“This Is A Game-Changer For Uranium Stocks”

Submitted by Larry McDonald of The Bear Traps Report

The Uranium Bull Thesis

Uranium names are moving higher, breaking the recent downtrend just like energy names.

Our copper thesis has played out nicely. But from a Washington policy perspective Uranium is the next trade.

Last week we learned that Uranium Participation will be bought by Sprott. This is a large deal, game changer. A lot of hedge funds in our chat are discussing. I think Uranium prices double over the next 12 months. High conviction. It’s the pure, centrist green energy play, Nuclear power.

Plays – Nexgen, Denison, CCJ, URA ETF

This is BIG news.

U Participation Corp, was a company that was buying U and sitting on it, the original yellow cake. The market will now have daily price discovery and a retail / family office / small asset manager speculation vehicle. Game changer.

Denison CEO was reluctant, didn’t think he could increase the pounds per share, now we have a new team taking over (Sprott). Very bullish for uranium.

- We are getting a US listed vehicle with a physical redemption. Like a GLD for uranium. Look at PSLV and PHYS, equivalent.

- A new mechanism for retail, institutional. An at the market facility. Technically a closed end fund, NOT a GLD.

- Pounds come in, don’t go out. They could do a buyback if the market provides that opportunity.

- U Participation is tough to buy, pink sheet. RobinHood crowd cannot buy!!! Now there will be a new liquidity vehicle.

- Mgmt transition from Dennison to Sprott. Think Industry player to real asset mgr.

- When there is large premium, new buyers are vulnerable. This has suppressed upside momentum. NOW there is a liquid vehicle, large buyers can come in with a liquidity work out.

- Next, Sprott does a big offering, to bring in new pounds into the fund. There was too much inventory of uranium in the system, this vehicle will eliminate this problem. Substantially reduce the problem. New size buyers of the fund will quickly translate into spot buying!

- Think CME and oil, this could be a new real franchise / a liquidity central facility.

- Management take over might take 2/3 months. Then the premium U Part will come in, was 16% today. In a month or so, Dan Loeb can come in and buy $100m without the premium risk. Pounds will permanently be removed from the mkt. NOT at ETF, its a closed end fund. A discount may develop in the shares, but new buyers are in a much better spot.

- When a large hedge fund sells, they come back, stay in fund.

- Closed end fund, pounds come in, don’t go out. Pounds will stay in the vehicle. It’s not a create and redeem situation like an ETF. Big seller will just create a discount.

Uranium bulls in our chat are calling the bottom with conviction.

Transformational deal.

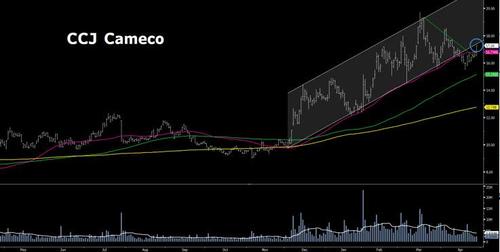

CCJ Cameco Breaking Out

CCJ Cameco Corp is a) breaking downtrend consolidation b) almost back in the BULL uptrend. We remain long a 2/3 position in CCJ and a 1/3 position in the URA Uranium ETF.

Uranium Participation Corp In Agreement with Sprott Asset Management to Modernize Business Structure and Pursue U.S. Listing

Entered into an arrangement agreement with Sprott Asset Management LP, a wholly owned subsidiary of Sprott Inc. (NYSE/TSX: SII), pursuant to which UPC shareholders will become unitholders of the Sprott Physical Uranium Trust a newly formed entity to be managed by Sprott Asset Management.

* * *

Uranium News of the day

Sprott Asset Management taking over management of Uranium Participation Corp will light this market on fire and ultimately help drive the price of uranium much higher and faster than most realize. Our friend Kevin Bambrough actually conceived of uranium participation corp back in the mid 2000’s (over a sushi lunch) in the year leading up to that lunch he had aggressively pitched Eric Sprott on going big in uranium stocks and predicted a move from $11/lb to $140/lb. think of $140/lb simply as the inflation-adjusted price from the 70’s uranium bull market and over that year players bought 20% of most uranium juniors and a decent chunk of Cameco. We also invested in a few privates and helped some shell companies acquire uranium assets. The uranium price had run up from the teens to the low 20’s around that time and the spot market was very thin much like today. Over the course of that lunch Kevin was ranting about how certain he was that the uranium price would be moving up soon. Our pal was certain that the thin market was ripe to be squeezed higher and that our stocks would all rip as the price moved up. A few hedge funds had recently bought a little physical uranium and were storing it with Cameco or Denison as req by law/regs. The lunch ended with the declaration that Kevin was going to pitch Eric Sprott to let him launch an uranium hold co ETF and Kevin did that very afternoon and it was an easy sell. One thing people loved most about working with Eric is that there was no fucking around. He made quick decisions. Only thing was he didn’t want was ‘wasting time’ on the ETF. They were running billions in hedge fund and equity funds and we think that year heading towards $100mm plus in incentive fees. Some years they hit $200mm of incentives. The fees from a uranium ETF would be small. They called Chris Roy at Cormark (Sprott securities then) and said let’s work on this idea together. Being a brokerage you can do the raises and get 5 percent. Or $5mm in fees on the first $100mm and Eric had blessed a $20mm lead order. Anyhow, long story short, they launched it and just the news of it coming sent the uranium price up several dollars. As orders for the ipo grew and uranium was purchased the price when up a few more. Moved near $22 to 28.50/lb in a few months as the prospectus got filed. The vehicle came out and kept trading at a premium and issue after issue swallowed up millions of lbs of uranium. Utilities felt incredible pressure knowing the vehicle was gonna keep gobbling up supply and this forced them to scramble and start entering into long term contracts. The spot price moving up over $100/lb and with little to no spot available forced them to sign contracts to try to get a discount and deals with $75/lb floors became the rage for miners. Those that signed long term fixed deals sub $50 took a look of flack from investors. So one thing to understand is utilities or fuel buyers will always avoid buying spot prices and pushing them higher. They have zero interest in doing that. All they want to do is secure long term contracts for supply. They prefer to sign deals with ceiling prices. They also try when possible to sign deals centered around a price like $45/lb (like they have with Cameco) but if the spot price goes up they only pay a portion of the increase.

URPTF Uranium Participation Corp

Uranium Participation Corp’s US ADR is broke out to the upside out of the recent wedge on Wednesday. The company is now pursuing a US listing, which in our view, will prompt front-running inflows.

Uranium Market

Oversupplied market like we’ve had meant they could point to a weak spot price and contract as such. Back then UPC (Uranium Participation Corp) wasn’t able to issue shares at the market and needed to trade at a decent premium in order to be able to justify paying issuance fees and accretively purchase more uranium. So here we are today. About a year off the bottom of the uranium market. Yellow cake did an issuance and some miners bought some lbs. Well the big dog in the space is upc by a country mile and it’s been notably quiet for months cause they were obviously working on this deal. In order to change to the trust format and be dual listed in Canada and the USA they needed a licensed money manager. Enter Sprott 2021 and the physical ETF powerhouse it’s become. UPC will become much like the Silver and Gold etfs and be able do ATM issuance. This is a complete game changer. It means both retail and institutional investors will be able to cause physical uranium to be purchased like never before.

UPC shares will be issued with just a slight premium and uranium will be purchased as close to real time as possible. Many of us uranium investors have a very positive view on physical uranium but often shy away from buying upc or yellowcake at a premium knowing well that any day a deal could be announced and the premium gets crushed and you can lose a quick 5 or 10 percent. Totally kills it. Demand has in my mind been incredibly pent up as a result of the lack of a clean structure. Also, many institutions will only allocate on a deal if that. Liquidity and lack of ability to get in or out near NAV is a big concern (as it should be). Well very soon that’s solved. Not only that but consider the various uranium etfs that also hold a piece of Uranium participation corp or Yellowcake. Those etfs continually issue shares and basket buy their holdings. We imagine often pushing the premium up on upc and likely cause other shareholders to sell. So once the transition is complete when uranium stock etfs get inflows and buy upc it will directly cause uranium lbs to be purchased. This improved liquidity may end up causing some etfs to increase there weighting in upc as a result. (Btw say good bye to yellowcakes premium. We doubt yellow cake will raise much more money unless they can issue ATM as well and we don’t know AIM rules.

So, carrying on with upc. Having it NYSE listed will give it much better exposure and make it eligible for many USA based funds that either cant or don’t invest in Canada. The total size of USA market is around $50 trillion vs Canada $3.5 trillion. 13x bigger.

UPC has not done an issuance yet in this uranium bull market. It was trading at a discount last year and actually sold uranium and bought back stock because it was accretive to do so. So the North American markets have been ‘underserved’ for a year.

Bulls will be buying UPC as soon as it has the ATM ability and they know their purchase will go to new uranium purchase. High conviction bulls feel the uranium price will be double in a few years or less… It’s the biggest no brainer safe trade you can find. If only a double in 10 years that’s 7 percent per annum. And it will double in 2 years or less, bulls say.

Institutions, high net worth, and retail investors will flock to it. So as some will argue.. that’s just noise. It was gonna happen anyhow. Well on to the next part… it’s not just about soaking up the spot market it’s about releasing this a new beast and what it does to the market psychologically. Fuel buyers / utilities are going to soon panic as they see the UPC doing volume every day and issuing shares. They will be following the spot market and wondering like all of us where the price will go next. How many more marginal lbs are available in the spot market? Potential sellers of spot will likely decide to hang on and ‘see’ what happens. It’s a totally new dynamic and it’s effect shouldn’t be under estimated.

In the past, just prior to an issuance by a upc or yellow cake they would put a call into a trader or Denison on behalf of upc.

Transformational deal.

Utilities will learn they overplayed their hand, now they will PAY up. We can’t tell you how many times we have said that in an asset class this mispriced things just happen to realize the value. And this is one of those things.

This deal between Sprott and UPC is transformational. It has the potential to be immense.

If run like their other commodity trusts, which we see no reason why not, it now puts a daily bid in the market. It allows for pure price speculation on a daily basis – which heretofore has not existed. It doesn’t require establishment of storage agreements by investors. They can just express their view in the market every day. This will take UxC’s bullshit broker average price that shows up daily based on bullshit trader bids and asks and render it useless as the price will be the last traded price . And with flows into a trust that buys uranium – well. That is new to this market. A constant bid in the market. This is what happens when something is absurdly cheap – it attracts capital.

Utilities with spot referred contracts – good luck. They may not figure it out right away. They will when investors have a vehicle to buy uranium every day.

Also, we assume that they will correct some of the features of UPC that held it back. For example, we assume they will maintain an evergreen prospectus and tap overnight markets to be agile. And, also we assume they will remove the restriction that procurement can only happen at a premium to NAV while buying uranium at a significant discount to market. That was always stupid.

Also the WMC guys are sharp. They will bring credibility to the investor marketing. And, assuming their liaison role extends to procurement and sales (building a small book to cover fees) they are quite familiar with the principles a fund needs to follow in these areas to maximize value for its investors (versus maximizing value for traders and utilities).

A Decade after Fukushima, Japan Restarting Nuclear

Japan; Governor has officially approved restart of 3 more nuclear reactors in Takahama-1 & 2 and Mihama-3. Minister says Japan “will use nuclear power sustainably into the future” – promising grants for further restarts.

Meanwhile…

Japan’s Coal Pipeline is Bare After Last Planned Project Axed – Link Here

Tyler Durden

Sat, 05/01/2021 – 16:45

via ZeroHedge News https://ift.tt/2PE9HIg Tyler Durden