Is The COVID-19 Recession Over?

Authored by Mike Shedlock via MishTalk.com,

As measured by GDP, the Covid-19 recession will soon be over assuming it isn’t already. But that is not the deciding measure.

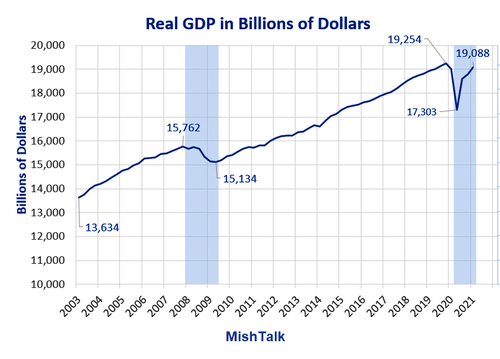

GDP Will Hit a New High Next Quarter

Real GDP is poised to hit a new high next quarter.

Is that a sufficient?

GDP Three Ways

GDP Reporting Confusion

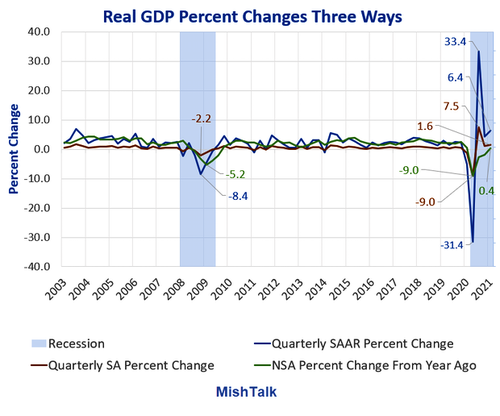

Reporting adds to the GDP confusion. Economists like to present GDP at a Seasonally-Adjusted Annualized Rate (SAAR).

In the first quarter of 2021 GDP was up a reported 6.4% annualized. Actually, quarter-over-quarter GDP was up 1.6%.

From the above chart one would be hard pressed to know the numbers I presented in the lead chart.

The 33.4% rise did not come close to wiping out the 31.4% decline.

It takes a 45.8% rise to wipe out a 31.4% decline.

GDP did not really fall 31.4% in the first place. It fell 9.0% but that was the biggest decline in the history of the data.

Official Arbiter of Recessions

The National Bureau of Economic Research NBER is the official arbiter of recession starts and ends.

Criteria is Flexible

The traditional role of the committee is to maintain a monthly chronology of business cycle turning points. Because the BEA figures for real GDP and real GDI are only available quarterly, the committee considers a variety of monthly indicators to determine the months of peaks and troughs. It places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms, which is a monthly measure that includes much of the income included in real GDI; and (2) payroll employment from the BLS.

Although these indicators are the most important measures considered by the committee in developing its monthly business cycle chronology, it does not hesitate to consider other indicators, such as real personal consumption expenditures, industrial production, initial claims for unemployment insurance, wholesale-retail sales adjusted for price changes, and household employment, as it deems valuable. There is no fixed rule about which other measures contribute information to the process or how they are weighted in the committee’s decisions.

The committee’s approach to determining the dates of turning points is retrospective. It waits until sufficient data are available to avoid the need for major revisions.

The Keys

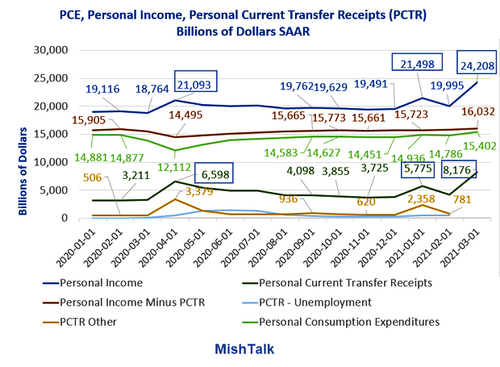

The two primary keys are personal income minus transfer payments and employment.

Curiously, the NBER seems to place little significance on GDP itself.

Personal Income Soars Over 21% on Third Round of Free Money

I discussed personal income this morning noting Personal Income Soars Over 21% on Third Round of Free Money.

Life Support

Note that personal income minus transfer payments is barely above the pre-pandemic high while stimulus is through the roof.

And stimulus it has taken massive stimulus to keep PCE afloat, also just now above the pre-pandemic high.

What About Employment?

Every month I comment on the Jobs data which typically comes out the first Friday of every month.

On April 2, I noted the Economy Adds Over 900,000 Jobs Beating the Consensus By a Mile.

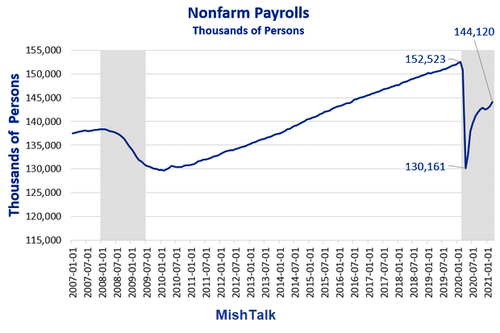

And the unemployment rate fell to 6.0%. But nonfarm payrolls tell another story.

Nonfarm Payrolls

The above chart puts a much needed perspective on the recovery.

-

Jobs are up 13,959,000 from the low in April 2020.

-

Jobs are still 8,403,000 from the February 2020 pre-covid high.

Some losses are permanent due to a surge in work-at-home and online shopping (less office space and malls needed).

What Happens When the Stimulus Efforts Stop?

That is the key question. Millions make more being unemployed than they did employed.

Also long-term rates have risen and that will impact housing.

The Fed inflated assets which have also propped up spending. Yet, despite a massive boom in housing and the stock market PCE has barely recovered.

NBER Patience

The NBER announced that the trough of the 2007-2009 recession occurred in June 2009 only on September 20, 2010. That was a lag of 15 months.

I do not know what the NBER will decide, but I do not expect a decision soon. There are too many issues and questions as well as a potential relapse as soon as the stimulus dries up.

Fed Says the Recent Jump in Inflation is Transitory

Meanwhile, Don’t Worry, the Fed Says the Recent Jump in Inflation is Transitory

That’s a rebuttal to the notion that current inflation is low, even while admitting the Fed will likely be correct on the transitory inflation.

The key is understanding what happens when bubbles pop.

Tyler Durden

Sun, 05/02/2021 – 09:20

via ZeroHedge News https://ift.tt/3eKdkoM Tyler Durden