record high. This positive mood music could be seen across a range of indicators, and Bloomberg’s index of US financial conditions actually eased to its most accommodative level since 2007 yesterday, which just shows the extent to which markets are primed for a strong recovery over the coming months.

A late selloff in Europe meant that indices there ended the session lower with the STOXX 600 closing down -0.26%. Banks outperformed however thanks to the moves higher for yields, and the STOXX Banks index was up +1.16% in its 6th successive daily advance, taking the index to its highest level since the pandemic began. Over in the US, the gains were fairly broad-based with over 78% of the S&P moving higher on the day, though the NASDAQ (+0.22%) underperformed slightly, while the small-cap Russell 2000 (-0.38%) lost ground. US banks (+2.10%) joined their European counterparts in reacting strongly to global yields. Otherwise nearly every industry group outside of the pandemic winners of Software (-0.59%) and Biotech (-1.02%) gained in the S&P. The biggest industry laggard was autos (-3.03%), where Ford (-9.41%) reduced its forecast significantly due to a semiconductor shortage that has caused vehicle production across the industry to stall. They forecasted a -$2.5bn hit to earnings because of the lack of chips, in what they considered the “worst-case”. This is becoming a recurring theme across different sectors.

Elsewhere in earnings, Amazon saw their shares rise +3.2% in after-market trading on strong beats across business segments. Q1 revenue rose +44% and the company offered guidance on sales for the upcoming quarter ahead of analysts’ estimates, with indications that aspects of the pandemic bump in online-sales may endure. Elsewhere in big tech, Twitter saw shares slide over -7% with EPS at $0.16 (vs. $0.12 exp.) on lower revenue guidance even as user growth was in-line with prior estimates. One issue for the company may be the stronger ad revenues seen by competitors Google and Facebook earlier this week.

Overnight in Asia we have seen China’s official April PMIs come in softer than expectations for both manufacturing (51.1 vs. 51.8 expected) and services (54.9 vs. 56.1 expected). Zhao Qinghe, an economist at the statistics bureau said that “some surveyed companies said problems such as chip shortages, poor international logistics, shortages of containers, and rising freight rates are still serious.” He also added that a slowdown in manufacturing supply and demand and rising cost pressures are also issues. These comments on rising cost pressures and chip shortages are likely to get more attention from markets and particularly inflation enthusiasts. In the details of the manufacturing PMI, a sub-index of new export orders for factories eased to 50.4 in April from 51.2 previously, while new orders were at 52. In contrast to the official manufacturing PMI, China’s Caixin manufacturing PMI came in at 51.9 as against 50.9 expected. The statement accompanying the release said that the increase was supported by significant expansion in both manufacturing demand and supply, as “manufacturers stayed confident about the economic recovery and keeping Covid-19 under control.” So a little different to the official release.

Elsewhere, Chinese regulators have imposed wide-ranging restrictions on the financial divisions of 13 companies, including Tencent and ByteDance in an antitrust crackdown.

Asian markets are mostly trading lower this morning with the backdrop of conflicting signals from China’s April PMIs and the continued antitrust crackdowns on tech giants in the country. The Nikkei (-0.52%), Hang Seng (-1.53%), Shanghai Comp (-0.51%) and Kospi (-0.74%) are all losing ground. Futures on the S&P 500 are also down -0.28% and European ones are also pointing to a weaker open. In terms of other overnight data, Japan’s final April manufacturing PMI printed 0.3pt stronger than the flash at 53.6.

There were also a number of important data releases for markets to digest yesterday, even if the overall impact was muted as they came in basically as expected. The main highlight was the news that the US economy had grown at an annualised pace of +6.4% in Q1 (vs. +6.7% expected), leaving US GDP less than 1% beneath its pre-Covid peak in Q4 2019. Meanwhile, the upward revision of +19k to last week’s initial jobless claims data from the US meant that this week’s number of 553k was the lowest since the pandemic began last year, albeit above the 540k reading expected.

Another story yesterday was the continued strength in commodity markets, which has been one of the major themes of the month as pretty much the entire range from metals to agriculture to energy prices have shown sizeable gains in recent weeks. Oil prices rose for a 3rd day running, with both Brent crude (+1.92%) and WTI (+1.80%) prices seeing decent advances, which were in part attributed to data showing road-fuel demand in the UK is nearing the levels seen last-summer and also as large cities in the US announce reopening plans. Meanwhile copper rose above $10,000/tonne in trading at one point for the first time in a decade yesterday, as it closes in on an all-time high set in February 2011 of $10,190 on an intraday basis. The industrial metal finished the day marginally lower (-0.11%), but is up nearly +28% YTD.

Positive headlines regarding the pandemic were another factor supporting sentiment yesterday. Firstly, French President Macron said that the restrictions would be eased from May 3 when restrictions on domestic travel would be lifted, while the nightly curfew would be gradually eased before it’s completely lifted on June 30. Meanwhile in Germany, health minister Spahn said that 1.1m vaccine doses had been administered yesterday, which is a record for the country. And in the UK, the 7-day case average fell to 2,259 yesterday, which is its lowest level since early September when the level of testing was a fraction of its current levels. In the US, NYC Mayor de Blasio said that they planned to fully reopen the city on July 1, though Governor Cuomo pushed back that he would like it to happen even sooner. Chicago’s mayor also announced they would be easing restrictions to allow for more seating capacity at restaurants, bars and other indoor venues. There was some bad news in the US, where Oregon announced a surge in cases, driven primarily by the younger, partially-vaccinated populations. The Governor has responded by increasing the risk-level on many counties to their extremes, shuttering indoor dining among other restrictions.

Elsewhere, emerging markets like Brazil and India are continuing to reel under the severe current wave with total fatalities in Brazil now topping 400k with the country reporting more covid deaths so far in 2021 than in whole of 2020. India has reported a record 386,452 daily infections while daily fatalities came in at 3,498. On the more positive side, BioNTech CEO Ugur Sahin said that he is “confident” the company’s Covid-19 vaccine with Pfizer will be effective against the Indian variant of the COVID-19 virus. He added that the company is evaluating the strain and the data will be available in the coming weeks.

Looking at yesterday’s other economic data, and the European Commission’s economic sentiment indicator for the Euro Area advanced to 110.3 in April (vs. 102.2 expected), which is the highest it’s been since September 2018. Over in Germany, data showed that unemployment unexpectedly rose by +9k in April (vs. -10k expected), while the preliminary inflation reading for April rose to a 2-year high of +2.1% (vs. +2.0% expected). Finally, pending home sales in the US rose by a lower-than-expected +1.9% in March (vs. +4.4% expected).

To the day ahead now, and there are an array of data highlights including the first look at Q1 GDP for the Euro Area, Germany, France and Italy. On top of that, we’ll also get the flash Euro Area CPI reading for April, and the unemployment rate for March. Over in the US, there’s the personal income and personal spending data for March, the MNI Chicago PMI for April and the final University of Michigan consumer sentiment index for April. From central banks, the Fed’s Kaplan will be speaking, while earnings releases include Exxon Mobil, Chevron, AbbVie and Charter Communications.

Tyler Durden

Fri, 04/30/2021 – 07:47

via ZeroHedge News https://ift.tt/3u7jOo5 Tyler Durden