Berkshire Profit Soars As It Sells Others, Buys Back Its Own Stock

Over a decade into the biggest metaphorical massacre of value investors by the Federal Reserve (which sadly was also literal in the case of Charles de Vaulx, a renowned value investor and co-founder of International Value Advisors, who last week jumped to his death from a Manhattan skyscraper), people still seem to care what the biggest value investor of them all, Warren Buffett, does. Or at least some people.

To satisfy their curiosity – even as an entire generation of traders no longer cares, or has heard, about the 90-year-old Oracle of Omaha and instead wants to know which stock to squeeze to generate overnight tendies – this is what Berkshire Hathaway reported earlier this morning when it filed its first quarter 10Q:

- Q1 operating profit rose 20%, to $7.02 billion, or about $4,600 per Class A share, from $5.87 billion a year earlier. This was the second-highest level on record (going back to 2010) and was only surpassed by the third quarter of 2019. The gains were fueled by the firm’s insurers and its group of manufacturers, servicing businesses and retailers.

- Insurance underwriting operating profit $764 million vs. $363 million y/y

- Railroad, utilities & energy businesses operating earnings $1.95 billion, +12% y/y

- Insurance float $140.0 billion, +7.7% y/y

- Q1 net income of $11.71 billion, or $7,638 per Class A share, compared with a net loss of $49.75 billion, or $30,653 per share, a year earlier.

The near-record operating profit suggests that the Omaha conglomerate has already suffered through the worst effects of the pandemic, including the loss of tens of thousands of jobs, and the company said many businesses are now posting “considerably higher” earnings and revenue despite the negative impact of February winter storms, though some businesses are still suffering.

Last year’s results reflected a $55.62 billion loss on investments and derivatives, as global stock markets plunged before Powell came to the rescue of billionaires – such as Buffett. Accounting rules require Berkshire to report gains and losses on stocks it owns even if it does no buying and selling.

Manufacturing operations boosted pre-tax profit by 15%, with earnings nearly doubling at the Clayton Homes mobile housing unit as sales revenue increased and credit losses fell. Pre-tax profit from retailers such as the Nebraska Furniture Mart and See’s Candies more than doubled, as Berkshire’s auto dealerships sold more vehicles and some results surpassed pre-pandemic levels despite supply chain disruptions.

One unit still struggling is aircraft parts maker Precision Castparts, which in 2020 took a $9.8 billion writedown and shed 13,400 jobs. Buffett has called that particular purchase a mistake. Berkshire said Precision’s quarterly revenue fell 36%, and revenue and earnings should remain “relatively low” in 2021 because aircraft production is unlikely to grow significantly.

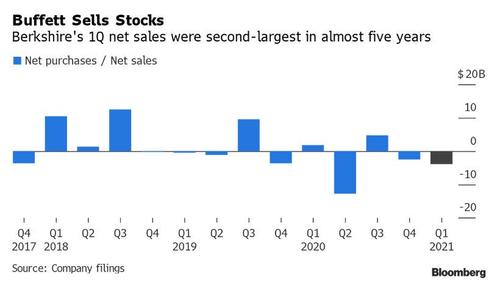

Berkshire’s solid operations notwithstanding – since they naturally benefit from every economic recovery, no matter if it comes from trillions in fiscal stimulus or otherwise – what we found more interesting is that not only did Berkshire’s stock-buying drought extend for one more quarter, but the conglomerate’s stock sales in the first quarter were the second-highest in almost five years…

…. confirming that once again, there is nothing in the market that Buffett finds worth buying.

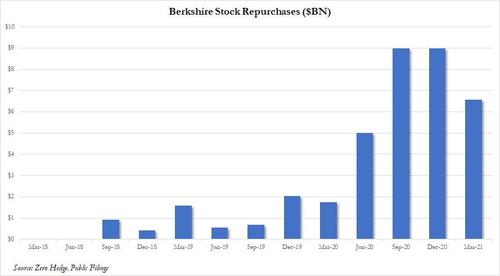

Well, there was one exception: Berkshire itself, although while Berkshire bought some $6.6BN of its own stock in Q1, this was down from a record $9BN in Q3 and Q4 of last year and a total of $24.7 billion for the full 2020 (that said, Reuters noted that Berkshire’s share count fell from March 31 to April 22, suggesting that the company repurchased more than $1.2 billion of stock in that period).

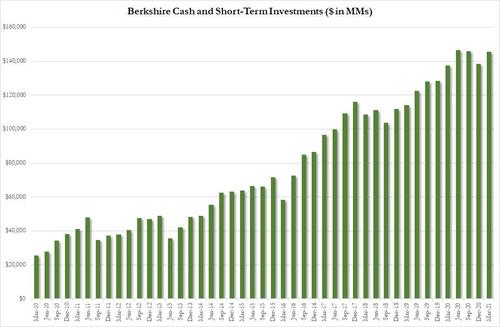

This helped push Berkshire’s cash pile up 5.2% from three months earlier to a near-record $145.4 billion at the end of March.

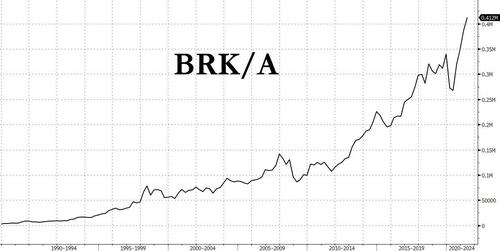

Class A shares of Berkshire closed Friday at $412,500, after hitting a record high a day earlier. They have risen 19% this year, topping the 11% gain in the Standard & Poor’s 500, but trailed the index by 36 percentage points in 2019 and 2020.

Buffett will join his longtime business partner, Charlie Munger, 97, for Berkshire’s annual meeting Saturday. The pair will field questions from investors for hours during the virtual event. The livestream can be watched after the jump (or by clicking here).

Tyler Durden

Sat, 05/01/2021 – 12:11

via ZeroHedge News https://ift.tt/3eFRdja Tyler Durden