Key Events This Week: Payrolls, ISM And More Earnings

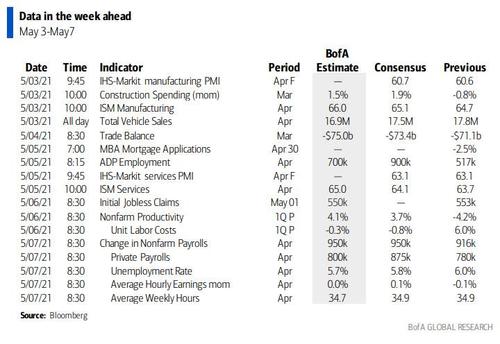

The key event in the first week of May will be another outstanding jobs report with April nonfarm growth expected around 950k (some whispers have it as rising as high as 1.5 million, a number that will unleash another reflation tantrum) and the unemployment rate dropping to 5.7% from 6.0% in March. ISM surveys are likely to push even higher in April, with the manufacturing index rising to 66 and services reaching a new record of 65. As BofA summarizes, with the US economy reopening amid vaccinations, real activity should be robust.

While more than half of S&P companies have now reported, and we are due for a slowdown in earning season, there is still a bevy of heavyweights reporting including iRobot and Chegg on Monday, Pfizer, TMobile on Tuesday, GM, PayPal and Rocket on Wednesday, Moderna, Square and Roku on Thursday and retail darling DraftKing on Friday.

Focusing on the US economy, the key economic data releases this week are the ISM manufacturing and non-manufacturing reports on Monday and Wednesday, jobless claims on Thursday, and the April employment report on Friday. There are several speaking engagements from Fed officials this week.

Here is a daily breakdown courtesy of Goldman:

Monday, May 3

- 09:45 AM Markit manufacturing PMI, April final (consensus 60.7, last 60.6)

- 10:00 AM Construction spending, March (GS +1.8%, consensus +1.8%, last -0.8%): We estimate a 1.8% increase in construction spending in March, reflecting a rebound following winter storm effects in February.

- 10:00 AM ISM manufacturing index, April (GS 65.2, consensus 65.0, last 64.7): We estimate that the ISM manufacturing index increased 0.5pt to 65.2 in April, reflecting a 1.8pt increase in our manufacturing tracker (to 63.3) and a boost to the supplier deliveries time component from chip shortages.

- 02:20 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will speak at a virtual event hosted by the National Community Reinvestment Coalition. Prepared text and moderated Q&A are expected.

- 05:00 PM Lightweight motor vehicle sales, April (GS 17.4m, consensus 17.5m, last 17.75m)

Tuesday, May 4

- 08:30 AM Trade balance, March (GS -$74.6bn, consensus -$73.5bn, last -$71.1bn); We estimate that the trade deficit increased by $3.5bn in March, reflecting an increase in the goods trade deficit. Goods imports are now well above their pre-pandemic level, and goods exports are slightly above their pre-pandemic level. Both imports and exports of services have recovered only slightly from their 2020Q2 troughs.

- 10:00 AM Factory orders, March (GS +1.3%, consensus +1.6%, last -0.8%); Durable goods orders, March final (last +0.5%); Durable goods orders ex-transportation, March final (last +1.6%); Core capital goods orders, March final (last +0.9%); Core capital goods shipments, March final (last +1.3%): We estimate that factory orders increased by 1.3% in March following a 0.8% decrease in February. Durable goods orders increased by 0.5% in the March advance report, and core capital goods orders increased by 0.9%.

- 01:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will take part in a virtual Q&A moderated by Minneapolis Fed President Kashkari and hosted by the Economic Club of Minnesota.

- 01:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will take part in a moderated virtual discussion hosted by the North Texas Commercial Association of Realtors and Real Estate Professionals.

Wednesday, May 5

- 08:15 AM ADP employment report, April (GS +800k, consensus +888k, last +517k); We expect an 800k rise in ADP payroll employment, reflecting strong underlying job growth and a boost from lower initial jobless claims. We expect ADP to underperform the BLS payroll measure this month, in part because workers returning to their previous employers may not be fully captured by the ADP panel methodology.

- 09:30 AM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will give a virtual speech on the U.S. economy and monetary policy at an event hosted by Bard College. Prepared text and Q&A with audience and media are expected.

- 09:45 AM Markit services PMI, April final (consensus 63.1, last 63.1): 10:00 AM ISM services index, April (GS 64.0, consensus 64.1, last 63.7): We estimate that the ISM services index increased 0.3pt to 64.0 in April, reflecting a 2.5pt increase in our services tracker to 60.4 and possible seasonal drag.

- 12:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will give a virtual speech on the economic outlook to the Boston Economic Club. Audience Q&A is expected.

Thursday, May 6

- 08:30 AM Nonfarm productivity, Q1 preliminary (GS +4.2%, consensus +3.7%, last -4.2%); Unit labor costs, Q1 preliminary (GS flat, consensus -0.8%, last +6.0%): We estimate nonfarm productivity growth of 4.2% in Q1 (qoq saar), reflecting a larger increase in business output than in hours worked. We expect that Q1 unit labor costs—compensation per hour divided by output per hour—remained unchanged.

- 08:30 AM Initial jobless claims, week ended May 1 (GS 530k, consensus 540k, last 553k); Continuing jobless claims, week ended April 24 (consensus 3,620k, last 3,660k): We estimate initial jobless claims decreased to 530k in the week ended May 1.

- 10:00 AM Dallas Fed President Kaplan (FOMC non-voter) speaks; Dallas Fed President Robert Kaplan will take part in a moderated discussion hosted by Bard College.

- 01:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will take part in a virtual conversation hosted by the University of California, Santa Barbara. Audience Q&A is expected.

Friday, May 7

- 08:30 AM Nonfarm payroll employment, April (GS +1,300k, consensus +978k, last +916k); Private payroll employment, April (GS +1,200k, consensus +900k, last +780k); Average hourly earnings (mom), April (GS flat, consensus flat, last -0.1%); Average hourly earnings (yoy), April (GS -0.4%, consensus -0.4%, last 4.2%) ;Unemployment rate, April (GS 5.5%, consensus 5.7%, last 6.0%): We estimate nonfarm payrolls rose 1,300k in April (mom sa). Mass vaccinations and the easing of business restrictions likely supported rapid job growth in virus-sensitive industries, including leisure and hospitality, retail, and education (public and private). Additionally, Big Data signals generally indicate monthly job gains of 1mn or more in the month. We note the possibility that the establishment survey undercounts job gains from reopening establishments, which other things equal would result in a relatively stronger household survey. Reflecting this and an expected rise in the participation rate, we estimate a five-tenths drop in the unemployment rate to 5.5%. We estimate a flat monthly reading for average hourly earnings (mom sa) due to negative composition and calendar effects; coupled with the anniversary of the spring 2020 lockdowns, this would result in a sharp drop in the year-on-year rate (from +4.2% to -0.4%).

- 10:00 AM Wholesale inventories, March final (consensus +1.4%, last +1.4%)

Source: Goldman, BofA

Tyler Durden

Mon, 05/03/2021 – 09:20

via ZeroHedge News https://ift.tt/2QNROas Tyler Durden