No, Bonds Aren’t Overvalued… They’re A Warning Sign

Authored by Lance Roberts via RealInvestmentAdvice.com,

There has been much commentary suggesting bonds have gotten overvalued due to historically low rates.

“Stocks are expensive, but bonds are enormously overvalued on a long-term basis” – Jeremy Siegel

However, is that the case?

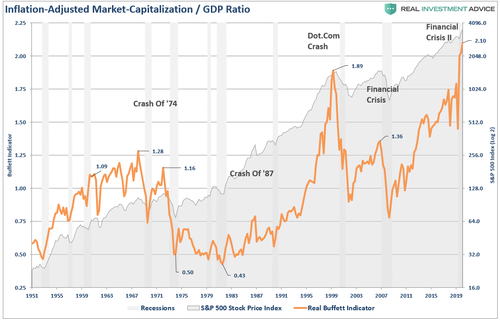

There is no argument stocks are highly overvalued. We spent much of the past week discussing why forward returns will be lower over the next decade.

The basic premise is that overpaying for earnings today leads to lower rates of return in the future. Of course, given the flood of liquidity from global Central Banks, the overvaluation of markets is of no surprise.

However, while analysts develop various rationalizations to justify high valuations, none hold up under objective scrutiny. While Central Bank interventions boost asset prices in the short-term, there is an inherently negative impact on economic growth in the long term.

However, bonds are a different story.

Bonds Can’t Get Overvalued.

Unlike stocks, bonds have a finite value. At maturity, the principal gets returned to the “lender” along with the final interest payment. Therefore, bond buyers are very aware of the price they pay today for the return they will get tomorrow. As opposed to an equity buyer taking on “investment risk,” a bond buyer is “loaning” money to another entity for a specific period. Therefore, the “interest rate” takes into account several substantial “risks:”

-

Default risk

-

Rate risk

-

Inflation risk

-

Opportunity risk

-

Economic growth risk

Since the future return of any bond, on the date of purchase, is calculable to the 1/100th of a cent, a bond buyer will not pay a price that yields a negative return in the future. (This assumes a holding period until maturity. One might purchase a negative yield on a trading basis if expectations are benchmark rates will decline further.)

As noted, since bonds are loans to borrowers, the interest rate of a bond is tied to the prevailing rate environment at the time of issuance. (For this discussion, we are using the 10-year Treasury rate often referred to as the “risk-free” rate.)

However, with existing bonds traded on secondary markets, the price is determined by the difference between the coupon rate and prevailing rates for similar obligations. The benchmark rate acts as the baseline.

A Very Basic Example.

Let’s review an example.

Bond A:

-

Current benchmark interest rates = 5%

-

A $1000 bond gets issued at 100.00 (par) with a 5% coupon with a 12-month maturity.

-

At the end of 12-months, Bond A matures. $1000 gets returned to the lender with $50 in interest, equating to a 5% yield.

For the person who loaned the money, the 5% coupon for 12-months is sufficient to offset various market and economic risks.

Now, let’s assume the benchmark interest rate falls to 4%.

-

What is the “fair value” of Bond A in a 4% rate environment?

-

Since the fixed coupon is 5%, the price must change adjust the “yield at maturity.”

-

In this case, the price of Bond A would rise from $100 to $101.

-

At maturity, the principal value of $1000 gets returned along with $50 in interest to the holder.

-

However, if the bond was sold at $1010 ($1000 x 101%), there is a loss of $10 in value ($1010 – $1000) at maturity. Such equates to a net return of $1000 +($50 in interest – $10 loss in principal = $40) = $1040 or a 4% yield.

Got it?

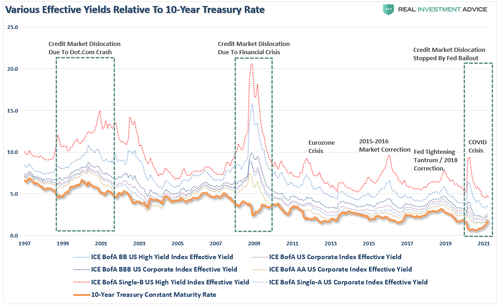

The chart below shows the 10-year Treasury yield as compared to BBB to AA Corporate Bond rates. Not surprisingly, as the credit rating declines, the spreads between the “risk-free” rate and the “risk” rate increase. However, except for the bond market freeze during the “financial crisis” and “Covid shutdowns,” the ebb and flow of yields primarily track the “risk-free” benchmark rate.

Since rates are generally tied to a primary benchmark, for bonds to become overvalued, the benchmark rate would have to become detached from the underlying metrics that drive the level of borrowing costs.

Is that the case now?

Rates Are A Function Of The Economy

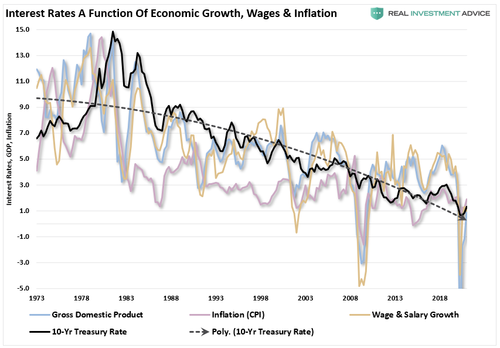

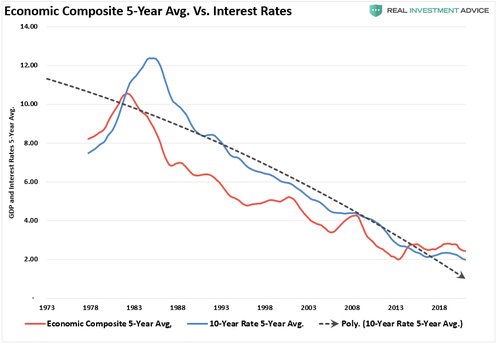

As I have discussed many times in the past, interest rates are a function of three primary factors: economic growth, wage growth, and inflation. The relationship, shown below, should not be surprising given that, as stated above, the “rate” charged for lending money must account for economic growth and inflation.

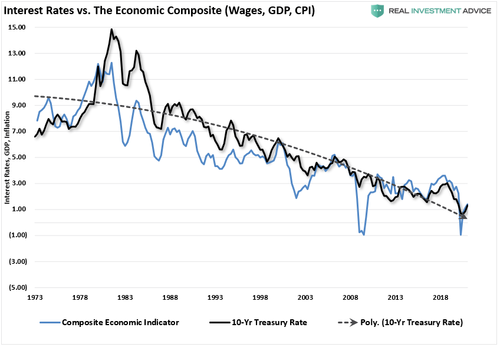

Okay, maybe not so clearly. Let me clean this up by combining inflation, wages, and economic growth into a single composite for comparison purposes to the level of the 10-year Treasury rate.

Again, the correlation should be surprising given that lending rates get adjusted to future impacts on capital.

-

Equity investors expect that as economic growth and inflationary pressures increase, the value of their invested capital will increase to compensate for higher costs.

-

Bond investors have a fixed rate of return. Therefore, the fixed return rate is tied to forward expectations. Otherwise, capital is damaged due to inflation and lost opportunity costs.

As shown, the correlation between rates and the economic composite suggests that current expectations of sustained economic expansion and rising inflation are overly optimistic. At current rates, economic growth will likely very quickly return to sub-2% growth by 2022.

Longer Views Tell The Same Story

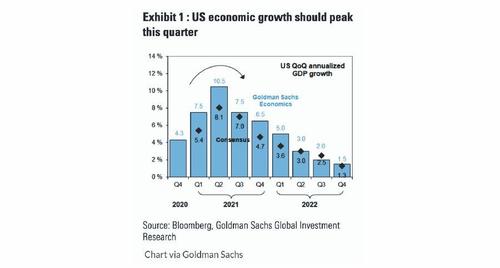

“But Lance, this year, GDP is expected to surge to 6%, so doesn’t that change things?”

The answer is “no.“

The jump in GDP growth in 2021 has several problems attached to it.

-

It is a recovery from deeply depressed levels in 2020, not expanding growth absorbing population growth.

-

The recovery is a reflection of an artificial stimulus that has a minimal effective window before depletion. As such, it has an almost negative multiplier effect economically.

-

Lastly, given that businesses understand the “bump” of activity is temporary, they are unwilling to make long-term investment commitments requiring a cost-of-capital above longer-term economic growth projections.

As Goldman Sachs recently showed, economic growth will quickly return to 20% growth trends as the “artificial” support fades.

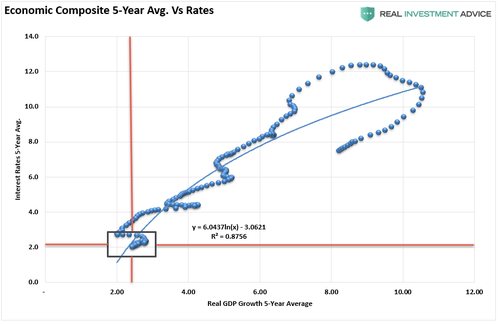

These “bumps” of activity are not uncommon throughout history. However, if we smooth the data using a 5-year average of both the economic composite and rates, the correlation emerges.

As shown, the current 5-year average suggests that rates and growth will continue to run along much lower levels. Such does not foster increased capital investment, strong employment above population growth rates, or increase labor-force participation rates. With a near 90% correlation, economists and analysts will likely be disappointed as growth slows and rates fail to rise.

Bonds Are Sending A Warning

Currently, investors are exuberant in the financial markets due to the “Moral Hazard” created by the Federal Reserve. However, as stated in “No Way, This Doesn’t End Badly,”

“Such is where fundamentals become extremely important. When, or if, expectations of recovery are disappointed, the market will begin to reprice itself for its intrinsic value. Given that the market is currently trading more than twice the level of underlying economic growth, which is where corporate profits come from, such suggests a significant risk.”

The correlation between the “economic composite” and “rates” currently suggests that the “risk of disappointment” is elevated.

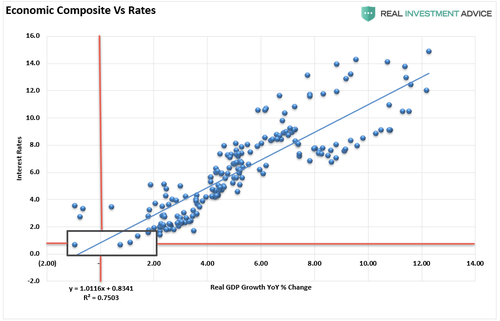

At the peak of nominal economic growth over the last decade, interest rates rose to 3% as GDP temporarily hit 6%. However, what rates predicted is that economic growth would return to its long-term downtrend line. In other words, while the stock market was rising, predicting more robust growth, the bond market was sending out a strong warning.

Once again, economists predict 6% or better economic growth, yet interest rates are roughly 50% lower than previously. In other words, the bond market is suggesting that economic growth will average between 1.75% and 2% over the next few years.

From our view, rates matter. Given their close tie to economic activity and inflation, we think they will matter a lot.

Are bonds overvalued? No.

But stocks are, and the bond market is ringing alarm bells warning you of the same.

Tyler Durden

Fri, 04/30/2021 – 08:48

via ZeroHedge News https://ift.tt/3t7vSUQ Tyler Durden