“The Social Contract Is Broken”: Why Millennials Who Lack Rich Parents Feel Increasingly Hopeless

The worsening precarity of the millennial generation has been a hot topic for the financial press over the last year, and it hasn’t failed to disappoint. Thinkpieces about crushing student loan debt, rising housing prices placing home-ownership further out of reach, and the soul-crushing intensity of formerly sought-after jobs in finance have abounded. And now, the Financial Times has launched a new series where it explores some of the biggest problems facing its millennial readers. And what the report discovered might come as a surprise to some. Picking up where that PowerPoint about the miserable working conditions of Goldman junior analysts left off, the FT reported that even millennials with strong resumes and “good jobs” who “did everything right” are “drowning in insecurity.”

As the FT sees it, millennials’ fate will depend largely upon whether they’re the progeny of wealthy families, or not. Those who can depend on “the bank of mom and dad” for an interest-free loan (or a generous inheritance) will always have an advantage in procuring the best homes, jobs and school placement as entry to the upper echelon of society still largely depends on having access to the best schools and alumni networks. Millennials who don’t enjoy these advantages will be forced to compete in a market set up to cater to those who do.

Source: FT

But while that conclusion is relatively self-evident, an even more surprising detail from the FT’s report is that once-safe careers in investment banking and private equity no longer convey the same promise of long-term security. As an example of these phenomon, the FT introduces Akin Ogundele, who works in London’s financial sector, and lives in the city with his wife and young family. The fact that he’s struggling to pay his bills in a rental flat, with little hope of affording his own home any time soon, has given him a “sense that the social contract is broken for his generation…” something that’s shared by many young people “and not just in London.”

Many of the story’s most striking examples are delivered with a quote. Here are a few of our favorites:

-

“If I carry on the way I am, I’m not sure what I’ll be able to pass down,” he says. “It can’t be good for the country — the disparities are just going to grow, the wealthy are going to grow wealthier and those that aren’t will get more and more removed.”

-

For Killian Mangan, who graduated during the pandemic last year and struggled to find a job, it feels as if “we are drowning in insecurity with no help in sight”. A twenty-something who works for a central bank says: “I sometimes have this feeling that we are edging towards a precipice, or falling in it already.”

-

A 30-something who works in private equity in the UK turns to collateralised debt obligations for a metaphor to describe the position of his generation. “The space I feel I occupy in the sociopolitical order is akin to being the first loss tranche in the debt stack,” he says. “Whenever anything bad happens I have no doubt that, because we lack political and economic clout, we will be left holding the bag.”

-

“At the moment, while the wealth is still held by older generations it shows up in the data as a difference between generations, but wealth doesn’t disappear, it’s going to flow down and [then] it moves on to being an issue about inequality within younger generations,” says David Sturrock, an IFS senior research economist. “It’s basically saying how much you stand to gain depends on who your parents are and the wealth they have.” Many developed countries share “a lot of the same dynamics”, he adds.

-

“I ate spaghetti for a month in 2009 because the company I worked for was owned by a private equity firm, which thought it best to cut me so it could buy out smaller competitors,” says Jim from California in the US. “They eventually hired me back for close to half the pay…way to develop talent, right?”

-

“After 30 or so rejections, I was chosen out of a pool of 2,500 applicants to undergo a psychometric test, followed by a video interview, followed by an assessment centre, followed by a week-long virtual scheme culminating in an interview before being offered a two-year training contract,” says Hadrien, a recent UK graduate. “We are competing with machines and bots, and an ever increasing population of skilled humans,” says another.

But while some might dismiss these quotes as more whining from millennials who have nobody but themselves to blame for being duped into taking out hundreds of thousands of dollars in debt for a four-year liberal arts degree, the FT also peppered the story with data supporting this vision of a downwardly mobile fate.

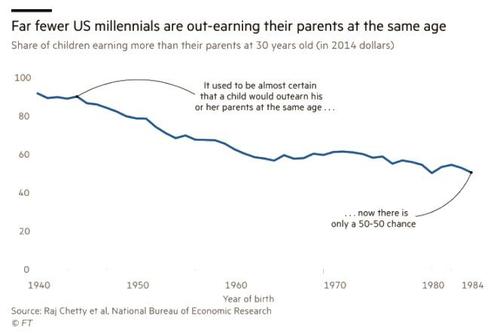

It started with data showing fewer millennials will out-earn their parents.

Source: FT

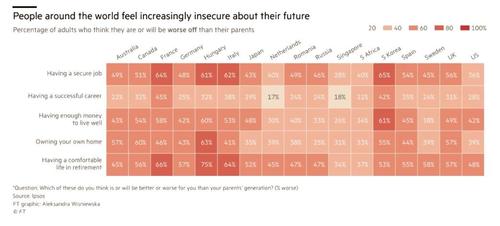

And how feelings of career insecurity are shared by young people around the world, in both developing and emerging economies.

Source: FT

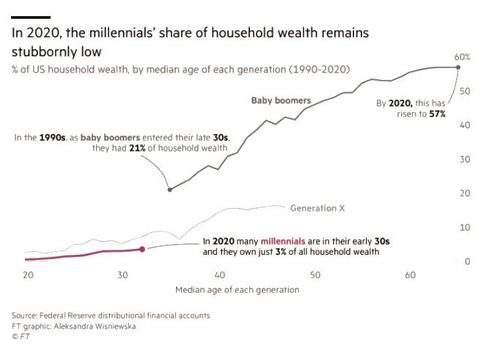

Millennials, meanwhile, struggling with a stubbornly low share of household wealth (partly a factor of the wealth-draining impact of student loans).

Source: FT

According to an editor’s note, the story is merely the first in a series about the myriad problems facing the millennial generation. While we’re sure its audience will appreciate the FT’s attempt to court more youthful readers, we suspect it might come off as a tad whiny. After all, millennials just had the opportunity to get in on one of the greatest wealth-creation engines of all time (crypto) while boomer CEOs were mostly left scratching their heads.

Tyler Durden

Fri, 04/30/2021 – 16:40

via ZeroHedge News https://ift.tt/2QKuASH Tyler Durden